Vietnam stock market sees potential for further recovery, but cautious of reversal risks

After a positive session, the stock market witnessed a tug-of-war between buyers and sellers. The VN-Index closed slightly lower on November 27, down 0.16 points to 1,241. Trading liquidity remained subdued, with the value of transactions on the HOSE exceeding VND 11,300 billion.

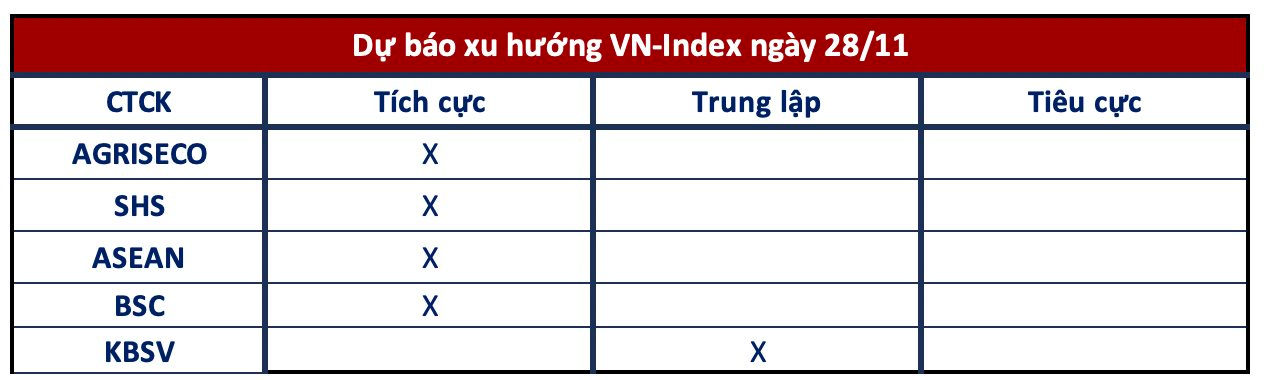

Looking ahead to the next trading session, most securities companies anticipate a continuation of the recovery trend, but caution against potential reversal risks as the index approaches resistance levels.

VN-Index Extends Gains

Agriseco Securities:

The RSI indicator has broken out of the oversold region and reached a new high since the beginning of the month. Agriseco Research believes that the VN-Index has the opportunity to advance towards the 1,260-point level in the upcoming sessions, as selling pressure remains low. The 1,225-point level is expected to act as a near-term support for the current uptrend.

Agriseco recommends that investors maintain their long positions in stocks purchased in previous sessions and consider increasing their exposure during market dips. Priority should be given to leading stocks and VN30 constituents that have been trading at discounted prices.

SHS Securities:

The short-term trend of the VN-Index continues to target the 1,240-point level, breaking above the downtrend line connecting the October-November 2024 highs. The index is now aiming for the 1,255-1,260 point range, which corresponds to the 200-day moving average and the highest price of 2023. This represents a significant resistance level.

Asean Securities:

The market paused as it traded in a narrow range around the reference level. Investor sentiment turned cautious again, and trading volume remained low in November. A positive development is the resumption of net buying by foreign investors, which is expected to boost market sentiment and liquidity in the near future.

The market is likely to remain range-bound, consolidating at current levels to accumulate demand. Trading volume is anticipated to increase significantly after this consolidation phase, driven by the release of market outlook reports for the end of the year.

Caution on Reversal Risks Remains

BSC Securities:

In the short term, the VN-Index still has the potential to retest the 1,265 threshold. However, profit-taking pressure is likely to emerge as the index approaches this strong resistance level.

KBSV Securities:

The index’s ability to maintain its closing level above the 20-day moving average without significant selling pressure or breakdowns to lower price levels indicates a relatively stable sentiment among stockholders. While this leaves room for further recovery, it is important to remain vigilant about potential reversals as the index approaches subsequent resistance levels.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.

The Stock Market Shows Bottoming-Out Signals: VPBankS Expert Names Undervalued Stock Group

According to experts, investing in lower-priced regions may mitigate risks, but to gauge the potential profits, one must delve into the industry’s future outlook.

Stock Market Blog: Are Bottom-Fishing Stocks a Thing of the Past?

The upward momentum significantly stalled in today’s session, yet the market managed to maintain a delicate balance between supply and demand. The volatility was relatively subdued, with narrow fluctuations in both indices and individual stocks. Notably, the combined trading volume of the two exchanges once again dipped below the 10 trillion dong threshold, indicating that investors are holding onto their stocks rather than engaging in short-term trading.