Numerous Real Estate Businesses Owe Trillions in Taxes

The list of top debtors is dominated by real estate companies. The largest debtor is the Joint Stock Company for Industrial Construction Investment of Nam Kim (Nam Kim Company), located in Phu Tan Industrial Park, Thu Dau Mot, Binh Duong province, owing nearly 137 billion VND in taxes as of October 31, 2024.

Nam Kim Company is a member of Kim Oanh Real Estate Group (Kim Oanh Group), founded by real estate tycoon Dang Thi Kim Oanh. Established in 2013, the company primarily operates in the real estate sector, dealing in the ownership, leasing, or rental of real estate. As of September 2023, its chartered capital exceeded 496 billion VND.

|

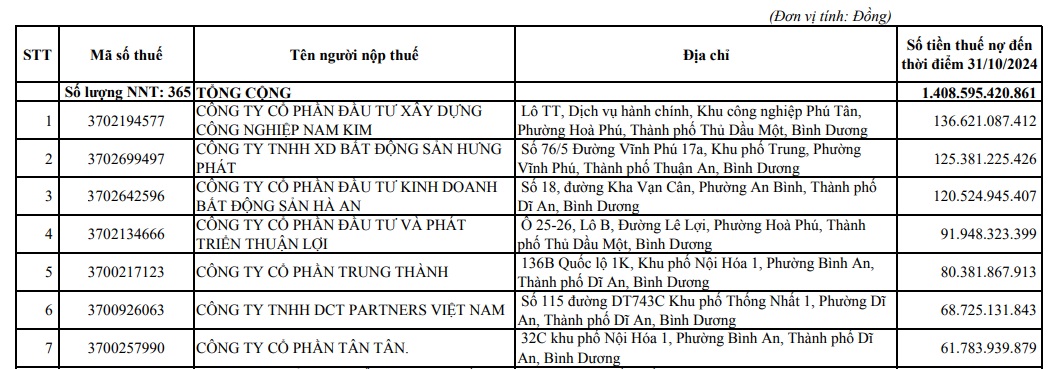

Businesses with the Highest Tax Debts in Binh Duong

Source: Binh Duong Tax Department

|

The legal representative of Nam Kim has changed several times. Ms. Nguyen Thi Nhung (born in 1992), Kim Oanh’s daughter, previously held the positions of Chairman and General Director while also serving as the legal representative of Nam Kim. However, in July 2024, the role of legal representative was transferred to Mr. Vu Van Vu (born in 1988), who also serves as the Enterprise’s General Director. Currently, Ms. Nhung holds the position of Member of the Board of Directors of Kim Oanh Group, according to the company’s website.

Ms. Dang Thi Kim Oanh – Chairman of Kim Oanh Group

|

Kim Oanh Group is currently one of the most prominent real estate companies in the market, with a portfolio of renowned projects such as RichHome, The Mall City 1, 2, Ben Cat Center Point, and City Mall. Notably, Kim Oanh was the victim in a case of embezzlement of 767 billion VND involving Mr. Tran Qui Thanh, the former Chairman of Tan Hiep Phat Group, in 2023.

Returning to the list of tax debtors, another notable name is DCT Partners Vietnam Co., Ltd., located in Binh An ward, Di An city, Binh Duong province, with a tax debt of nearly 69 billion VND. The company is part of the Charm Group ecosystem and is the investor in the Charm Diamond project in Binh Duong. The legal representative is Mr. Nguyen Huu Nghia (born in 1993), who was appointed as Deputy General Director of Charm Group in January 2024. Mr. Nghia also represents several other legal entities, such as Saigon Container Joint Stock Company, Viet Hai Joint Stock Company, and Heritage Ho Tram Joint Stock Company…

A corner of Charm City Di An with two towers, Charm Ruby and Charm Sapphire, already in use. Photo: TV

|

Additionally, among the 365 businesses and individuals on the tax debt list in Binh Duong are notable names such as Tan Tan Joint Stock Company, the company behind the Tan Tan peanut brand, owing nearly 62 billion VND in taxes; the branch of Mai Linh Group (Mai Linh taxi) in Binh Duong owing more than 2.8 billion VND. Several listed companies are also on the list, including the Joint Stock Company for Investment and Development of Infrastructure Projects of the Pacific (UPCoM: PPI), owing nearly 18 billion VND; Dzĩ An Electrical and Mechanical Joint Stock Company (UPCoM: DZM) owing nearly 3.4 billion VND; and An Phu Radiation Joint Stock Company (UPCoM: APC) owing more than 564 million VND…

Moreover, numerous foreign individuals are also on the tax debt list, with debts ranging from hundreds of millions to billions of VND.

Add a Channel to Notify of Delayed Exit for Unpaid Taxes

The tax delinquent, regardless of the amount owed, will be temporarily barred from exiting the country, according to the leader of the General Department of Taxation. They have established multiple channels to forewarn these individuals, ensuring they are aware that they cannot leave the country until their tax obligations are fulfilled.