The loan has a term of 12 months from the date of the signed contract. Of the approved limit of VND 800 billion, VND 150 billion is allocated as an unsecured limit. The CTS Board of Directors agreed to approve the borrowing as per the proposal by the Company’s General Director on November 20.

CTS will utilize term deposits, savings accounts, current account balances, and certificates of deposit at ABBank and other credit institutions approved by ABBank as collateral for the loan.

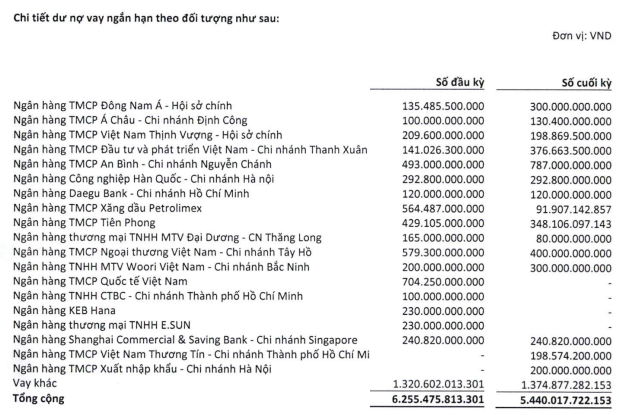

As of the end of Q3 2024, CTS had outstanding borrowings of over VND 6,490 billion, all of which were short-term, representing a 4% increase from the beginning of the year and accounting for 70% of total assets.

The loans, with tenures ranging from 21 days to 12 months, carry interest rates of 3.45-6.5% per annum. The majority of these loans are secured by approximately VND 2,275 billion in term deposits and other securities, with the remaining collateral comprising of nearly VND 69 billion in stocks and almost VND 32 billion in land-use right certificates, totaling over VND 2,375 billion.

Notably, while CTS’s debt balance has slightly increased since the beginning of the year, it has surged by 19% compared to the previous quarter, amounting to approximately VND 5,440 billion. At that time, its major lending partners included ABBank – Nguyen Chanh Branch with VND 787 billion, Vietcombank – Tay Ho Branch with VND 400 billion, BIDV – Thanh Xuan Branch with nearly VND 377 billion, and TPBank with over VND 348 billion.

| CTS’s short-term debt balance has been on an upward trend in recent quarters |

Source: CTS’s 2024 Semi-annual Reviewed Financial Statements

|

Huy Khai

The Prime Minister Calls for Lower Bank Interest Rates

Prime Minister Pham Minh Chinh has urged the Governor of the State Bank of Vietnam to continue instructing commercial banks to cut costs, boost digital technology adoption, and reduce interest rates for businesses and individuals. This move aims to stimulate production and business activities in the remaining months of this year and the beginning of 2025.