There was no adjustment to the cash flow, which had been waiting for a discount to buy, and it suddenly surged in today’s session, rising by 8.35 points to 1,250 points, surprising the market.

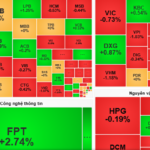

The main driver came from foreign capital, as this group bought strongly again, with a net buy of 333.9 billion VND, accumulating a net buy of nearly 1,000 billion VND over the last five sessions after selling 91,000 billion VND since the beginning of the year. The breadth also improved, with 222 stocks advancing and 147 declining. Real estate was the only group that faced greater selling pressure than buying demand, with Vin stocks falling in unison: VHM decreased by 0.73%, VIC by 0.49%, and VRE by 0.56%. Meanwhile, industrial real estate stocks performed better, rising unanimously.

On the contrary, most other sectors advanced, with strong gains in telecommunications (up 4.49%), information technology (up 3.55%), insurance (up 5.11%), food and beverage (up 1.44%), banking (up 0.62%), and securities (up 0.5%). The market’s top contributors included FPT, which contributed the most with 1.74 points, followed by VCB and BID, which contributed nearly 2 points, and other stocks such as BVH, HPG, CTG, MSN, and HVN.

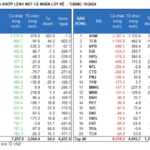

As the market rises, skeptical investors hold back, resulting in today’s liquidity not being exceptionally high, with a combined matched trading volume of nearly 15,000 billion VND on the three exchanges, including net buying from foreign investors of 359.7 billion VND. Specifically, in matched trading, they net bought 226.9 billion VND.

Foreign investors’ net buying in matched trading focused on information technology, food and beverage, and consumer staples sectors. The top stocks they net bought in matched trading included FPT, CTR, MSN, PNJ, MWG, CTG, DPM, BID, and HPG.

On the selling side, foreign investors net sold real estate stocks in matched trading. The top stocks they net sold in matched trading were VRE, VHM, HDB, VCB, TCB, FRT, VND, VIB, and DIG.

Individual investors net sold 129.4 billion VND, of which 220.6 billion VND was net sold in matched trading.

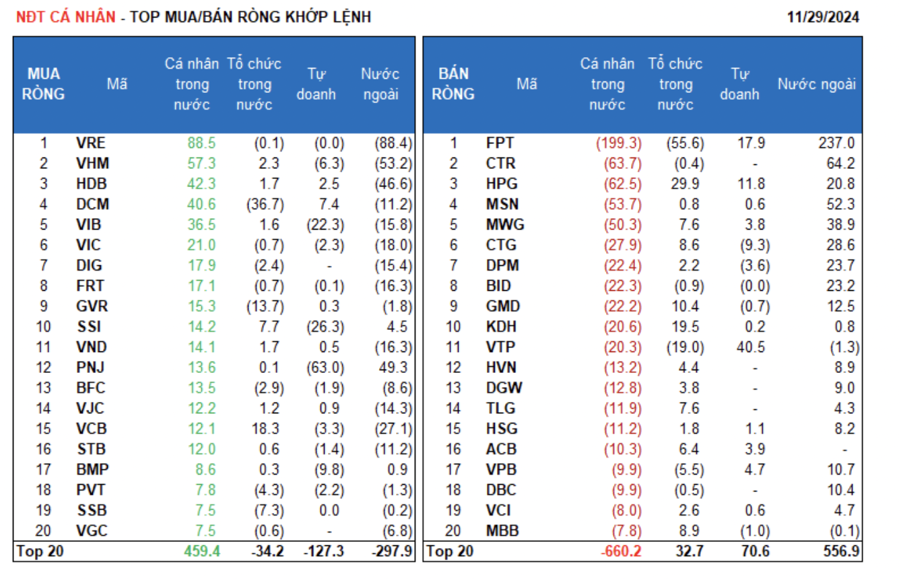

In matched trading, individual investors net bought 9 out of 18 sectors, mainly focusing on the real estate sector. Their top net bought stocks included VRE, VHM, HDB, DCM, VIB, VIC, DIG, FRT, GVR, and SSI.

On the selling side, in matched trading, they net sold 9 out of 18 sectors, mainly focusing on information technology, food and beverage, and consumer staples sectors. Their top net sold stocks included FPT, CTR, HPG, MSN, MWG, CTG, BID, GMD, and KDH.

Proprietary trading net sold 83.5 billion VND, of which 81.2 billion VND was net sold in matched trading.

In matched trading, proprietary trading net bought 10 out of 18 sectors, with the strongest buying in the industrial goods and services and food and beverage sectors. The top net bought stocks in matched trading today included VTP, FPT, HPG, TCB, DCM, SBT, VPB, VNM, ACB, and MWG. The top net sold sector was financial services. The top net sold stocks included PNJ, FUEMAV30, SSI, VIB, BMP, CTG, VHM, BVH, CMG, and TPB.

Domestic institutional investors net sold 117.0 billion VND, of which they net bought 74.9 billion VND in matched trading.

In matched trading, domestic institutions net sold 5 out of 18 sectors, with the largest net selling in the chemicals sector. Their top net sold stocks included FPT, DCM, VTP, GVR, SSB, HAH, VPB, IMP, TCH, and HDG. The sector with the largest net buying was financial services. Their top net bought stocks included FUEMAV30, HPG, KDH, VCB, GMD, TCB, MBB, CTG, FUEVFVND, and SSI.

Today’s matched trading volume reached 2,041.0 billion VND, up 18.1% from the previous session and accounting for 13.7% of the total trading value.

Notably, today, there was a matched trading transaction of 841,000 FPT shares (equivalent to 120.3 billion VND) and more than 2.1 million MSN shares (equivalent to 155.4 billion VND) between foreign institutions.

In addition, individual investors continued to trade in the banking sector (SHB, STB, SSB, LPB, VPB, and EIB) and large-cap stocks (FPT, MSN, HPG, and MWG).

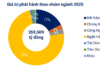

The allocation of cash flow among sectors showed an increase in construction, chemicals, retail, software, and textiles and garments, while it decreased in real estate, banking, securities, steel, electrical equipment, oil and gas, and plastics, rubber, and fibers.

In terms of market capitalization, the allocation of cash flow in matched trading increased in mid-cap stocks (VNMID) and decreased in large-cap stocks (VN30) and small-cap stocks (VNSML).

Stock Market Blog: Just an Intraday Adjustment, the Market is Strong

It appears that there are visible shifts in the behavior of those with purchasing power. Buyers have now accepted higher prices after multiple instances of the market “dipping” rather than taking a significant downturn. The market is trending in a direction where procrastinating with caution will only lead to worse buying opportunities.

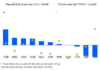

The Domestic Firm Makes Its Mark in October, Sweeping Up the Most Net Buys in the Market

Institutional domestic investors bought a net amount of 1,031.7 billion VND, with a match order of 761.8 billion VND. They were the strongest net buyers in the market in October.

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.

The Ultimate Guide to Navigating the Stock Market’s Pitfalls: A Safe Path to Profits

Introducing the ultimate guide to successful bottom-fishing: the three key ingredients to mastering this art are Method, Timing, and Target.