Masan Consumer Holdings (MCH) stock closed the trading session on November 29 with a nearly 5% gain, reaching a new peak of VND 229,900 per share. This marks a remarkable milestone for the company.

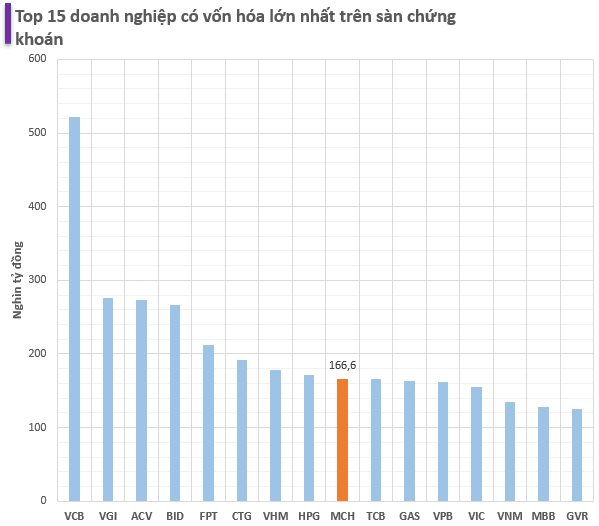

MCH has witnessed an impressive growth trajectory since the beginning of the year. Compared to the start of 2024, the stock price has surged by a remarkable 192%. With a market capitalization of VND 166,600 billion, Masan Consumer is now among the top 10 largest companies by market cap on the Vietnamese stock market.

The primary growth driver for Masan Consumer’s stock remains the anticipated listing of the company’s shares on the HoSE. Specifically, in early October 2024, the company’s Board of Directors confirmed the timeline for the transition from UPCoM to HoSE in 2025.

The plan to list on HoSE was first revealed by Mr. Nguyen Dang Quang, Chairman of Masan Group (the indirect parent company of Masan Consumer), back in April 2024. This move has garnered significant attention in the Vietnamese stock market, as no large enterprise has gone public in the past two years, heightening investors’ expectations for Masan Consumer.

In preparation for the listing, the company distributed a substantial cash dividend for 2023, amounting to a staggering 268% dividend payout ratio. The total amount disbursed to shareholders was approximately VND 19,000 billion.

On October 2, Masan Consumer also sought shareholder approval for an interim dividend for 2024, with a maximum payout ratio of 100% (equivalent to VND 10,000 per share).

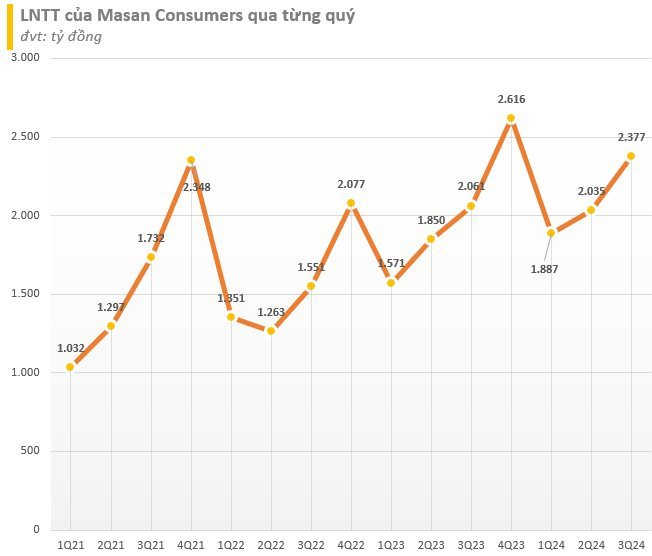

Masan Consumer’s robust financial performance in the third quarter of 2024 further bolstered the stock’s growth. The company recorded a 10% year-over-year increase in revenue, amounting to VND 7,987 billion.

After accounting for expenses, Masan Consumer’s net income rose by 14% to surpass VND 2,094 billion. Similarly, net income attributable to the parent company’s shareholders climbed by 14% to reach VND 2,072 billion.

MCH attributed the profit increase to the growth of its beverage, convenience food, and seasoning segments, coupled with effective management of production costs, which collectively enhanced the company’s gross profit.

For the first nine months of 2024, MCH achieved VND 21,955 billion in revenue and VND 5,553 billion in net income, reflecting an 11% and 14% year-over-year increase, respectively.

In addition to the company’s internal developments, favorable macroeconomic factors also played a role in Masan Consumer’s successful performance. The government has proposed a 2% reduction in the VAT rate, applicable to goods and services currently subject to a 10% rate (resulting in an 8% rate), with certain exceptions.

The 2% VAT reduction policy has been implemented in recent years to mitigate the adverse effects of the COVID-19 pandemic. According to the government, this policy has contributed to lowering prices for consumers by reducing the tax burden on businesses engaged in the production and trading of goods and services.

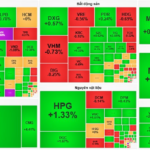

The VN-Index Soars Past 1,250 Points, Insurance and Tech Stocks in the Spotlight

An influx of investor buying overwhelmed selling pressure, propelling the VN-Index to a remarkable gain of over 8 points and surpassing the 1,250-point milestone. Insurance and technology stocks were the stars of the show, experiencing a veritable “renaissance” and attracting substantial capital inflows from discerning investors.

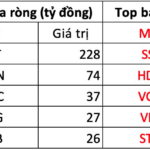

The Heat is On: Foreign Investors Turn to Selling

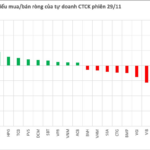

The VN-Index continued its upward trajectory throughout the morning session, but the gains are gradually diminishing. Trading volume on the HoSE remained similar to yesterday’s morning session, and large-cap stocks showed resilience, maintaining their stability.