Market liquidity increased compared to the previous trading session, with the matching trading volume of the VN-Index reaching over 427 million shares, equivalent to a value of more than 11.5 trillion VND; HNX-Index reached over 43.1 million shares, equivalent to a value of more than 759 billion VND.

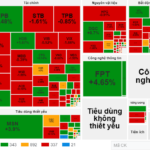

VN-Index switched to a tug-of-war state at the beginning of the session with the advantage tilting towards the buying side, reflecting the continued optimistic sentiment of investors, helping the index close in the positive green zone at the end of the session. In terms of impact, FPT, VCB, BID, and BVH were the codes with the most positive influence on the VN-Index, with an increase of over 4.2 points. On the contrary, VHM, VIC, EIB, and NVL were the codes with the most negative impact, but the impact was not significant.

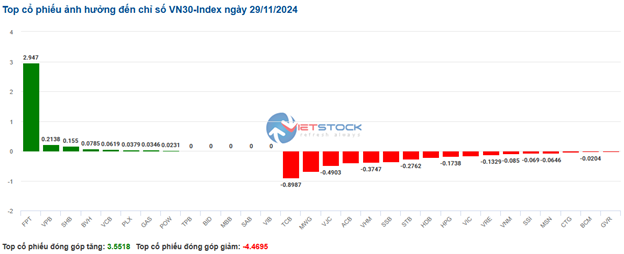

| Top 10 stocks affecting the VN-Index on November 29, 2024 |

Similarly, the HNX-Index also had a positive performance, with the index positively impacted by the codes MBS (+2.19%), PVI (+2.7%), KSV (+3.06%), and VCS (+2.33%)…

The telecommunications industry was the group with the most impressive increase in the market, with 4.24%, mainly driven by the codes VGI (+4.84%), CTR (+1.62%), FOX (+3.92%), and ELC (+2.34%).

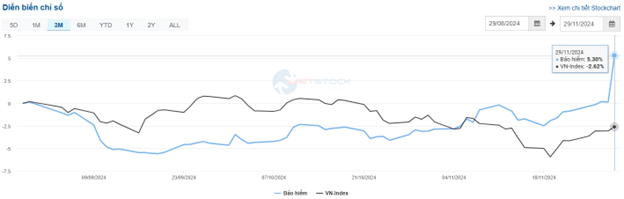

In addition, from a technical perspective, the industry index surged in the trading session of November 29, 2024, forming a Three White Candle pattern, while volume continued to increase and exceeded the 20-session average, indicating that trading activity had picked up. Currently, the telecommunications industry index is testing the Fibonacci Retracement 61.8% level (corresponding to the 3,500-3,630-point region) while MACD continues to rise after giving a buy signal. At the same time, the gap between the SMA 50-day and SMA 100-day lines is narrowing. If the Golden Cross reappears in the coming sessions, it will further support the recovery scenario for this industry group.

Source: https://stockchart.vietstock.vn/

|

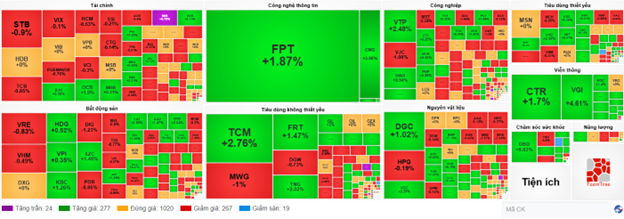

Following the recovery were the information technology industry and the essential consumer industry, with increases of 3.54% and 1.42%, respectively. On the other hand, the real estate industry recorded the most significant decrease in the market, with -0.14%, mainly driven by the VHM (-0.73%), DIG (-0.25%), VRE (-0.56%), and KBC (-0.18%) codes.

In terms of foreign trading, this group continued to net buy more than 310 billion VND on the HOSE floor, focusing on the codes FPT (237.89 billion), MSN (89.51 billion), HPG (72.52 billion), and CTR (63.03 billion). On the HNX floor, foreigners net bought more than 14 billion VND, focusing on MBS (8.07 billion), IDC (4.64 billion), and PVS (4.42 billion) codes.

| Foreign trading net buying and selling dynamics |

Morning Session: Insurance Group Speaks Up, BVH, MIG Ceiling

The market trend was more positive and vibrant in the last part of the morning session. In addition to the familiar rising sectors such as information technology and telecommunications, money flow started to look for less noticed groups such as insurance, pharmaceuticals, and textiles. At the midday break, the VN-Index increased by 5.76 points, or 0.46%, to 1,247.87 points; HNX-Index increased by 0.31% to 224.26 points.

Buyers are gradually regaining the upper hand on a large scale. Leading on the positive impact side were FPT, BVH, VCB, and CTG stocks, helping the VN-Index gain about 2.5 points. Conversely, the total impact of the 10 most negative stocks took away only half a point from the overall index.

Money flow is looking for many new stock groups, with the insurance group being the most prominent. After a stagnant downward trend in the last 3 months, this group has had an impressive surge in the morning session of November 29, currently leading the market with an increase of more than 5%. The purple and green colors appeared in many stocks, such as BVH and MIG hitting the ceiling price, PVI (+4.77%), BIC (+4.83%), BMI (+5.16%), PTI (+4.95%), VNR (+2.62%), PRE (+2.16%), and ABI (+2.78%),…

Source: VietstockFinance

|

The pharmaceutical and textile groups were also notable in the morning session. Many stocks attracted positive buying power from the beginning of the session, such as DBD hitting the ceiling price, DMC (+3.68%), VDP (+4.75%), DVN (+1.2%), TRA (+1.8%), DHT (+1.81%), DTP (+1.79%), and IMP (+1%) ; VGT (+3.68%), TCM (+3.19%), TNG (+1.61%), GIL (+3.46%), and MSH (+0.61%).

The telecommunications and information technology groups maintained their performance with increases of 3.31% and 2.02%, respectively. The upward trend continued in stocks such as VGI (+3.8%), FOX (+2.86%), CTR (+1.62%), ELC (+1.56%); FPT (+1.94%), and CMG (+3.86%).

The downside was in foreign investors, who turned to net sell slightly after recent positive net buying sessions. The net selling value on the HOSE reached 33.5 billion, and on the HNX, it exceeded 3 billion at the end of the morning session.

10:40 am: Lack of Real Estate and Finance Groups, VN-Index Unable to Break Out

The market has not been able to break out strongly due to the lack of leadership from the finance and real estate sectors, causing the main indices to continue to fluctuate around the reference level. As of 10:30 am, the VN-Index gained slightly by 0.85 points, trading around 1,242 points. The HNX-Index increased by 0.33 points, trading around 223 points.

Most of the stocks in the VN30 basket were in the red. Specifically, TCB, MWG, VJC, and ACB took away 0.89 points, 0.68 points, 0.49 points, and 0.39 points from the overall index, respectively. On the other hand, FPT, VPB, SHB, and BVH remained in the positive territory, contributing more than 3.3 points to the VN30-Index.

Source: VietstockFinance

|

The real estate group is putting pressure on the market with the most significant decrease of 0.51% amid a mixed performance, with the red side slightly dominating. The selling pressure was mainly on residential real estate stocks such as VHM, which decreased by 0.73%, DXG by 1.15%, NVL by 1.35%, and PDR by 0.71%… In addition, commercial real estate stocks such as VRE were also in the red, falling by 0.83%, with a matching trading value of 65.55 billion VND, the highest in this group. Conversely, only a few stocks managed to stay in the green territory, including HDG, SZC, HDC, and KOS, but the gains were rather modest, below 1%.

Following was the finance sector, which was also weighing on the overall index amid a highly mixed performance, with the selling side dominating. Specifically, stocks such as STB fell by 0.75%, HDB by 0.4%, TCB by 0.85%, and VIX by 0.1%… The rest remained mostly unchanged, and only a few stocks, such as OCB, MBS, BVH, and LPB… managed to stay in the positive territory.

In contrast, the telecommunications services group continued to reflect the optimistic sentiment of investors, with an impressive increase of 3.69%, supporting the market. Buying pressure was present in most stocks in the industry, such as VGI rising by 4.61%, CTR by 1.79%, FOX by 2.76%, and TTN by 3.35%…

Compared to the beginning of the session, the tug-of-war continued with a balanced mix of green and red ticks. The number of rising stocks was 277, while the number of falling stocks was 267.

Source: VietstockFinance

|

Opening: Caution at the Beginning of the Session

The market opened with a slight negative tone, indicating the continued caution of investors. The main indices fluctuated and traded around the reference level.

The red tick temporarily dominated the VN30 basket, with 13 decreasing stocks, 13 increasing stocks, and 4 unchanged stocks. Specifically, MWG, VJC, and SSB were the most negative stocks. Conversely, BVH, VPB, and SHB were the most positive stocks.

The telecommunications services group was one of the most prominent industries in the market. Notably, stocks such as VGI increased by 4.72%, CTR by 1.02%, YEG by 1.32%, ELC by nearly 1%, and TTN by 2.23%,…

Following was the industrial sector, which also contributed positively to the market performance this morning. Typically, stocks such as ACV rose by 1.69%, VTP by 1.16%, PC1 by 0.43%,…

Stock Market Week of Nov 25-29, 2024: Foreign Investors Maintain Net Buying

The market remains cautious despite a strong recovery in the VN-Index last week. Trading volume needs to improve in the coming period to sustain this upward momentum. Notably, consecutive net buying by foreign investors is a positive signal that bodes well for the VN-Index’s outlook.

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

The Market Beat: Where Does the Money Flow?

Today’s trading session ended with the VN-Index climbing over 1 point to 1,245.76, while the HNX-Index gained 0.4 points to reach 224.86. The market remains in an accumulation phase with low liquidity. The total trading value across the market barely surpassed 12 trillion dong, with more than 3 trillion dong coming from negotiated trades.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.