Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 383 million shares, equivalent to a value of more than 9.1 trillion VND; HNX-Index reached over 43.4 million shares, equivalent to a value of more than 649 billion VND.

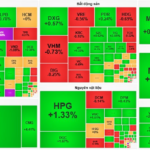

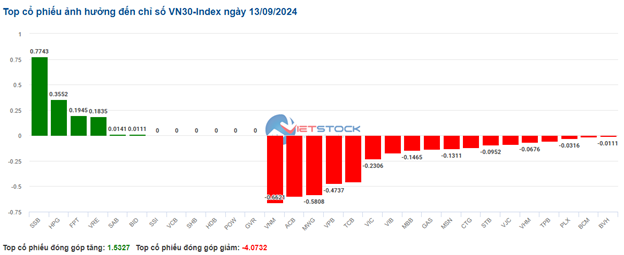

Pessimism continued to grow in the early afternoon session for the VN-Index despite the return of buying pressure to support the index, but by the end of the session, there was no change and sellers continued to dominate. In terms of impact, GAS, VNM, MSN, and BID were the most negative stocks, taking away more than 2.3 points from the index. On the other hand, VCB, FPT, SAB, and VRE were the most positive stocks, contributing 1.1 points to the index.

| Top 10 stocks with the highest contribution to VN-Inex session on 13/09/2024 |

However, the HNX-Index was not overly pessimistic, with the index positively impacted by KSV (+4.91%), MBS (+1.87%), PVI (+1.57%), and CEO (+1.32%)…

|

Source: VietstockFinance

|

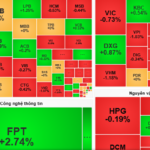

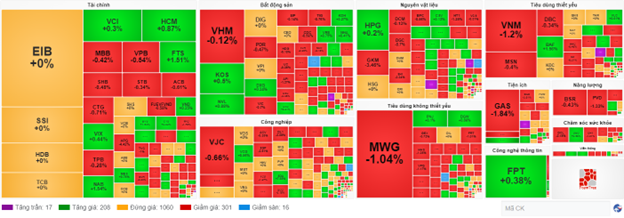

The utilities sector saw the biggest drop in the market, falling by -0.9%, mainly due to GAS (-2.37%), POW (-0.78%), NT2 (-1.01%), and BWE (-0.11%). This was followed by the energy and healthcare sectors, which fell by 0.61% and 0.45%, respectively. On the other hand, the information technology sector saw the strongest recovery in the market, rising by 0.52%, mainly driven by FPT (+0.53%), CMG (+0.59%), ITD (+0.86%), and VBH (+8%).

Securities groups performed well in today’s session. On September 12, 2024, the State Securities Commission held an emergency meeting to discuss draft amendments to four circulars regulating securities trading on the securities trading system, securities settlement and payment, securities business activities, and information disclosure in the market.

This development aims to expedite the resolution of outstanding issues and move towards upgrading the market, as directed by the Government and the Ministry of Finance.

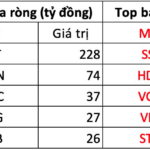

In terms of foreign trading, foreigners continued to net sell over 115 billion VND on the HOSE exchange, focusing on VHM (188.95 billion), MWG (124.19 billion), VCI (85.47 billion), and HPG (73.47 billion). On the HNX exchange, foreigners net bought over 5 billion VND, focusing on IDC (7.9 billion), BVS (5.08 billion), VC3 (2.45 billion), and NTP (1.73 billion).

| Foreign Trading Buying and Selling Dynamics |

Afternoon Session: Securities Groups “Rebel” but the Market Remains Dull

The market traded weakly as liquidity continued to fall sharply from the previous session’s low. The securities group “rebelled” but failed to receive a response from the overall market. At the midday break, the VN-Index fell 0.34%, settling at 1,252.04 points; HNX-Index edged down 0.01% to 231.88 points. The market was mixed, with the decline slightly outweighing the advance, as 312 stocks fell and 254 rose.

Liquidity dried up, with the VN-Index matching volume reaching nearly 153 million units in the morning session, equivalent to a value of nearly 3.9 trillion VND, a drop of more than 33% from the previous session’s low. The HNX-Index recorded a trading volume of over 25 million units, with a value of over 351 billion VND.

In terms of impact, GAS, VNM, and CTG exerted the most negative pressure, taking away more than 1.6 points from the VN-Index. On the other hand, VCB, FPT, and SSB helped the VN-Index stay above the 1,250-point level, contributing more than 1 point to the index.

Sector performance was mixed. On the positive side, the securities group stood out with a gain of more than 1%, but its market capitalization was not high enough to boost buying pressure. Stocks that rose more than 2% included FTS (+2.91%), BVS (+2.3%), HCM (+2.25%), and MBS (+2.24%). Meanwhile, the information technology, materials, and essential consumer goods sectors managed to stay in positive territory but posted modest gains of less than 1%.

On the other hand, the utilities sector lagged the most, falling by 0.73%, weighed down mainly by the largest stock in the sector, GAS, which fell nearly 2%. Most other stocks in the sector saw only minor changes around the reference price. This was followed by the energy, non-essential consumer goods, and healthcare sectors, which all fell by around 0.5%.

Foreigners continued to net sell in the morning session, with a value of more than 70 billion VND on the HOSE exchange. MWG (75.7 billion) and VCI (63.8 billion) were the two most net-sold stocks. In contrast, FPT was the most net-bought stock by foreign investors, with a value of over 91 billion VND. On the HNX exchange, foreigners net sold over 7 billion VND, focusing their sales on SHS (10.5 billion).

10:35 AM: Selling Pressure Persists as Liquidity Dries Up

Investors’ cautious sentiment continued to weigh on the main indices, pushing them below the reference level. As of 10:30 AM, the VN-Index fell 6.6 points to around 1,249 points. The HNX-Index dropped 0.57 points to trade around 231 points.

The breadth among the VN30 stocks remained negative, with most stocks trading in the red, including VNM, ACB, MWG, and VPB. These stocks negatively impacted the VN30-Index, taking away 0.66 points, 0.6 points, 0.58 points, and 0.47 points, respectively. On the positive side, SSB, HPG, FPT, and VRE remained in positive territory, supporting the index.

Source: VietstockFinance

|

Overall, sector performance was mixed, with the utilities sector facing the strongest selling pressure, falling by 0.67%. Selling was concentrated in large-cap stocks such as GAS, which fell into the red immediately after the market opened, dropping by 1.58%. Other losers included POW (-0.39%), NT2 (-0.75%), and QTP (-0.71%)…

The industrial sector also underperformed, falling by 0.31%. Losers included VJC (-0.38%), HUT (-0.61%), and GMD (-0.52%). A few stocks managed to stay in positive territory, including VCG (+0.56%), HAH (+0.77%), and SAC (+3.57%)…

In a more positive development, the materials sector led the defensive groups with a modest gain of 0.13%. Specifically, HPG rose 0.2%, HSG climbed 0.5%, CSV added 0.25%, and DPM inched up 0.14%… However, the red prevailed in other stocks, including GKM (-3.46%), DGC (-0.62%), NKG (-0.24%), and GVR (-0.14…)

Compared to the opening, the number of stocks trading at the reference price remained high, at over 1,000, with sellers dominating. There were 301 declining stocks and 208 advancing stocks.

Source: VietstockFinance

|

Opening: VN-Index Fluctuates

A slight decline was seen at the opening, indicating investors’ caution. The main indices traded mixed and fluctuated around the reference level.

The European Central Bank (ECB) cut interest rates by 0.25 percentage points on September 12, marking the second cut this year. As a result, the ECB’s key interest rate fell to 3.5% from 3.75% previously.

This decision comes amid challenges facing the European economy. Economic growth in the Eurozone remains weak, while inflation is on a downward trend, approaching the ECB’s target of 2%.

As of 9:30 AM, the materials sector led the market, with most stocks trading in positive territory. Gainers included HPG (+0.6%), POM (+7.69%), HSG (+0.25%), VLB (+1.81%), DCM (+0.4%), and KQS (+6.67%),…

The energy sector also performed well in today’s morning session. Notable gainers included BSR (+0.43%), PVD (+0.38%), and PVB (+0.71%)…

The VN-Index Soars Past 1,250 Points, Insurance and Tech Stocks in the Spotlight

An influx of investor buying overwhelmed selling pressure, propelling the VN-Index to a remarkable gain of over 8 points and surpassing the 1,250-point milestone. Insurance and technology stocks were the stars of the show, experiencing a veritable “renaissance” and attracting substantial capital inflows from discerning investors.

Tomorrow’s Stock Market Insights: Riding the Waves of Which Stock Groups?

Although the stock market was relatively subdued on November 27th, investors can still take advantage of any volatility to invest in the next session.