I. VIETNAMESE STOCK MARKET WEEK 25-29/11/2024

Trading: The main indices gained during the last trading session of the week. At the close on November 29, VN-Index rose by 0.67%, reaching 1,250.46 points; HNX-Index increased by 0.48% to 224.64 points. For the whole week, VN-Index climbed a total of 22.36 points (+1.82%), while HNX-Index went up by 3.35 points (+1.51%).

The market continued its positive recovery last week. The VN-Index ended in the green for 4 out of 5 trading days, despite modest liquidity, as selling pressure eased significantly, indicating that investor sentiment is gradually stabilizing. Moreover, foreign investors switched from net selling to net buying throughout the week, which is a notable positive signal. The VN-Index closed the week at the 1,250.46-point level.

In terms of impact, FPT, VCB, and BID were the three main pillars contributing the most to the market’s gain in the last session, helping the VN-Index rise by nearly 4 points. On the other hand, no stock had a significantly negative impact, and the top 10 losers took away less than 1 point from the overall index.

The green dominated the market in the last session, with the insurance group being the most prominent highlight. Many stocks in this sector surged impressively from the beginning of the session, including BVH and MIG, which hit the ceiling price, BIC (+5.29%), BMI (+4.42%), PVI (+2.7%), VNR (+3.06%), PTI (+4.29%), ABI (+3.17%), PRE (+1.08%), and BHI (+7.14%).

Following closely were the telecommunications and information technology groups, which maintained their momentum with outstanding gains of 4.24% and 3.54%, respectively. The main contributors were VGI (+4.84%), FOX (+3.92%), CTR (+1.62%), ELC (+2.34%), FPT (+3.52%), and CMG (+4.41%).

The food, pharmaceutical, and textile groups also attracted significant buying interest, with notable names such as MCH (+4.93%), MSN (+1.1%), VHC (+1.82%), ANV (+3.07%), MPC (+5.26%), FMC (+2.99%), DBD hitting the ceiling price, DHT (+2.38%), DMC (+3.2%), DVN (+1.6%), and VDP (+4.75%). Additionally, VGT (+2.94%), TCM (+2.87%), and GIL (+3.93%) also performed well.

On the declining side, real estate was the only sector that ended in the red, falling by 0.14%. This was mainly due to adjustments in NVL (-1.35%) and the Vingroup trio: VHM (-0.73%), VIC (-0.49%), and VRE (-0.56%).

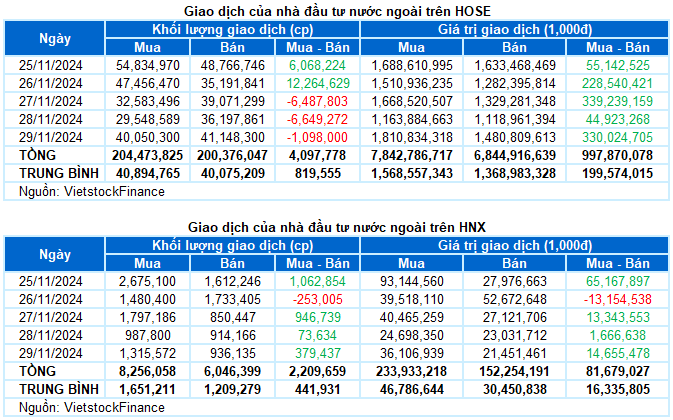

Foreign investors returned to net buying, with a value of nearly VND 1,100 billion on both exchanges during the week. They net bought nearly VND 979 billion on the HOSE and nearly VND 82 billion on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

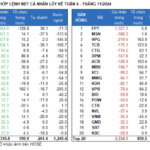

Net trading value by stock code. Unit: VND billion

Stocks with significant increases last week: DC4

DC4 rose by 18.36%: DC4 had a brilliant trading week, gaining 18.36%. The stock continuously climbed in 4 out of 5 sessions and closely followed the Upper Band of the Bollinger Bands, indicating a very optimistic investor sentiment. However, the Stochastic Oscillator indicator has entered the overbought zone. Investors should exercise caution in the coming period if sell signals reappear.

Stocks with significant decreases last week: NO1

NO1 fell by 24.06%: NO1 experienced a negative trading week, continuously declining sharply with the appearance of bearish candlestick patterns: Falling Window and Black Marubozu. At the same time, the trading volume surged significantly above the 20-day average, reflecting investors’ pessimistic sentiment.

Additionally, the Stochastic Oscillator and MACD indicators continued to decline after generating sell signals, suggesting that short-term correction risks remain present.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic Analysis & Market Strategy Department, Vietstock Consulting

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

The Market Beat: Where Does the Money Flow?

Today’s trading session ended with the VN-Index climbing over 1 point to 1,245.76, while the HNX-Index gained 0.4 points to reach 224.86. The market remains in an accumulation phase with low liquidity. The total trading value across the market barely surpassed 12 trillion dong, with more than 3 trillion dong coming from negotiated trades.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.