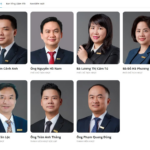

Mr. Nguyen Hoang Hai, Acting CEO of Eximbank

On November 28th, Vietnam Export Import Joint Stock Commercial Bank (Eximbank) held an extraordinary General Meeting of Shareholders (GMOS) for 2024 in Hanoi. One of the key agenda items that garnered significant shareholder attention was the management’s proposal to relocate the bank’s head office to the city.

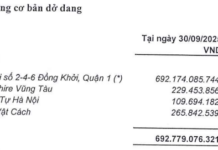

As per the plan submitted by Eximbank’s Board of Directors, the bank intends to relocate its head office from the 8th floor, Office No. L8-01-11+16, Vincom Center, 72 Le Thanh Ton, Ben Nghe Ward, District 1, Ho Chi Minh City, to a new address at 27-29 Ly Thai To, Ly Thai To Ward, Hoan Kiem District, Hanoi.

It is understood that the address at 27-29 Ly Thai To, Ly Thai To Ward, is a complex of hotels, commercial services, and leased offices invested by the Gelex Group. This project is commercially known as Fairmont Hanoi. In April 2024, Central Construction Joint Stock Company coordinated with Gelex to hold a roof-sealing ceremony for this project, which is one of Gelex’s key projects in a prime location.

Addressing shareholders’ concerns about the impact of the head office relocation on the interests of southern-based employees, Mr. Nguyen Hoang Hai, Acting CEO of Eximbank, stated: “This year marks Eximbank’s 35th year of operation, primarily focused on Ho Chi Minh City and the southern region. Eximbank has a customer base of 2.4 million, which has remained unchanged for the past decade. Meanwhile, our competitors, who started from a lower position, have far surpassed us.”

Additionally, Mr. Hai emphasized: “Eximbank is the Joint Stock Commercial Bank for Export and Import of Vietnam, not just Ho Chi Minh City or the southern region. Hence, we aim to expand our brand presence nationwide.”

According to the Acting CEO, beyond expanding the brand’s reach to the north, Eximbank also intends to focus on sectors expected to thrive in this region in the near future, including not only finance but also logistics, transportation, infrastructure, and industrial park services.

Mr. Hai believes that the southern market has reached a saturation point after 35 years of development. In contrast, the northern market presents opportunities for Eximbank to catch up with its peers within three to five years through new business strategies, rather than remaining stagnant with 2.4 million customers and a false sense of superiority.

Mr. Nguyen Hoang Hai also shared that Eximbank currently employs 6,300 people, 1,890 of whom are based at the Ho Chi Minh City head office.

“Relocating the head office to Hanoi will double Eximbank’s ability to seize opportunities and expand its market presence in the northern region. We will not make any decisions that compromise the interests of our dedicated employees. However, those with malicious intentions, acting against the organization’s interests or causing harm or suspected harm to Eximbank, will be automatically removed,” Mr. Hai asserted.

“Moreover, there have been baseless rumors circulating in the market, creating a negative impact on the morale of Eximbank’s staff and resulting in tangible losses. The bank is currently working with relevant authorities to assess the extent of the damage and identify the perpetrators,” the Acting CEO added.

Regarding the project at 7 Le Thi Hong Gam, Mr. Hai shared that the total investment for this project was VND 3,000-4,000 billion. “The Eximbank management has chosen a better option, prioritizing business operations over the brand. Hence, we have decided to temporarily halt the construction of the head office at this location,” he explained.

Vice Chairman Tran Tan Loc addressed shareholders’ queries about the costs already incurred for the head office project at Le Thi Hong Gam. He clarified that the expenses related to the construction of 7 Le Thi Hong Gam were incurred during the previous terms of the Board of Directors.

According to Mr. Loc, if the head office relocation proceeds and the construction of the head office at 7 Le Thi Hong Gam is discontinued, the Board of Directors will review the files with the partner from the previous term. If any costs have been incurred, they will negotiate a reasonable expense level to minimize losses for the bank. In case of any damages, they will be calculated and handled according to legal regulations, regardless of subjective or objective factors.

“Anyone who causes losses due to subjective factors will be handled according to legal regulations,” Mr. Loc emphasized.

Following the vote, the Eximbank GMOS approved the proposal to change the location of the head office, with 1,016 million shares, or 58.73% of shareholders, in favor and 713 million shares, or 41.23%, against.

However, two proposals regarding amending and supplementing the Articles of Association to align with the change in the head office location and terminating the investment in the Eximbank head office project at 07 Le Thi Hong Gam were not approved. Both proposals received 58.73% approval and 41.23% disapproval.

As these are crucial issues, the approval of more than 65% of the total shares with voting rights was required for these proposals to pass. For the remaining proposals, a simple majority of more than 51% of the total shares with voting rights was sufficient for approval.

A Group of Shareholders Propose the Removal of Two Vice Chairmen of Eximbank’s Board of Directors: Ms. Luong Thi Cam Tu and Mr. Nguyen Ho Nam

On November 28, the Joint Stock Commercial Bank for Foreign Trade (Eximbank – EIB) will hold an extraordinary general meeting for the year 2024.

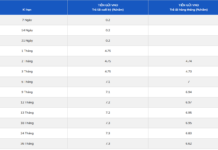

The Race to Raise Deposit Rates: Why Banks Are Competing to Offer Higher Returns

As we approach the year-end, there has been a significant surge in demand for capital, especially medium and long-term funds. In response, banks have engaged in a fierce competition to raise deposit interest rates, with the highest rate reaching an impressive 6.4% per annum for terms of 18 months and beyond.

“The Future of Eximbank: A Transformative Meeting”

The recent developments at Eximbank come amidst a change in its largest shareholder. CTCP Group has acquired 174.7 million EIB shares, equivalent to a 10% stake in the bank, making it the new dominant player in Eximbank’s shareholder landscape.