The Power Sector’s Challenge from 2030

According to the targets set out in the “Action Program on Green Energy Transition, Carbon and Methane Emissions Reduction in the Transport Sector”, approved by the Prime Minister, electric vehicle sales in the Vietnamese market from now until 2050 must reach 78 million units. This also means that the number of electric vehicles on the road, along with the demand for charging, will increase significantly year after year.

However, the World Bank’s (WB) recent report, “Vietnam: Proposal for a Roadmap and National Action Plan for the Transition to Electric Vehicles”, points out that the Power Development Plan VIII approved in 2023 does not take into account electric vehicle charging activities and only forecasts a low level of electric vehicle usage, mainly for electric motorcycles charged at home.

As a result, from now until 2030, the demand for electric vehicle charging will not create a significant strain on Vietnam’s power sector. This is because electric vehicle usage during this period will mainly be for two-wheelers – vehicles that use small batteries and typically travel short distances.

A significant increase in electric vehicles will put pressure on the power sector due to the increased demand for charging. |

Electric vehicle charging activities will only require an additional 1-2% of electricity production compared to the high-level scenario of Power Development Plan VIII until 2030, and this percentage can be addressed by increasing the surplus electricity production margin as planned.

However, by 2035, the power sector will need to increase production by 5% and network capacity by 4% to meet the demand for electric vehicle charging. By 2045, this demand will require a maximum of 16% more electricity production compared to the high-level scenario of Power Development Plan VIII, and this will further increase to a maximum of 28% by 2050.

This is because, by then, most of the energy demand in the transport sector will have shifted from fossil fuels to electricity if the targets for the use of electric vehicles are met.

Compared to the present, Vietnam’s vehicle mix in 2050 will mainly consist of large, energy-intensive vehicles such as cars, instead of two-wheelers. Adding electricity to the grid on this scale will require an annual growth rate of 5.1% in the period 2035-2050, while the current annual growth rate in the high-level scenario of Power Development Plan VIII is 3.7%.

WB recommends that after 2030, Vietnam will need to add an average of 3-5% network capacity compared to the high-level scenario of Power Development Plan VIII to meet the charging load of electric vehicles in the period 2030-2045. Subsequently, a maximum of 15% additional transmission capacity will be required by 2050 to enable 100% electrification of road transport.

Investing $14 billion annually to increase power supply

To achieve the electric vehicle consumption targets, from now until 2030, in addition to the capital for the implementation of Power Development Plan VIII, Vietnam will need to invest up to $9 billion in the power sector. An investment of about $1 billion will be allocated for the expansion of network capacity.

In the period 2031-2050, Vietnam will need to invest an average of $14 billion annually to produce additional electricity and expand the network compared to the estimates in the plan.

To meet the demand for electric vehicle charging, Vietnam needs to invest an average of $14 billion annually to produce additional electricity and expand the network. |

In addition, Vietnam must improve the efficiency of the power grid and battery usage, and promote the long-term transition of passenger and freight transport to reduce the impact of electric vehicle usage on the power sector.

Promoting the transition of passenger transport in urban areas from electric cars to mass public transport, and the transition of freight transport from inter-provincial electric trucks to railways and waterways, will significantly reduce the total demand for electric vehicle charging. WB experts calculate that a 35% shift between these segments by 2050 will reduce the additional electricity demand by 9-11%.

The report also suggests that Vietnam should encourage the use of public charging stations during the day (outside peak hours) as much as possible. This can reduce the impact of electric vehicle charging on the system’s peak consumption.

Key policy interventions include implementing an electricity price reform program to encourage off-peak charging, expanding the scale of smart charging equipment, and installing rooftop solar power systems at public charging stations to reduce the load on the power grid.

“The transition to green transport with electric vehicles is a great challenge, but Vietnam’s commitment is an important first step,” said Mariam J. Sherman, World Bank Country Director for Vietnam, Cambodia, and Laos.

According to the approved Power Development Plan VIII, the total installed capacity of power sources by 2030 will be about 146,000 MW (excluding rooftop solar power and co-generation sources). Of this, there will be 37,467 MW of coal-fired power, 23,900 MW of LNG-fired power, 16,121 MW of onshore wind power, 7,000 MW of offshore wind power, and 8,736 MW of large-scale solar power.

This scale is sufficient to meet the forecasted peak load demand of 93,300 MW by 2030, with a reasonable reserve of power sources in the national power system and in regions and provinces. The total installed capacity of power sources in the national power system will increase to 217,596 MW by 2035 and reach about 401,556 MW by 2045.

Tam An

Preparing Sufficient Land Reserves for Logistics and E-Commerce

Savills Vietnam has observed a boom in e-commerce and logistics, which has led to a surge in demand for warehouses and industrial properties. This sector is poised for significant growth in the coming years, and the company foresees vast potential for development in the real estate market to cater to these industries.

A Bold Economic Vision: Targeting an Ambitious 8% GDP Growth for 2025

At the National Conference held on the morning of December 1, Prime Minister Pham Minh Chinh reported on the key socio-economic achievements of 2024 and outlined the strategies for accelerating socio-economic development in 2025.

A Venerable Shrimp Processor Pays Dividends in Cash at 110%

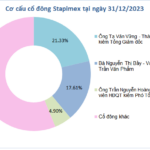

After distributing a 50% dividend for the first period of 2024, Stapimex, a leading seafood company in Soc Trang Province, is pleased to announce that it will be offering a second interim cash dividend for 2024 to its valued shareholders, with an impressive 60% dividend payout ratio.