With Japan’s aging population and the rise of single lifestyles, the 7-Eleven convenience store chain should have been booming, but the brand is now facing the risk of being taken over.

One of the main reasons for this is the brand’s stagnation in innovation and value creation.

According to the Nikkei Asian Review, one of 7-Eleven’s strengths lies in its ability to introduce new eating habits to consumers and create new economic domains.

The way their core products and services are presented at convenience stores nationwide, such as Onigiri rice balls, bento boxes, Soba and Udon noodles, hot snacks, banking services, and fresh coffee, were all developed or perfected by 7-Eleven.

However, since the chain’s coffee innovation with automated machines that brew and dispense freshly ground coffee on demand in a matter of seconds in 2013, 7-Eleven hasn’t introduced anything groundbreaking that has changed consumption patterns since then.

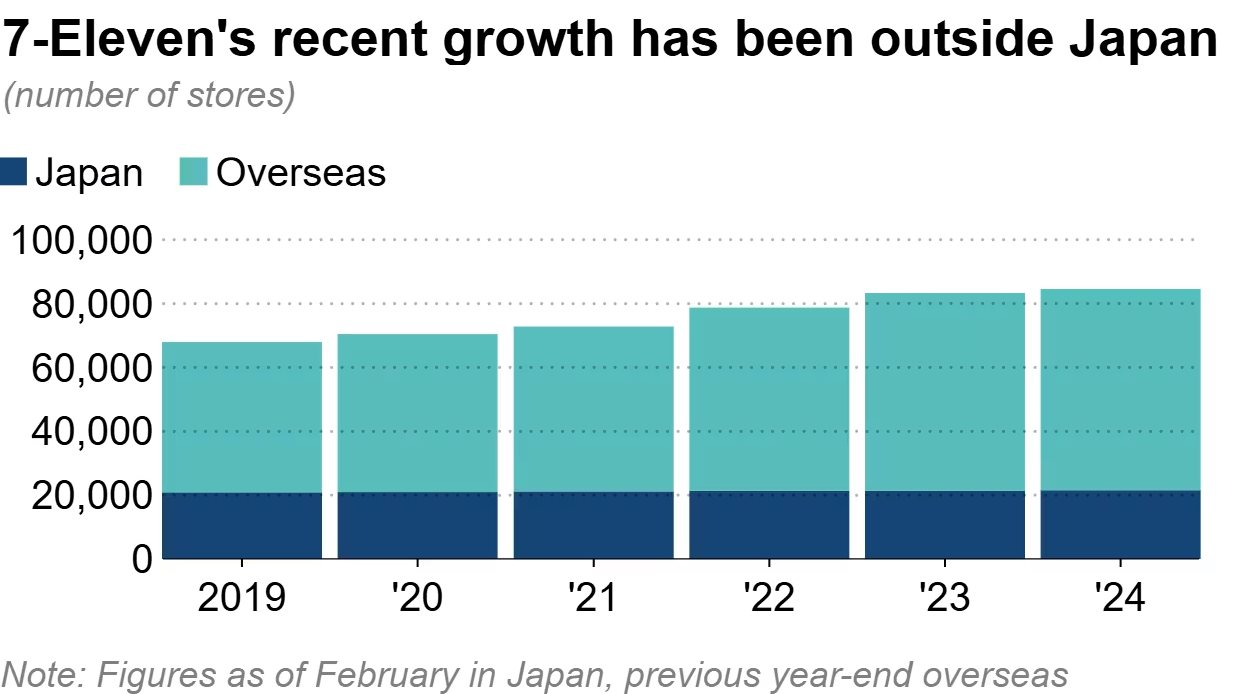

Number of 7-Eleven stores in Japan and overseas

As a result, Nikkei points out that 7-Eleven’s growth has slowed down as its innovation stagnated, thus failing to attract as many customers as before.

Of course, the post-pandemic context, which has made consumers more frugal globally, is also a contributing factor affecting this Japanese cultural icon.

The Success Formula

After World War II, Japan’s retail market underwent a complete revolution, with major brands intensifying price competition, promoting new lifestyles, and boosting domestic consumption.

However, when the country’s economic bubble burst in the 1990s, retailers like Daiei, Saison, Sogo, Mycal, and Yaohan were burdened with massive debts, leading to bank control and their eventual disappearance from the public eye.

This presented an opportunity for 7-Eleven to thrive with a series of value-creating innovations, from supply chain optimization to logistics management and customer data collection to cater to local needs.

Although each 7-Eleven store isn’t as large as Walmart or Target and may even seem cluttered, the approximately 3,000 products in each branch are carefully selected using detailed data, allowing each store to cater to the habits and tastes of the local population.

For instance, some branches sell more cookies, while others offer a wide range of craft beer to cater to local preferences.

Their fresh food offerings and exceptional logistics capabilities have made 7-Eleven profitable in the highly competitive grocery retail sector.

Initially, deliveries of up to 70 trucks per day would cause traffic jams in front of Japanese 7-Eleven stores. Therefore, since 1976, the company has developed a new system that centralizes deliveries from multiple brands and suppliers, allowing the stores to replenish their inventory with fewer than ten trucks today.

In 1982, 7-Eleven in Japan introduced an item-level inventory management model, utilizing a computer system that allowed stores to order only what was necessary based on real-time sales data, thus minimizing waste.

This exceptional logistics and inventory management capability enabled Mr. Suzuki, the owner of 7-Eleven Japan, to emphasize fresh products, frequent restocking, and a diverse product portfolio, including ready-to-eat meals tailored to local tastes, giving 7-Eleven Japan a significant advantage.

7-Eleven adapts to local culture in each market

Then, when 7-Eleven Japan acquired 70% of the shares of its American parent company in 1991, Toshifumi Suzuki comprehensively restructured the brand in the West.

One of the most notable reforms was the operational structure that empowered individual store managers to decide on the products to sell and the delivery schedule.

For example, stores located on university campuses might sell more beer and chips, while those on federal highways might offer more auto supplies and sunglasses.

Additionally, 7-Eleven branches would monitor daily sales and collect demographic information about their local customers.

The stores also utilized a distribution system where franchisees placed daily orders based on the company’s recommendations for top-selling items nationwide and in their region.

Notably, 7-Eleven raised its standards for suppliers, especially regarding food. Their processed snacks and treats are often popular in local areas because they understand local tastes and preferences.

For instance, 7-Eleven in Virginia specializes in chicken sandwiches and jalapeno steak sandwiches, which are favorites among the locals.

Saturation

Despite these successes, 7-Eleven hasn’t introduced any significant innovations or changes since 2013.

Consequently, while 7-Eleven’s average daily sales have increased over the past decade, reaching 691,000 yen in the 2023 fiscal year, their growth rate has slowed down.

According to Nikkei, while convenience store sales have been robust over the past five years, the growth rate has slowed due to the impact of the Covid-19 pandemic. The convenience store chains in Japan, which used to expand by opening 1,000 new branches annually, have now saturated the market.

The number of FamilyMart stores, one of the top three convenience store chains alongside 7-Eleven and Lawson, decreased from 16,430 branches at the end of February 2019 to 16,253 stores at the end of October 2024.

The Lawson brand also reduced its number of stores from 14,444 in the 2019 fiscal year to 14,643 at the end of February 2024.

Although 7-Eleven’s store count increased from 20,876 at the end of February 2019 to 21,535 at the end of February 2024, their growth rate has slowed compared to previous years.

In October 2024, 7-Eleven executives announced plans to close nearly 450 locations in North America to cut costs due to reduced consumer spending caused by inflation. The company reported a 26% decline in tobacco sales since 2019, the lowest in 80 years.

Over the past year, 7-Eleven has attempted to improve some of its branded products and sell more specialty beverages like cappuccino and latte, diversifying beyond just gas and tobacco sales.

However, by halting innovations that create new experiences to attract customers, 7-Eleven is losing the formula that made their convenience stores superior and appealing to customers.

*Source: Nikkei