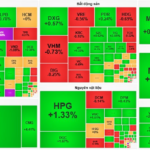

The market continued its upward trajectory this week, amid growing skepticism. While the scores were even better than last week, liquidity took a significant hit, dropping to a record low in the last year and a half. Experts believe that this upward trend is being supported more by supply than by cash flow, and even cash holders are unsure whether to participate at this point.

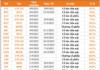

However, regardless of the driving force, the end result is still rising stock prices and indexes. The VN-Index disappointed many investors last week as it failed to adjust and instead rose to 1250 points. The average matching order value on the HoSE floor was only VND 10,154 billion/session, the lowest since the first week of May 2023.

From a technical perspective, experts believe that the market is still in a resistance zone and has the potential to adjust again. The threshold of around 1260 points, equivalent to the MA200-day, is considered a potential zone. Many opinions lean towards the scenario of a market adjustment due to the current rally lacking high liquidity, and as prices rise, liquidity worsens. There will come a point when selling pressure increases, and the small amount of money currently in the market won’t be enough to sustain it.

However, some analysts argue that there are no unfavorable pieces of information that would cause investors to panic and sell off their stocks. Even for non-surfers, the market is suitable for the holding perspective. Even in the short term, history shows that December is usually a month of growth, and there are often high expectations. The lack of surfing activities is also a reason for the overall liquidity to drop sharply.

The rally amid skepticism has left investors who haven’t bought yet confused, forcing them to either accept late entry or wait for an adjustment that may or may not come. Experts also find it challenging to give unanimous advice as it depends on the specific portfolio state. Long-term investors can still buy regularly, while surfers should wait. Even within a portfolio, buying and selling transactions can vary depending on the specific state of the stock.

Nguyen Hoang – VnEconomy

The VN-Index continued its upward trajectory last week, even surpassing the 1240-point mark to reach 1250 points. Instead of a backward movement to test the bottom as many expected, the market continued to rise. In our previous discussion, you didn’t rate the chances of forming a V-shaped bottom highly and predicted that the upward momentum would face challenges around the 1240-point region. How do you assess the profit-taking pressure in this area? Has the strong performance last week changed your perspective?

December brings the possibility of the FED lowering interest rates again by 0.25%, the “review” period for the portfolios of ETFs and indexes in the final phase, not to mention the push for disbursement and credit growth at the end of the year. New money flow may return to the market to “catch the wave” of Q4 business results and get ahead of the market before 2025, which promises to be a brighter year.

Mr. Le Duc Khanh

Mr. Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

According to my observations, the high-price supply pressure has tried to push back the index’s upward momentum, indicating intraday volatility. However, the balanced buying force towards the end of the session has helped the index recover well recently, reflecting the improving sentiment of investors in the market. After the closing session, the chart formed a positive upward candle, confirming a successful breakthrough of the MA20 on the daily frame. On the weekly frame, the index also simultaneously confirmed the reversal candle of the previous week, which is enough to re-establish the short-term uptrend, supporting the continued recovery of the VN-Index next week.

Mr. Nguyen Huy Phuong – Senior Head of the Analysis Center, Rong Viet Securities

The market’s performance last week was quite surprising as the VN-Index surpassed the 1240-point mark and stopped at 1250 despite significant cooling signals on November 28. The main driving force behind this development is not cash flow support but depends on the low supply status. The low supply is partly due to the reversal of foreign blocks, which have been net buying for five consecutive sessions and temporarily halted the previous strong net selling status.

Although the market has performed quite well and surpassed the 1240-point mark, my personal perspective on the market remains unchanged. The factors driving the market’s sustainable growth are still unclear, reflected in the cautious cash flow participation. The market’s recovery momentum could push deeper into the 1250-1265-point region next week, but supply is expected to increase again and put pressure on the market in this area.

Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

The market continued to rise this week. Although the momentum looks positive, the volume is not, as it tends to decrease, indicating a weakening buying force. The market’s rise is mainly due to a temporary shortage of supply.

However, the market has now entered the resistance zone of 1240-1260, where potential supply may emerge, so I remain cautious at this point and expect adjustments to occur next week. If the selling pressure is not strong, the market may continue its upward trajectory. However, if the selling pressure is strong, the nearly two-week recovery may come to an end.

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

The series of positive recovery sessions pushed the VN-Index back to the 1250-point mark. Theoretically, the VN-Index could still rise to the 1255-1260-point range before a technical adjustment, accompanied by a 2-3 session accumulation phase above the strong support zone of 1240-1245 points. The profit-taking pressure in this area will increase but may not be too strong as investors may become more optimistic about the market’s future trend and want to hold on to their stocks. Of course, portfolio restructuring may also be appropriate for some investors next week.

Nguyen Hoang – VnEconomy

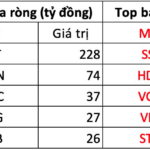

A surprising highlight last week was the return of net buying by foreign investors. The USD-Index has turned downward, causing a significant cooling of the exchange rate in the country. Is this the reason why foreign blocks reduced their selling and started buying again, or is it simply that the withdrawal phase has passed its peak as the year-end of the financial year approaches?

Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

In my opinion, the cooling of the USD is a positive sign, but it is not the main reason for the net buying by foreign investors. Vietnam is the only Southeast Asian market that has been bought back this week, while other markets such as Thailand, the Philippines, Indonesia, and Malaysia still witnessed net outflows of foreign capital. This difference may be due to the genuinely attractive valuation of the Vietnamese stock market. With the promising profit growth prospects for the end of this year and 2025, the market is currently trading at a projected P/E 2025 of about 10.x, approaching -2 times the standard deviation compared to the 10-year average. This projected P/E is also lower than that of other markets in the region.

However, it is still too early to affirm that foreign capital has truly returned. Last week, foreign investors net bought nearly VND 1,000 billion on the HoSE floor, mainly due to a significant reduction in selling volume. Meanwhile, new buying volume did not increase much, mainly from the net buying of FPT stock alone (over VND 1,250 billion). If, in the coming period, foreign investors push for disbursement in the pillar industry groups such as Banks, Securities, and Retail, it will be a clearer signal of a reversal in their position.

Mr. Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, this development results from a combination of both factors. First, the interest rate gap between USD and VND narrowed, and the DXY index cooled down, positively affecting the exchange rate stability. Stable exchange rate fluctuations are essential in influencing the behavior of foreign investors, slowing down the net selling. Moreover, after a prolonged period of net selling, foreign investors are likely to start buying again to rebalance their portfolios, especially as we near the end of the financial year.

The market’s recovery momentum could push deeper into the 1250-1265-point region next week, but supply is expected to increase again and put pressure on the market in this area.

Mr. Nguyen Huy Phuong

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

I think there are many factors behind the net selling and net buying of foreign investors, not just the exchange rate fluctuations. Timing, portfolio status, and investment strategies may consider the investment environment, stock holding periods in the portfolio, new disbursement opportunities, or portfolio rebalancing activities before the “review” period at the end of the year.

Mr. Nguyen Huy Phuong – Senior Head of the Analysis Center, Rong Viet Securities

Foreign investors have been net selling strongly in the past, especially before and after the event of Donald Trump’s election victory. This development may be due to asset restructuring globally to prepare for Trump’s policies. This activity has slowed recently, so the USD-Index has cooled down, reducing the selling pressure of foreign investors in the Vietnamese stock market. However, the net buying activity of foreign investors is currently only exploratory, mainly focused on FPT stock.

Nguyen Hoang – VnEconomy

There is pressure to disburse investment capital and credit growth in the last months of the year. The State Bank adjusted the credit room upward at the end of last week, and the stock market rose sharply in the last session. This development shows that the market is “thirsty” for supportive information. What informative “boosts” do you expect in the short term in December that could support the upward trend?

Mr. Nguyen Huy Phuong – Senior Head of the Analysis Center, Rong Viet Securities

Although the market points have improved, it is still quite subdued in terms of cash flow, indicating that the market is “thirsty” for supportive information. Currently, there is no information significant enough to affect the market after the strong point fluctuations in the past period. In my opinion, the following information is expected to support the market in December: i) Q4 GDP growth is likely to remain at a good level; ii) The government continues to promote public investment and transport infrastructure development; iii) Credit is expected to continue to grow in December; iv) The State Bank strives to stabilize deposit interest rates, simplify loan procedures, and strives to reduce lending rates…

The cooling of the USD is a positive sign, but it is not the main reason why foreign investors are investing again. Vietnam is the only Southeast Asian market that has been bought back this week, while other markets such as Thailand, the Philippines, Indonesia, and Malaysia still witnessed net outflows.

Ms. Nguyen Thi My Lien

Mr. Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In December, I believe that there will be information related to the 8th session of the National Assembly, with adjustments, amendments, and supplements to some laws, which will take time to permeate and create new expectations for stocks in related industries, boosting stock prices. December is also the time when information about Q4 and 2024 business results begins to emerge, gradually forming the first picture of the business landscape and prospects for the coming year.

In addition, information about the FED meeting is also an event that attracts market attention. If the FED lowers interest rates, this will positively affect investor sentiment and support the index’s upward momentum.

Moreover, the end of the year is also the time when investment funds finalize their results, so the buying and selling behavior of these organizations should be noted as it may affect the market next month.

Mr. Le Duc Khanh – Director of Analysis, VPS Securities

Many positive or negative pieces of information sometimes fail to fully explain the “abnormal” market fluctuations in the short term due to behavioral and trading psychology factors that are sometimes difficult to explain by phenomena. The market rose again and continued to rise because it needed to do so at this time – the market adjusted and then rose again because, after falling to a certain point, it would quickly rise again, as we witnessed in the sessions last week.

December brings the possibility of the FED lowering interest rates again by 0.25%, the “review” period for the portfolios of ETFs and indexes in the final phase, not to mention the push for disbursement and credit growth at the end of the year. New money flow may return to the market to “catch the wave” of Q4 business results and get ahead of the market before 2025, which promises to be a brighter year.

Ms. Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

December is expected to welcome positive signals from the economy, especially the Q4 and 2024 GDP growth figures. The strong surge in export and domestic orders, reflected in the optimistic PMI indices and business survey results, indicates robust production activities in this period.

At the same time, retail sales are expected to recover strongly due to increased domestic shopping demand during the year-end holidays and the continued growth of tourist arrivals in Vietnam.

In addition, public investment disbursement will be boosted by cyclical factors, creating a positive impact on private domestic investment activities.

Foreign direct investment (FDI) inflows are also expected to maintain stable growth. All these factors will contribute to strengthening businesses’ and the market’s confidence in a promising Q4 profit report.

Another bright spot is the “NAV beautification” activities of domestic and foreign investment funds at the end of the year, along with the participation of the self-business of securities companies, which promises to create a positive driving force for the market in December. Notably, we cannot ignore the informative “boost” of the “Santa Claus Rally” phenomenon – a familiar cyclical phenomenon that can evoke optimism and positive sentiment in the market. In 13 years (2010-2022), the VN-Index has recorded nine years of growth and only four years of decline, reinforcing hopes for a positive December for investors.

The Art of the Pen: Crafting Words that Win

“Ngân Tín Quy Nhơn: Unveiling a Visionary Urban Project in Bình Định, with a Capital of nearly 300,00 Billion VND”

Mr. Nguyen Tuan Thanh, Vice Chairman of Binh Dinh People’s Committee, has signed a decision to approve the auction results for land use rights for the Tay Nam Nhon Ly Urban Area project in Quy Nhon City.

The VN-Index Soars Past 1,250 Points, Insurance and Tech Stocks in the Spotlight

An influx of investor buying overwhelmed selling pressure, propelling the VN-Index to a remarkable gain of over 8 points and surpassing the 1,250-point milestone. Insurance and technology stocks were the stars of the show, experiencing a veritable “renaissance” and attracting substantial capital inflows from discerning investors.