The stock market recorded a positive trading week at the end of November. VN Index successfully rebounded above the resistance level of 1,250 points. Blue-chip stocks played a dominant role in maintaining the index’s recovery momentum. Active selling liquidity was not too high, and buying demand remained, helping the market maintain stability. At the end of the week, the VN-Index gained a total of 22.36 points (+1.82%) compared to the previous week, closing at 1,250.46.

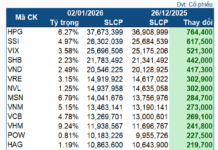

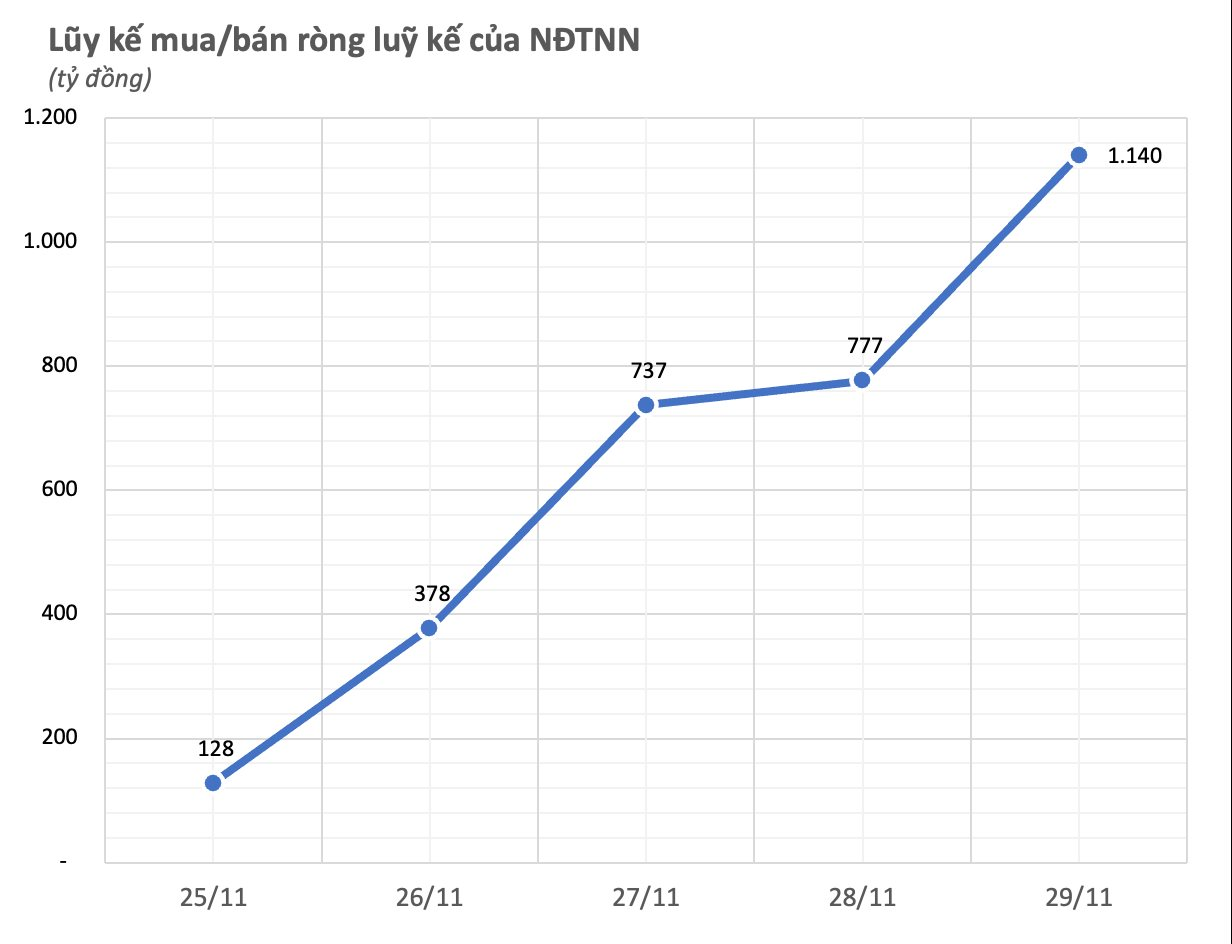

Notably, after a long period of net selling, foreign investors unexpectedly returned to strong net buying during the week of November 25-29. Cumulatively over five trading sessions, foreign investors net bought VND 1,140 billion on the entire market – marking the fifth week since the beginning of 2024 that foreign capital net bought trillions of dong on the entire exchange.

In terms of individual exchanges, foreign investors net bought VND 1,026 billion on HoSE, VND 90 billion on HNX, and VND 40 billion on UPCoM.

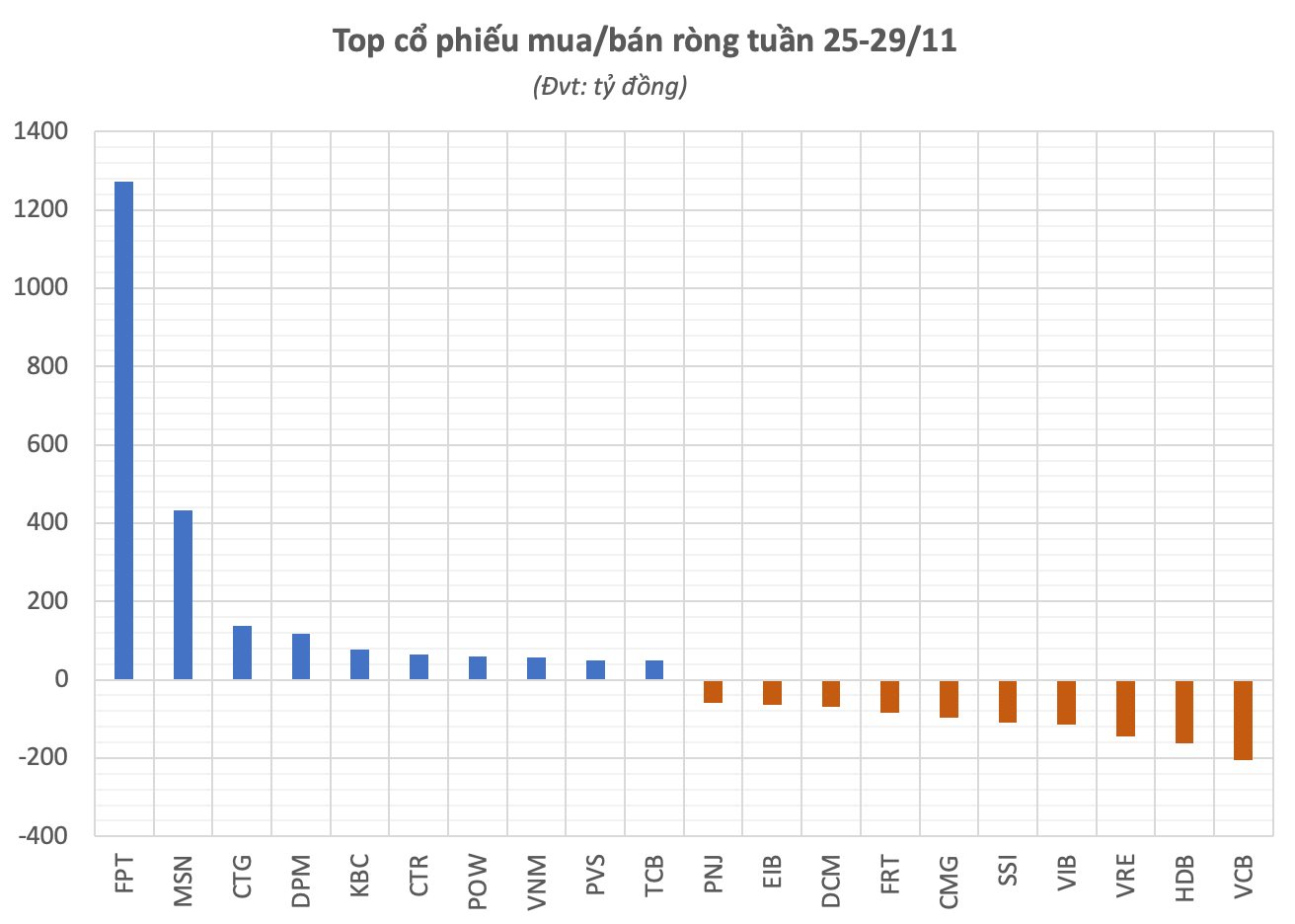

According to statistics on individual stocks, FPT, a technology stock, witnessed the strongest net buying from foreign investors, with a value of VND 1,272 billion. This came as FPT continued its impressive performance, breaking its peak for the 36th time this year. After eleven months, FPT has risen more than 70%, outperforming the VN-Index.

Foreign capital also flowed into MSN and CTG stocks, with respective values of VND 434 billion and VND 137 billion, while DPM was net bought with VND 118 billion. Buying demand was also seen in VNM, KBC, CTR, POW, VNM, and others, cumulatively over the five trading sessions last week.

On the other side, the focus of net selling this week was on VCB, a leading bank stock, with a net selling value of VND 205 billion. HDB and VRE stocks also experienced net selling, with respective values of VND 162 billion and VND 145 billion.

The net selling list also included VIB and SSI, which were net sold in the hundred-billion range, at VND 115 billion and VND 109 billion, respectively. Other stocks that were net sold by foreign investors last week included CMG, FRT, DCM, and EIB.

The Motivation Void: Reviving a Lackluster Trading Landscape

Investor sentiment turns cautious after a near week-long recovery rally from the 1,200-point mark, causing a drought of capital inflows. However, buying demand for some blue-chip stocks helps keep the VN-Index balanced.

The Foreign Capital Net Buy, VN-Index Approaches 1240 Points

The market held its ground in the afternoon session, maintaining its highs without surging or plunging significantly. Notably, foreign investors turned net buyers again, with a net purchase value of over VND 165 billion on the HoSE, marking the second consecutive net buying session. Despite the continuous upward momentum offering attractive short-term gains, investors seem reluctant to offload their positions.

Unlocking the Power of Words: Reigniting Interest in the VN-Index’s Journey to 1,260 Points While Navigating the Ever-Present Risk of Reversal

Looking ahead to the next trading session, most securities companies anticipate a continuation of the market’s upward trajectory. However, they also caution against potential reversals as the market approaches resistance levels.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.