Recurring Patterns and Bitcoin’s Future Outlook

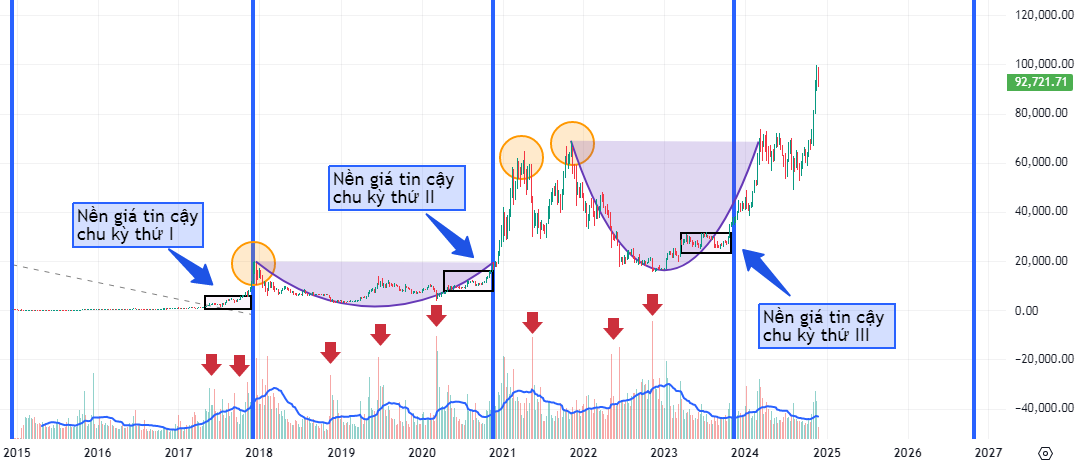

Looking at the past decade, we can clearly observe Bitcoin’s dynamic movement and significant price surges from early 2015 onwards. However, before any feverish rally, BTC tends to repeat its historical “patterns.”

Firstly, according to statistics, Bitcoin’s strong price increases typically occur in a cycle of approximately three years. Within this cycle, reliable price floors and powerful upward waves of BTC are often established and developed during the last six months.

Additionally, the cycle curves suggest a high probability of BTC reversing its trend, as evidenced by the peak of Cycle I and the confirmation points of new trends in Cycles II and III, as illustrated in the weekly chart below.

BTC Chart from 2015 – 2024 – Source: TradingView

Secondly, as per Bitcoin’s price chart, during each growth cycle, BTC consistently forms higher highs and higher lows compared to the previous cycle. Concurrently, the buy/sell signals from the MACD indicator around these cycle curves have been quite accurate, foretelling BTC’s past weakness and robust price gains. This indicates a long-term optimistic outlook, and investors can confidently employ more aggressive trading strategies when the MACD signals a buy/sell at the cycle transition zones.

Furthermore, before any feverish rally, Bitcoin undergoes a consolidation phase, often accompanied by sharp declines and surging trading volumes. The longer this consolidation phase lasts, the stronger the subsequent breakout tends to be.

Lastly, the wash-out phases with increasing volume at the bottoms of the Rounding Bottom pattern enhance the likelihood of its successful formation. Investors can consider allocating capital, keeping an eye on these characteristics if this pattern persists in the upcoming period.

In conclusion, considering these cyclical characteristics, I believe Bitcoin’s long-term growth prospects remain positive in the current cycle. Investors may continue holding and only deploy capital for long-term targets during significant corrections and shakeouts.

Technical Analysis Department, Vietstock Consulting

The Race to $100,000: Can Bitcoin’s Bull Run Continue?

According to cryptocurrency investors who spoke with MarketWatch, Bitcoin’s price is likely to reach the $100,000 mark, thanks to its recent surge in the aftermath of Donald Trump’s victory in the US elections. While the future beyond this significant milestone remains uncertain, the digital currency has seen a boost, with investors attributing it to Trump’s win.

The Big Sell-Off Hasn’t Happened Yet, Foreign Investors Bet Big on FPT

The afternoon session witnessed a slight uptick in liquidity, rising nearly 6% from the morning session, yet it remained relatively low. Trading was stable, and even the breadth was better than the morning. The VN-Index closed with a minor loss of 0.16 points, indicating a maintained balance. The market has not witnessed any significant selling pressure thus far.

“Honda Vision Scooters Now at a Massive Discount — Slashing Over 20 Million VND Off Previous Prices”

Once commanding a price of up to 60 million VND, the Honda Vision scooter is now being offered by dealerships across Vietnam at prices below the manufacturer’s suggested retail price. This unexpected turn of events has created a unique opportunity for savvy consumers to get their hands on this once highly sought-after model.