Vietnam’s stock market witnessed a positive session on November 29, with the VN-Index closing 8.35 points (0.67%) higher at 1,250.46. Foreign investors’ net buying continued for the sixth consecutive session, with a net purchase value of over 300 billion VND on the entire market.

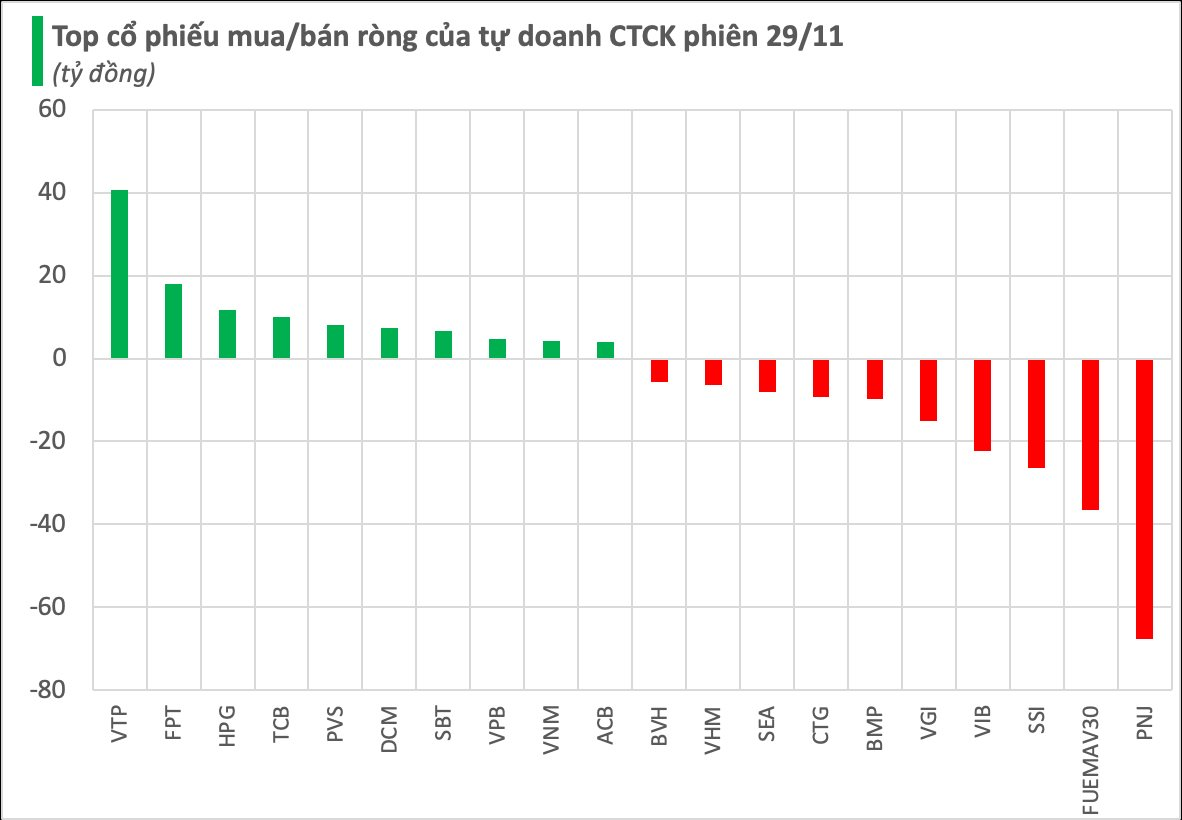

Securities companies’ proprietary trading recorded a net sell of 115 billion VND on the entire market.

On the HoSE, securities companies’ proprietary trading net sold 98 billion VND, including 96 billion VND on the matching channel and 2 billion VND on the negotiated channel.

Specifically, PNJ witnessed the strongest net selling by securities companies at 68 billion VND. FUEMAV30 and SSI were also net sold at 36 billion VND and 26 billion VND, respectively. Other stocks that faced net selling in today’s session included VIB, BMP, CTG, and others.

On the buying side, securities companies net bought 41 billion VND worth of VTP and 18 billion VND worth of FPT. Stocks like HPG, TCB, DCM, and a few others were also net bought during the November 29 session.

On the HNX, securities companies’ proprietary trading net bought 8 billion VND, with net buying in PVS (8 billion VND) and MBS (1 billion VND). In contrast, TNG faced net selling of nearly 1 billion VND.

On the UPCoM, securities companies’ proprietary trading net sold 24 billion VND, with VGI and SEA being net sold at over 15 billion VND and 8 billion VND, respectively.

The Foreigners’ Sector: Week Five Buying Spree, Investing $1.3 Billion in a Blue-Chip Stock While Offloading Vietcombank Shares

After a prolonged period of offloading, foreign investors made a surprising comeback in the final week of November, ending the month with strong net buying.

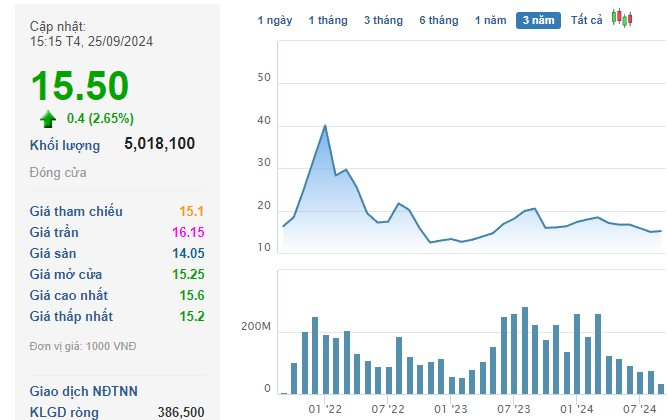

The Stock Market Liquidity Dries Up, FPT Shares Prop Up the VN-Index

The stock market is experiencing a drought in liquidity, with total trading values across all three exchanges reaching just under VND 12,900 billion. In a surprising turn of events, the FPT stock of the tech giant FPT witnessed a significant surge, single-handedly propping up the main VN-Index.