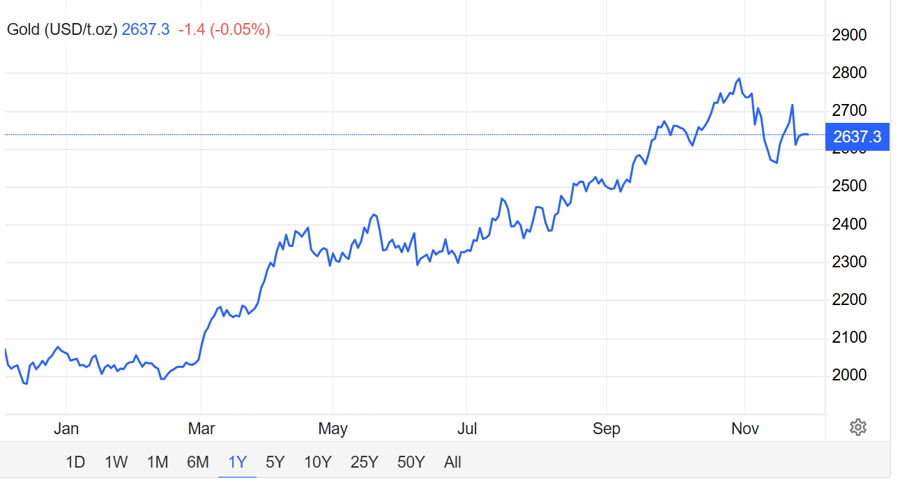

According to data from the Kitco exchange, gold spot prices rose by 1.3 USD/oz at the New York close, settling at 2,636.9 USD/oz.

Meanwhile, in the Asian market at nearly 7 a.m. Vietnam time, the spot gold price rose by 0.6 USD/oz compared to the US session close, equivalent to a 0.02% increase, trading at 2,637.5 USD/oz.

According to Aneeka Gupta, Director of Macro Research at WisdomTree, global geopolitical risks continue to escalate due to the Russia-Ukraine war. Even with a ceasefire agreement between Israel and Hezbollah, Israeli retaliatory measures are still causing tensions to rise.

“In addition, President-elect Donald Trump’s statements about tariffs targeting Canada, Mexico, and China are raising concerns about retaliatory actions from these countries. All of these factors continue to provide significant support for gold prices,” Gupta remarked.

Gold prices plummeted after Trump’s statement earlier this week but quickly recovered as the market increased its forecast for a possible 0.25 percentage point rate cut by the Federal Reserve at the December policy meeting. According to data from CME’s FedWatch Tool, the market is now betting on a 70% chance of a 0.25 percentage point rate cut next month, up from 55% earlier this week.

However, Trump’s tariff plans are also seen as a factor driving inflation in the US, causing the Fed to slow down the rate cut process. This could somewhat hinder the upward momentum of gold prices.

Data released on November 27 showed that the pace of disinflation in the US has slowed in recent months – a development that could make the Fed more cautious about cutting interest rates.

Earlier, after the wave of Republican red in the November 5 election, the gold market witnessed a massive sell-off.

“After that sell-off, the return of investor interest has supported gold prices,” said StoneX analyst Rhona O’Connell. “The market is now tending to be more cautious, and gold prices may fluctuate within a narrow range, with a downward trend likely to occur more often from now until the end of the year.”

However, Hamad Hussain, climate and commodities economist at Capital Economics, believes that gold prices could continue to fluctuate significantly in the coming months ahead of Trump’s inauguration and due to developments in the Middle East.

Analysts at Swiss bank UBS believe that gold prices still have room to grow in the long term and set a price target for the period from now until the end of 2025 at 2,900 USD/oz.

“Gold remains a useful hedge against geopolitical risks and fiscal concerns,” UBS wrote in a recent report.

The Prime Minister Calls for Lower Bank Interest Rates

Prime Minister Pham Minh Chinh has urged the Governor of the State Bank of Vietnam to continue instructing commercial banks to cut costs, boost digital technology adoption, and reduce interest rates for businesses and individuals. This move aims to stimulate production and business activities in the remaining months of this year and the beginning of 2025.

The Greenback Takes a Tumble in Vietnam

The USD exchange rate at banks retreated from the 25,500 VND/USD threshold as the greenback cooled off in the international market.