In the international market, the DXY index gained 0.82 points from the previous week, reaching 107.49. This marks the third consecutive week of increases, with the index reaching its highest level since November 6, 2022.

Donald Trump’s victory has ignited a fire under the strength of the US dollar, which has been simmering for weeks. Trump’s campaign promises to boost the American economy through tax cuts for businesses and citizens, along with increased infrastructure spending and a focus on domestic job creation, have had a significant impact.

The expectation of a stronger US economy has attracted international capital to US-denominated assets, such as American stocks and government bonds. The increased demand for USD-denominated assets has driven up the value of the currency.

Furthermore, robust economic growth can lead to inflation, influencing the Federal Reserve’s (Fed) interest rate decisions. A slower pace of Fed rate cuts keeps US interest rates relatively higher than those in other countries, making the US dollar more attractive to global investors and pushing up the USD exchange rate.

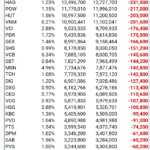

Source: SBV

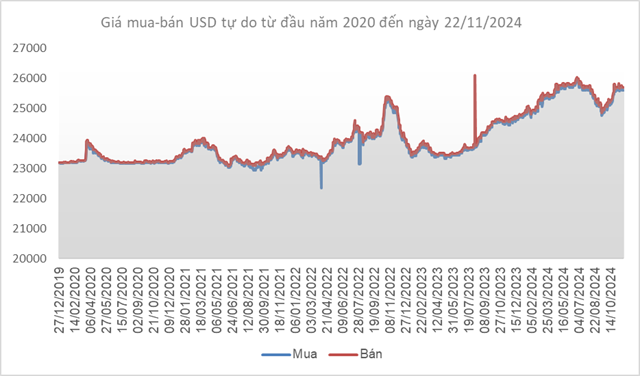

|

Domestically, the central exchange rate of the Vietnamese dong to the USD decreased slightly by 3 VND/USD compared to the previous week (November 15), settling at 24,295 VND/USD on November 22, 2024.

With a 5% margin, the allowable trading range for commercial banks is between 23,080 and 25,510 VND/USD.

At the State Bank of Vietnam (SBV), the immediate buying price remains unchanged at 23,400 VND/USD. The immediate selling price is also fixed at 25,450 VND/USD from October 25, serving as the intervention rate to rein in the exchange rate (equivalent to the intervention rate in Q2/2024). Commercial banks can purchase USD from SBV provided they meet the negative foreign currency status condition.

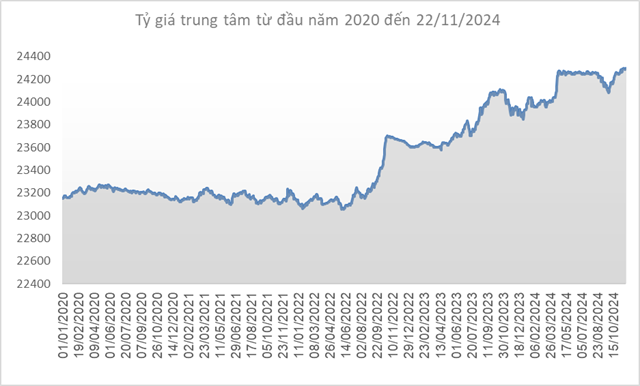

Source: VCB

|

Notably, Vietcombank increased its USD buying price by 10 VND/USD but lowered its selling price by 3 VND/USD compared to the previous week, with the exchange rate set at 25,170-25,509 VND/USD (buy-sell).

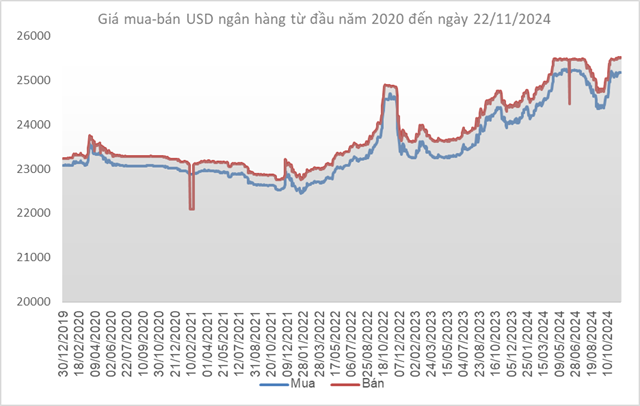

Source: VietstockFinance

|

In the free market, the USD/VND exchange rate decreased by 20 VND/USD in both buying and selling, settling at 25,600-25,700 VND/USD.

The Golden Conundrum: Navigating the Tug-of-War Between Conflicting Factors

The Swiss bank UBS predicts that gold prices will continue to oscillate in the short term “between mixed signals”.