While the VN-Index struggles within the 1,200-1,300 point range, FPT shares have once again reached a new all-time high. Since the beginning of 2024, this stock has set a new record by surpassing its peak a total of 36 times, a rare feat in the history of Vietnam’s stock market. After 11 months, FPT has surged over 70%, outperforming the VN-Index.

Based on the current market price, FPT’s market capitalization is approximately 210 trillion VND (~8.4 billion USD). This figure solidifies FPT’s position among the top 3 listed companies in Vietnam. When considering all three stock exchanges, the value of this technology group only trails behind four state-controlled giants: Vietcombank, BIDV, ACV, and Viettel Global.

The surge in FPT shares is largely driven by the strong comeback of foreign investors after the room limit was lifted above 3%. In just six sessions from November 22 until now, foreign investors have consistently bought a net of about 8 million shares of this technology stock, with a net buying value of thousands of billions of VND.

The peak-breaking performance of FPT shares brings great joy to shareholders, especially long-term investors. Recall that at the 2024 Annual General Meeting of Shareholders held in April this year, many FPT shareholders enthusiastically shared their experiences of investing in the group’s shares.

Shareholder Nguyen Viet Hung (Hanoi) shared that he started investing in the stock market four years ago, and FPT was one of his first stock picks. “Since investing, I’ve seen FPT shares only go up. There were some minor dips, but overall, it wasn’t significant, so I held on to them and had no intention of selling until now. FPT shares are a good, high-yield stock, so I feel secure holding and buying more to accumulate. I hope that FPT continues to grow, and distribute dividends consistently” – said Hung.

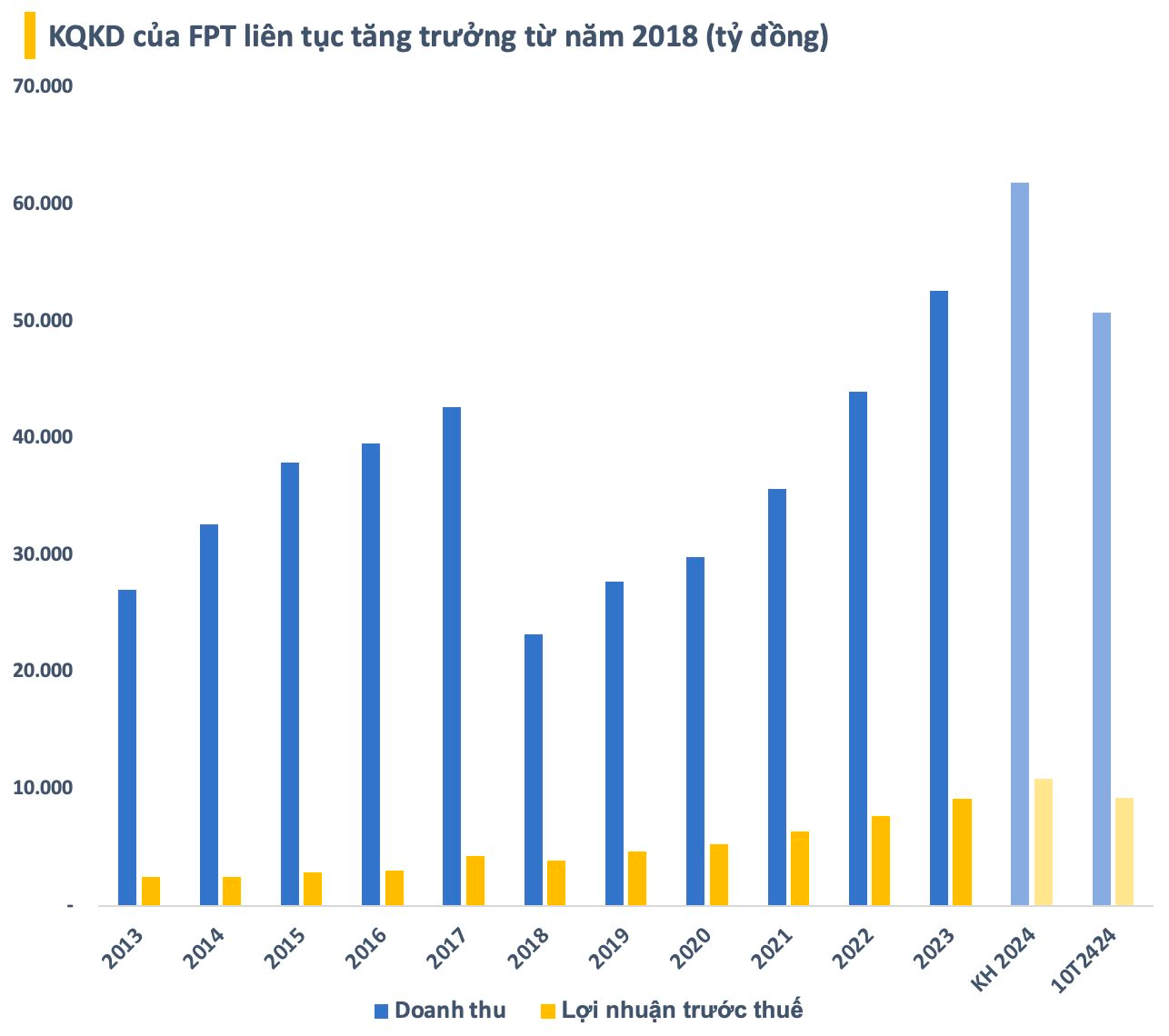

In reality, FPT has lived up to the expectations of its shareholders, consistently growing its profits at a steady rate of 2x% every month, quarter, and year. Moreover, the company has been diligent in distributing dividends to shareholders in both cash and stock.

On December 3, FPT will finalize the list of shareholders eligible for the first 2024 dividend payment in cash, with a ratio of 10% (1,000 VND per share). With nearly 1.5 billion shares currently in circulation, the company expects to spend about 1,500 billion VND on this dividend. The payment is scheduled for December 13, 2024, just ten days after the record date.

This is the second dividend FPT shareholders have received this year. Previously, in mid-June, the company paid out the remaining dividend for 2023 at a rate of 10% in cash. In addition, FPT also rewarded shareholders with a 15% stock dividend (shareholders holding 20 shares received 3 new shares).

Regarding its business results for the first ten months of the year, FPT recorded a revenue of 50,796 billion VND and a pre-tax profit of 9,226 billion VND, up 19.6% and 20%, respectively, compared to the same period in 2023. After-tax profit attributable to the company’s shareholders and EPS reached 6,566 billion VND and 4,494 VND/share, respectively, an increase of about 21% over the same period last year.

For 2024, FPT set a record-high business plan with a revenue target of 61,850 billion VND (~2.5 billion USD) and a pre-tax profit of 10,875 billion VND, representing an increase of about 18% compared to the actual results of 2023. With the achievements in the first ten months, the group has fulfilled 82% of the revenue plan and 85% of the profit target.

The IT Services segment in overseas markets continued its impressive growth, recording a revenue of 25,516 billion VND in the first ten months – officially surpassing the 1 billion USD mark and equivalent to a 29% increase. This momentum was driven by growth across all four markets. Notably, the Japanese and APAC markets maintained their high growth rates, increasing by 31% (equivalent to a 37% increase in Japanese Yen) and 38%, respectively. The value of new orders in foreign markets reached 26,924 billion VND, up 15%.

Moving forward, FPT aims to enhance its expertise in the Automotive field (targeting a 50% growth rate per year and a revenue of 1 billion USD by 2030). The group also plans to expand its services in the semiconductor industry, with a goal to train 10,000 engineers and specialists in this field by 2030 (including short-term conversion certificates from related fields such as Electronics and Telecommunications…)

In another development, the FPT Nha Trang Consortium, established by FPT Software Company Limited and FPT Danang Joint Stock Company, has submitted a proposal to the Khanh Hoa Provincial People’s Committee for investing in a urban complex project in Phuoc Dong and Vinh Thai wards, Nha Trang city.

The FPT Nha Trang Consortium proposed a project area of over 50 hectares. Of this, over 8 hectares will be allocated for the construction of an AI software research center, and nearly 7 hectares for social housing. The remaining area will be for technical infrastructure and commercial services. Additionally, the project will include over 17 hectares of residential land for the construction of apartments, social housing, villas, and adjacent houses… The projected population is around 20,000 people, and the total investment capital is 9,230 billion VND.

The Motivation Void: Reviving a Lackluster Trading Landscape

Investor sentiment turns cautious after a near week-long recovery rally from the 1,200-point mark, causing a drought of capital inflows. However, buying demand for some blue-chip stocks helps keep the VN-Index balanced.

Shake It Off: VN-Index Remains Resilient at 1240 Points

Pressure continued to weigh on the afternoon session, pushing the VN-Index down to 1240.91 points at one stage. However, buying support helped to balance out the market, and the index only experienced minor fluctuations on very low liquidity.

The Foreign Capital Net Buy, VN-Index Approaches 1240 Points

The market held its ground in the afternoon session, maintaining its highs without surging or plunging significantly. Notably, foreign investors turned net buyers again, with a net purchase value of over VND 165 billion on the HoSE, marking the second consecutive net buying session. Despite the continuous upward momentum offering attractive short-term gains, investors seem reluctant to offload their positions.