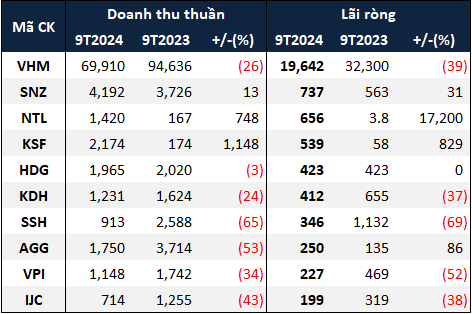

According to VietstockFinance, the revenue and net profit of 84 residential real estate enterprises listed on the stock exchange decreased by 17% and 44% respectively in the first nine months of 2024 compared to the same period last year, reaching over 111.3 trillion VND and more than 20.5 trillion VND. Among these companies, 19 enterprises reported increased profits, 36 enterprises had decreased profits, 5 enterprises turned losses into profits, and 5 enterprises turned profits into losses.

Leading the industry in profit size is the familiar name, Vinhomes (HOSE: VHM), with more than 19.6 trillion VND, a 39% decrease compared to the previous year. The company attributed its profits primarily to the handover of projects in Vinhomes Ocean Park 2 – 3 and the recognition of business results at Vinhomes Royal Island.

On the other hand, VHM’s sales revenue reached nearly 89.6 trillion VND in the first nine months, and unrecorded sales at the end of September 2024 exceeded 123 trillion VND.

Other giants such as Ha Do Group (HOSE: HDG) and Nha Khang Dien (HOSE: KDH) also made it to the top 10 highest profits, but generally remained stagnant or regressed compared to the previous year.

In contrast, An Gia Real Estate (HOSE: AGG) witnessed an 86% increase in net profit, amounting to 250 billion VND. It is known that in the first nine months, AGG handed over products at multiple projects, including the Westgate complex (Ho Chi Minh City) and The Standard isolated area (Binh Duong province).

|

Top 10 residential real estate enterprises with the highest net profit in the first nine months of 2024 (in trillion VND)

Source: VietstockFinance

|

Most enterprises experienced declining profits

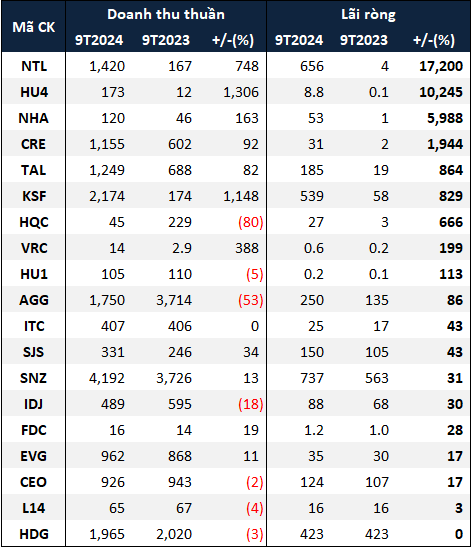

In addition to the aforementioned giants, the company that caused the biggest surprise was Urban Development and Investment Corporation of Tu Liem (HOSE: NTL), with a net profit in the first nine months that was 173 times higher than the same period last year, reaching nearly 656 billion VND. Thus, NTL topped the list of 19 enterprises with increased profits during this period and also made it to the top 10 most profitable enterprises.

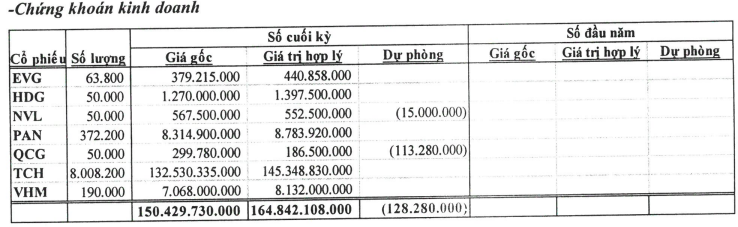

NTL’s dramatic increase was due to the auditor recognizing additional revenue, profit, and cost of goods sold for the area of land that had been sold to customers of the Bãi Muối Urban Area project (Quang Ninh). In another development, NTL attracted attention by investing over 150 billion VND in stocks in the third quarter. Based on the fair value at the time of the Q3/2024 financial statements, NTL’s investment portfolio gained nearly 10% compared to the original price.

|

NTL’s trading portfolio as of September 30, 2024

Source: NTL

|

HUD4 Investment and Construction JSC (UPCoM: HU4) also experienced a dramatic profit growth. Although its net profit after nine months was only about 9 billion VND, it was more than 103 times higher than the previous year. This result was achieved thanks to the company recognizing real estate revenue of nearly 102 billion VND, almost 16 times higher.

Despite its impressive business results, compared to the ambitious plan for 2024 with a total revenue of 425 billion VND and a net profit of nearly 26 billion VND, HU4 is unlikely to achieve its goals, having accomplished only 41% and 34% of the set targets, respectively.

|

19 real estate enterprises with increased net profit in the first nine months of 2024 (in billion VND)

Source: VietstockFinance

|

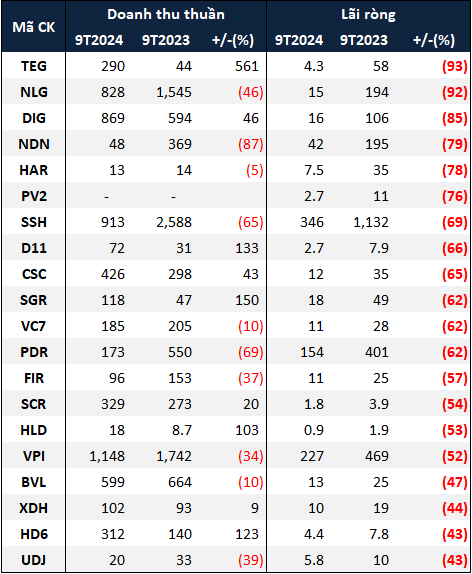

On the other hand, 36 residential real estate enterprises experienced declining profits. Among them, Energy and Real Estate JSC (HOSE: TEG) saw the sharpest decline, with a 93% decrease, resulting in a net profit of just over 4 billion VND, despite a 6.6-fold increase in revenue to nearly 290 billion VND. This contradiction occurred because in the previous year, the company profited from the transfer of capital contributions in affiliated companies and other investments totaling more than 113 billion VND, but this year it only amounted to about 5 billion VND.

Similarly, although Total Investment, Construction and Development JSC (HOSE: DIG) saw a 46% increase in revenue, its net profit decreased by 85%, amounting to 16 billion VND. DIG’s revenue mainly came from the transfer of apartments in the Cap Saint Jacques complex, the Dai Phuoc and Hau Giang raw houses (DIC Victory Hau Giang), and land use rights in the Nam Vinh Yen project.

Additionally, financial revenue decreased by 75%, to just under 52 billion VND, as the company had income of nearly 182 billion VND from investments in the previous year.

|

Top 20 real estate enterprises with decreased net profit in the first nine months of 2024 (in billion VND)

Source: VietstockFinance

|

Enterprise with huge losses

In addition to the enterprises with declining profits, 23 residential real estate enterprises suffered losses in the first nine months. The heaviest loss was reported by Nova Real Estate Investment Group JSC (HOSE: NVL), with more than 4.1 trillion VND, despite a 57% increase in revenue. If not for NVL’s loss, the total net profit of the industry would have decreased by more than 34% compared to the same period last year, instead of 44%.

NVL’s results for the first nine months were significantly impacted by the company’s net loss of over 7.2 trillion VND in the first half of the year due to increased provisions and financial expenses as per the auditor’s recommendation regarding land rent, land use fees payable, and late payment fees for the 30.1ha Nam Rach Chiec project in An Phu Ward, Thu Duc City. Additionally, there was a revaluation of foreign currency payable and a loss from the liquidation of a subsidiary. Although the third quarter saw a sudden surge in profit, increasing by more than 18 times compared to the same period last year and exceeding 3 trillion VND, it was not enough to pull NVL into profitability after nine months.

As for LDG Investment JSC (HOSE: LDG), the loss was almost predictable as the company’s net revenue was negative, at nearly 175 billion VND, due to the impact of returned goods totaling nearly 358 billion VND. It is highly likely that the value of returned goods came from the Tan Thinh Residential Area project (Dong Nai).

|

Top 10 loss-making residential real estate enterprises in the first nine months of 2024 (in billion VND)

Source: VietstockFinance

|

Many enterprises far from their targets

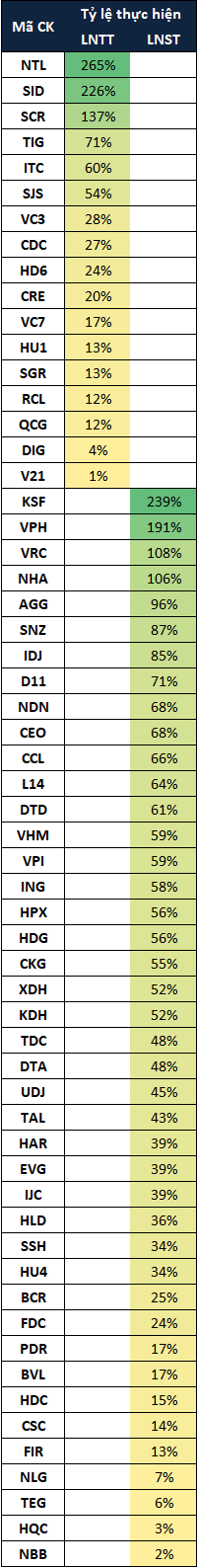

Although three-quarters of 2024 have passed, the progress in implementing the 2024 plans of real estate enterprises is not optimistic. Many companies predict that 2024 will continue to be a challenging year and set more conservative plans compared to 2023. Among the profitable enterprises, less than one-third have completed more than half of their annual targets after nine months, equivalent to 27 enterprises.

On the other hand, seven enterprises exceeded their annual plans (accounting for more than 8%), including NTL, Saigon Co.op Investment and Development, Dia Oc Sai Gon Thuong Tin JSC (HOSE: SCR), Sunshine Group JSC (HNX: KSF), Van Phat Hung JSC (HOSE: VPH), Real Estate and Investment VRC (HOSE: VRC), and the Southern Housing Development and Urban Development Corporation (HOSE: NHA).

However, many of these companies set relatively low business plans. For example, SCR planned for a pre-tax profit of only 16 billion VND for the whole of 2024 – the lowest in many years.

|

Implementation rate of 2024 plans of profitable enterprises after nine months

Source: VietstockFinance

|

Who Will Claim the EPS Throne in Q3 2024?

Once again, the companies with the highest EPS for the first nine months of this year are the usual suspects – renowned for their attractive cash dividend policies. And perhaps it is this very reputation that has kept their stock prices soaring in the stock market.

“BIG Set to Smash Year-End Revenue Targets, Thanks to Durian; 5.2% Dividend Payout Imminent”

The Hanoi Stock Exchange (HNX) has announced the record date for the cash dividend of Big Invest Group Joint Stock Company (BIG) listed on UPCoM. As of December 4, 2024, shareholders are entitled to a generous 5.2% dividend yield. The company’s leadership has also revealed impressive revenue growth projections for 2024, largely driven by the China-focused durian import-export business, especially during the pre-Lunar New Year peak season.

Handico6 Switches Dividend Payout from Stock to Cash

The Hanoi No. 6 Housing Investment and Development JSC (Handico6, UPCoM: HD6) has just announced a cash dividend for the year 2023. The record date for this dividend is set as December 9, 2024, meaning that shareholders who own the stock on this date will be eligible to receive the dividend payment.