The lack of momentum in the market can be attributed to investors’ weariness with the recent tug-of-war or their cautious wait-and-see approach ahead of the US presidential election results. It’s likely that many investors are also considering the potential market volatility that could arise once the election outcome is decided.

Today’s market breadth remained skewed towards sellers. While there were nearly 400 stocks that advanced, 300 declined. However, the large-cap stocks didn’t perform positively, making it challenging for the market to surge. HVN and GVR were the two stocks that contributed the most to the VN-Index’s gains today, with over 1 point added to the index. On the other hand, CTG and BID continued to weigh it down.

The materials sector finished the session on a relatively positive note. HPG, GVR, NKG, HSG, DCM, and BMP all posted slight gains.

Financial stocks had a lackluster session, with scattered greens and reds within the sector. Many securities and banking stocks closed unchanged. EIB stood out with a 3.2% increase and strong liquidity.

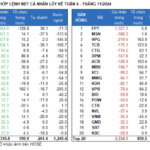

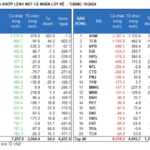

Foreign investors net sold nearly VND 850 billion. MSN remained the focal point, followed by VHM.

| Top 10 stocks that foreign investors net bought/sold the most on November 5, 2024 |

Morning session: Still trapped in a tug-of-war

The morning session ended with both the VN-Index and HNX-Index slightly below the reference price.

The market continued to witness a tug-of-war from the opening bell until the lunch break. It struggled to find a clear upward momentum or significant downward pressure. The cautious sentiment was reflected in the plunging liquidity, with the trading value in the morning session reaching just over VND 5.1 trillion.

EIB surged nearly 4%, leading the group that pushed the VN-Index higher. On the contrary, BID, CTG, and VCB dragged the index down by more than 1 point.

Telecom stocks remained the best-performing group in the morning session, thanks to the gains in VGI, FOX, FOC, and TTN.

Foreign investors were net sellers, offloading over VND 320 billion worth of stocks. MSN topped the list of stocks that were sold off, with a value of more than VND 70 billion in the morning session. TCB was among the most bought stocks, with a value of just over VND 30 billion.

10:35 am: Lack of liquidity keeps indices range-bound

The market remained trapped in a tug-of-war, with the indices fluctuating around the reference price.

Source: VietstockFinance

|

The absence of liquidity has been the primary reason for the indices’ inability to break free. By 10:30 am, the trading value on the HOSE reached just over VND 2.2 trillion, half of the previous session’s value.

The market breadth remained skewed towards buyers, with 275 stocks advancing and 250 declining. Sellers continued to exert pressure on strategic stocks, including banks such as CTG, VCB, VPB, and BID, as well as leading stocks like MSN, FPT, VJC, and GMD. Among them, VCB was the top drag on the index.

TLG unexpectedly hit the ceiling price mid-session. Thiên Long Group (HOSE: TLG) has set November 14 as the ex-dividend date for a 2023 stock dividend of 10% and an interim cash dividend for 2024 of 10%.

In the real estate sector, DXG, VHM, and DIG led in terms of liquidity and traded in the green.

Opening: Buyers slightly edge out sellers

The VN-Index’s slight gain of nearly 2 points at the start of the November 5 session indicated a continuation of the recent tug-of-war pattern. Buyers held a slight edge, with 220 stocks advancing and 130 declining.

Scattered greens were observed in some leading stocks, such as MSN, VHM, HPG, FPT, VNM, and GEX.

There were also slight gains in the banking sector, including EIB, TPB, and MBB. Banks continued to be the representative sector keeping the VN-Index in positive territory. VCB, LPB, TCB, STB, and EIB contributed over 1 point to the index’s gains. GVR, VHM, FPT, HPG, and MSN were also among the stocks that pushed the index higher. In contrast, SSB, BCM, and VPB were the top drags on the index, although the downward pressure was not significant.

Telecom stocks performed well in the early minutes of the session, with VGI surging over 2%, FOX gaining 1%, and CTR inching up 0.6%.

DXG recorded the highest trading volume in the market at the opening bell. By 9:32 am, over 7.2 million shares had been traded, and the stock posted a slight gain of nearly 2%.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.