The surge propelled Bitcoin to become the best-performing asset since February, when it recorded a 45% gain due to the launch of Bitcoin spot ETFs. Bitcoin’s price now stands at $97,081.81.

Trump’s victory has created a wave of unprecedented optimism. Bitcoin has been consistently breaking through resistance levels, coming closer than ever to the dream milestone of $100,000 USD. Analysts point out that the expectation of a new Trump term not only brings legitimacy to the nascent crypto industry but also promises profound macro changes: budget deficits may rise, potential inflationary pressure, and a possible shift in the US dollar’s status internationally – all factors that positively support Bitcoin.

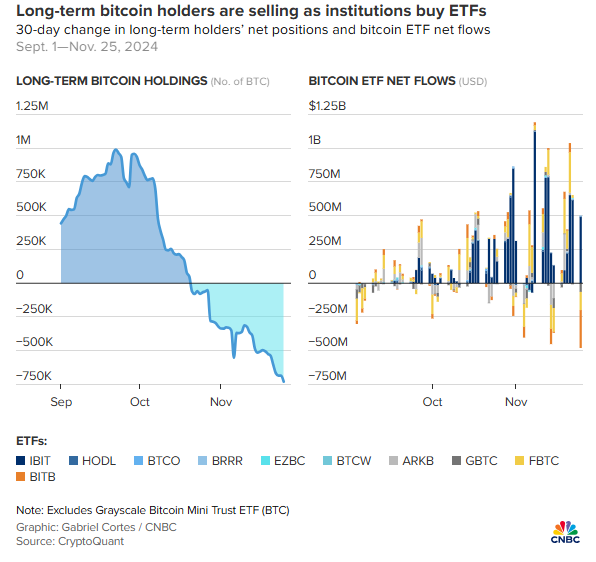

Notably, the wave of investment through Bitcoin ETFs has reached new heights. BlackRock’s IBIT fund leads this trend, with record inflows that match the selling pressure from long-term investors taking profits. The introduction of options trading on Bitcoin ETF also ushers in a new era for speculation and trading.

Looking ahead, investors are betting on the $100,000 USD mark by the end of 2024 and the possibility of doubling that by the end of 2025. However, many experts believe that the long-term price driver will come from more fundamental factors rather than political ones. Bitcoin is now widely recognized as a digital asset, with a clearer legal framework and its role as “digital gold” strengthened.

In addition to Trump, one of the most important catalysts for this rally was the halving event in April 2024, when the supply of new Bitcoins was cut in half. Combined with the increasing demand from financial institutions and even countries looking to adopt Bitcoin as a reserve asset, Bitcoin’s price is predicted to continue its upward trajectory. History shows that Bitcoin’s price peaks typically occur at least a year after each halving event.

The Future of Bitcoin (Part 2): Uncovering Cycles, Understanding Market Pulse.

In each growth cycle, BTC consistently forms new peaks and troughs, with each trough and peak being higher than the previous cycle. This consistent pattern indicates a strong potential for long-term growth, and there is a high probability that this upward trajectory will continue in the current cycle.

The Race to $100,000: Can Bitcoin’s Bull Run Continue?

According to cryptocurrency investors who spoke with MarketWatch, Bitcoin’s price is likely to reach the $100,000 mark, thanks to its recent surge in the aftermath of Donald Trump’s victory in the US elections. While the future beyond this significant milestone remains uncertain, the digital currency has seen a boost, with investors attributing it to Trump’s win.

The Future of Bitcoin (Part 1): Is the “Crypto Age” Upon Us?

The 2024 US Presidential Election results are in, and the Bitcoin fever is back with a bang. In less than a month, the cryptocurrency witnessed an astronomical rise of approximately 40% in value, breaking all previous records and soaring to new heights.

The Crypto Surge: Why Bitcoin’s Value Skyrocketed Post-Trump Election

Bitcoin Surges Towards $100,000: Why Trump’s Presidency Caused a Shock Spike.

A perfect storm of factors, including Trump’s unexpected victory, has sent Bitcoin surging towards the $100,000 mark, shocking investors and experts alike. But why has Trump’s presidency caused such a dramatic rise in this cryptocurrency’s value? In this introduction, we unravel the intriguing connection between Trump’s win and Bitcoin’s unprecedented surge.