Vietnam’s construction sector demonstrated robust growth in the first nine months of 2024, with a growth rate of over 7% compared to the same period last year, according to the Ministry of Construction. The country’s urbanization rate surpassed 43%, and 100% of urban areas have master plans in place.

The average living space per person in Vietnam is estimated to reach 26.5 square meters, an increase of 0.9 square meters compared to 2023. Additionally, the construction industry index rose by more than 6% (as of November 15) since the beginning of the year, while the VN-Index climbed by nearly 8%.

The Biggest Profit Earners in the First Nine Months

Financial reports from approximately 99 construction companies listed on the stock exchange reveal that the majority of them experienced growth in revenue and profits during the first three quarters of 2024.

Hòa Bình Construction Group experienced a remarkable turnaround in their business performance during the first nine months of 2024

The most impressive turnaround was achieved by Hòa Bình Construction Group Joint Stock Company (HBC, UPCoM), which shifted from a loss of 880 billion VND in the previous year to a profit of nearly 837 billion VND. This profit figure is not only the highest in the industry for the first nine months of 2024 but also far surpasses its peers.

This profit is more than three times HBC’s full-year net profit target of 269 billion VND. However, their revenue for the period decreased by 11% year-on-year to 4,787 billion VND.

Ranking second is CII Bridge and Road Investment Joint Stock Company (CII B&R, LGC, HoSE) with a profit after tax of over 441 billion VND, doubling its profit from the same period last year. CII’s subsidiary also recorded an 86% increase in revenue, reaching 1,888 billion VND.

In third place is PC1 Corporation (PC1, HoSE) with a profit of 399 billion VND, a significant surge compared to the 65.7 billion VND profit in the previous year. However, PC1 leads the industry in revenue, generating 7,538 billion VND, a 45% increase year-on-year.

Ranking fourth in the industry in terms of profit is Song Da Corporation – Joint Stock Company (SJG, UPCoM) with a profit of over 367 billion VND, a slight decrease of 8% year-on-year. SJG’s revenue also declined by 2% to 4,063 billion VND, ranking third in the industry.

Following closely is Deo Ca Transport Infrastructure Investment Joint Stock Company (HHV, HoSE) with a profit of 309.5 billion VND and revenue of over 2,298 billion VND, representing increases of 15% and 26%, respectively, compared to the same period last year.

Bamboo Capital Joint Stock Company (BCG, HoSE) reported a profit of 277 billion VND and revenue of 3,238 billion VND, increases of 99% and 14%, respectively, compared to the first nine months of 2023.

Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII, HoSE) also witnessed a remarkable surge in profit, reaching 271 billion VND, a 319% increase year-on-year. However, their revenue slightly dipped by 2% to 2,284 billion VND.

The last three companies in the top ten profit earners in the construction industry for this period had profits below 200 billion VND. These include Cienco4 Group Joint Stock Company (C4G, UPCoM) with 156 billion VND (a 51% increase), Northern Power Investment and Development Joint Stock Company (ND2, UPCoM) with 138 billion VND (a 53% increase), and Petroleum Equipment Assembly and Metal Structure Joint Stock Company (ICN, UPCoM) with nearly 132 billion VND (a significant increase compared to the previous year’s figure of over 23 billion VND).

| Column 1 | |

|---|---|

| HBC | 836.8 |

| LGC | 441.2 |

| PC1 | 399.1 |

| SJG | 367.1 |

| HHV | 309.5 |

Profits Soar in the Third Quarter of 2024

When considering the third quarter of 2024 alone, several companies reported net profits that increased manifold. For instance, BCG’s net profit for the third quarter reached nearly 132 billion VND, more than 23 times higher than the same period last year. According to the company’s explanation, the significant profit increase was due to reduced interest expenses and a recovery in revenue from their real estate segment.

Similarly, ICN’s net profit for the third quarter of 2024 amounted to nearly 48 billion VND, 16.5 times higher than the previous year. This surge in profit can be attributed to the recognition of revenue from their real estate business, specifically the project for the construction of a commercial center, service, and residential complex in Bac Chau Giang, Ha Nam province.

Another notable mention is Construction and Investment Joint Stock Company No. 18 (L18), which achieved a net profit of over 92 billion VND in the third quarter, ten times higher than the same period last year. This quarter also marks the highest profit for the company since its listing on HNX in 2008.

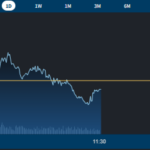

The Stock Market Liquidity Dries Up, FPT Shares Prop Up the VN-Index

The stock market is experiencing a drought in liquidity, with total trading values across all three exchanges reaching just under VND 12,900 billion. In a surprising turn of events, the FPT stock of the tech giant FPT witnessed a significant surge, single-handedly propping up the main VN-Index.

The Stock Market in 2025: Forget Forex, Aim for a Breakthrough

“Unleashing the potential of the market requires a focus on public investment. By invigorating public investment, we can create a new impetus for economic growth and development, paving the way for a thriving future.”