Mr. Nguyen Hai Long (furthest right) at TDH’s 2024 Annual General Meeting. Photo: Thuong Ngoc

|

The timing of his departure will be decided by TDH’s Board of Directors. Mr. Long cited personal reasons for his resignation, stating that he is no longer able to fulfill his duties and responsibilities.

Mr. Long was appointed as TDH’s CEO on April 15, 2024, replacing Mr. Dam Manh Cuong, so he has only served in the position for about 7.5 months.

Notably, Mr. Long is the second CEO to resign after the low-profile businessman, Nguyen Quang Nghia, became the Chairman of TDH’s Board of Directors. Furthermore, with Ms. Van Thi Hue’s resignation from her position as Deputy CEO on June 4, 2024, Mr. Long is currently the sole member of TDH’s Management Board.

Thuduc House’s CEO Unexpectedly Resigns

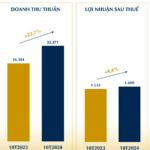

Mr. Long’s departure comes as TDH reported positive third-quarter financial results for 2024, with a net profit of nearly VND 30 billion, almost four times higher than the same period last year. This performance reduced the Company’s nine-month cumulative loss to nearly VND 4 billion (compared to a loss of over VND 12 billion in the previous year).

However, the favorable results mentioned above are not derived from the company’s core business operations but from compensation received as a result of court rulings. Firstly, there was an amount of over VND 2 billion from Quan Minh Tuan, and then nearly VND 30 billion from former CEO Nguyen Vu Bao Hoang regarding the 2017-2019 electronic component case.

In relation to the 2017-2019 electronic component case, as of October 21, 2024, TDH still owes Ho Chi Minh City Tax Department more than VND 91 billion.

“PJICO Stays Steadfast to its Business Goal of “Safety, Efficiency, and Sustainability””

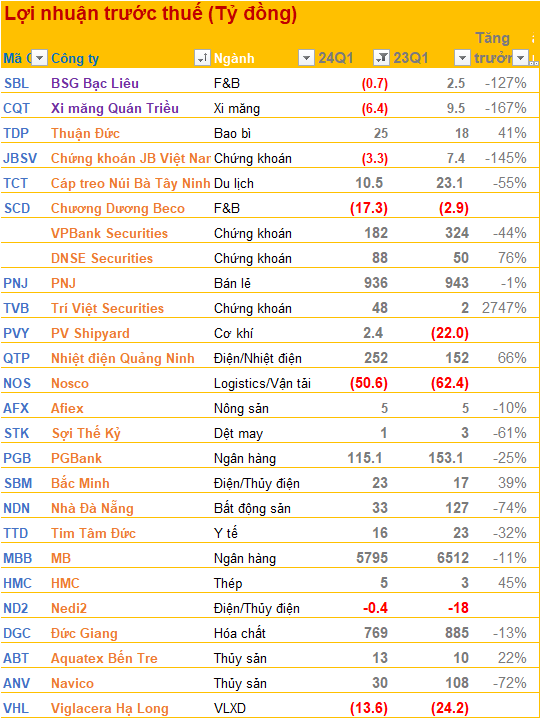

Petrolimex Insurance Joint Stock Corporation (PJICO – stock code: PGI) recently convened its 3rd meeting of the 2024-2029 term Board of Management to assess the performance of its 9-month business plan, key strategies for Q4 2024, and outline directions for crafting the 2025 roadmap.