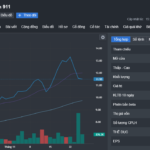

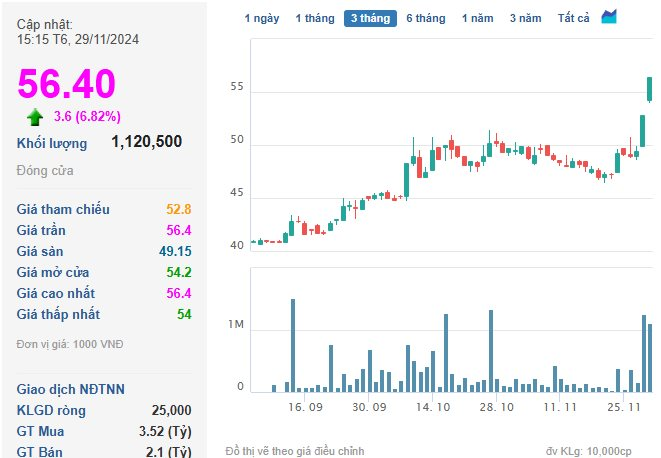

DBD shares soar to new all-time high. (Source: Cafef)

Closing session on November 29, DBD shares reached 56,400 VND per share, up 6.82% from the previous session, with a trading volume of over 1.1 million units.

This marks yet another record-breaking peak for the pharmaceutical company based in Binh Dinh province.

Kicking off the new year of 2024 at 43,360 VND per share, DBD shares have climbed an impressive 30.07% in market price as of this writing, equivalent to a gain of 13,040 VND per share.

Investors’ unwavering confidence in the company’s promising financial performance has propelled the share price of this Binh Dinh-based pharmaceutical firm to new heights.

In Q3 2024, Bidiphar posted an after-tax profit of 75 billion VND, reflecting an 11.61% increase compared to the same period last year.

According to the company’s explanation, this growth can be attributed to their strategic shift in business structure and the increased focus on selling self-produced pharmaceutical products. Total revenue from the sale of in-house pharmaceuticals in Q3 2024 witnessed a 5% uptick compared to the same quarter in the previous year.

Additionally, a reduction in certain expense items, such as a 134% decrease in provisions for doubtful accounts receivable in Q3 2024 compared to the same period in 2023, and marketing expenses sitting at only 31.7% of the 2024 plan, further bolstered their financial performance.

For the first nine months of this year, Bidiphar reported an after-tax profit of 214 billion VND, a 2.11% increase compared to the same period in 2023, translating to an additional 4.4 billion VND.

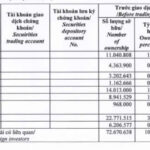

As of September 30, 2024, Bidiphar’s total assets stood at 2,134 billion VND, marking a 7.33% increase from the beginning of the year, equivalent to an increase of over 145.8 billion VND. Short-term assets accounted for 1,386 billion VND, a 10% surge. Notably, cash and cash equivalents soared to nearly three times the amount from the start of the year, reaching 261.8 billion VND.

On the other side of the balance sheet, as of the end of September 2024, the company’s payables stood at 497.8 billion VND, reflecting a 10.48% decrease from the beginning of the year. Notably, loans and financial taxes (both short-term and long-term) amounted to just over 23 billion VND, nearly halving from the start of the year.

In another notable development, the 2024 Annual General Meeting of Bidiphar, held on April 27, 2024, witnessed a surprising turn of events. Mr. Ta Nam Binh, initially excluded from the list of candidates for the Board of Directors for the 2024-2029 term, was eventually added back to the list and subsequently elected as the Chairman of the Board. Mr. Nguyen Tien Hai, the former Chairman, now serves as a member of the Board of Directors.

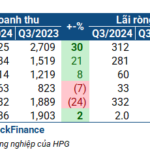

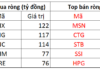

The Lucrative World of Pig Farming: Unveiling the Profits in Q3

The majority of businesses in the pig farming group witnessed substantial profit increases in Q3 2024. The primary reason for this impressive performance was the significant variation in the average piglet prices across the country between the two periods. Additionally, these businesses benefited from the low cost of animal feed.