FPT shares closed at VND 138,900 per share on November 27, marking a 2.74% increase from the previous session. The trading volume of FPT shares reached over 9.8 million units, with a total trading value of more than VND 1,358 billion.

This was the sixth increase in the last eight sessions for the technology stock, bringing its market price closer to the historical peak of VND 142,000 per share reached in mid-October.

Today’s strong performance can be attributed to investors’ confidence and positive expectations for the future growth of this sole technology stock in the VN30 basket.

FPT share price has been on an upward trajectory in recent sessions. (Source: Cafef)

Similarly, three out of the four remaining FPT-family stocks on the stock market also witnessed significant gains today: FOC +1.43%, FOX +2.72%, and FRT +0.29%. Conversely, FTS declined by 0.83%.

With today’s robust performance, FPT shares led the group of stocks that had the most positive impact on the VN-Index.

Stock Market Update: VN-Index Edges Lower as Liquidity Dries Up

Investors remained cautious and opted to stay on the sidelines, resulting in a record low liquidity in the market. The total trading value across the three exchanges barely reached VND 12,900 billion, with the HoSE exchange accounting for over VND 11,355 billion.

At the close of the November 27 session, the VN-Index lost 0.16 points to settle at 1,241.97. Similarly, the HNX-Index and UPCoM-Index also witnessed declines, falling 0.61 points and 0.1 points, respectively.

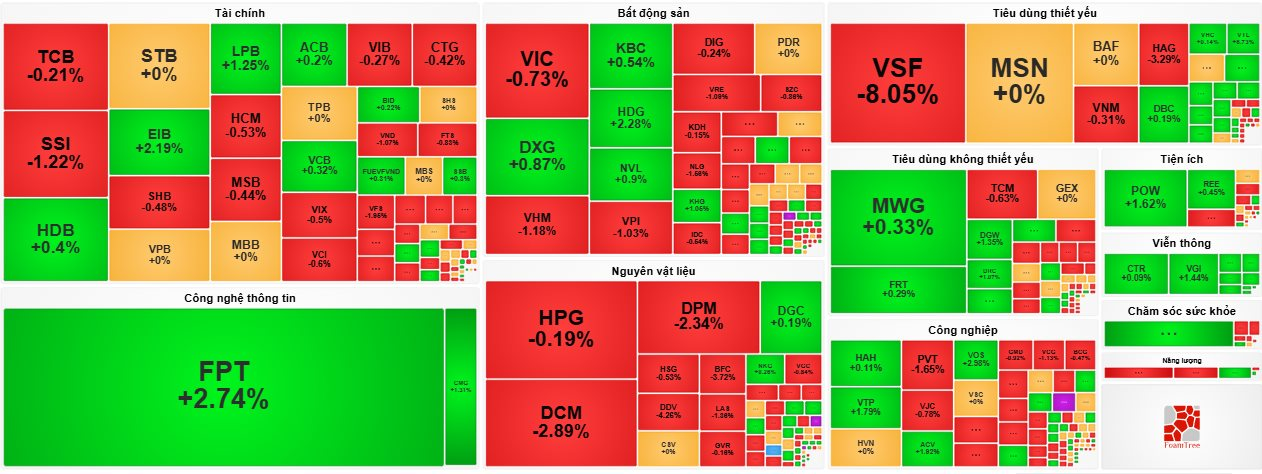

The market breadth inclined towards the red, with numerous sectors dominated by declining stocks.

The electronic board showed a predominance of red, as the VN-Index edged lower.

Among the “king” stocks, EIB of Eximbank surged 2.19% to VND 18,700 ahead of its upcoming extraordinary general meeting in Hanoi on November 28. LPB followed with a 1.25% gain. Other stocks in this category, including HDB, ACB, VCB, BID, and SSB, posted increases of less than 1%.

On the flip side, a slew of “king” stocks dipped into the red, with losses of less than 1% for CTG, VIB, TCB, SHB, MSB, BAB, OCB, and VBB, among others.

In the real estate sector, blue-chip stocks like VHM (-1.18%), VRE (-1.09%), VIC (-0.73%), VPI (-0.15%), DIG (-0.24%), SZC (-0.86%), KDH (-0.15%), NLG (-1.68%), IDC (-0.64%), TCH (-0.32%), and SIP (-1.28%) witnessed declines.

Conversely, QCG of Quoc Cuong Gia Lai continued its upward momentum for the second consecutive session, hitting the daily limit-up of 6.81% with a trading volume of over 234,000 matched orders. HDG of Ha Do Group also rose sharply by 2.28% to VND 29,200 per share. Other stocks in the sector, including DXG, KBC, and NVL, posted gains of less than 1%.

The fertilizer sector experienced heavy selling pressure, with DPM (-2.34%), DDV (-4.26%), DCM (-2.89%), BFC (-3.72%), and LAS (-1.38%) leading the declines.

Additionally, several blue-chip stocks across various sectors closed in negative territory, including HPG (-0.19%), VSF (-8.05%), HAG (-3.29%), PVT (-1.65%), SSI (-1.22%), VND (-1.07%), TCM (-0.63%), BSR (-1.03%), PVD (-1.47%), and VCG (-1.13%), to name a few.

The Stock Market in 2025: Forget Forex, Aim for a Breakthrough

“Unleashing the potential of the market requires a focus on public investment. By invigorating public investment, we can create a new impetus for economic growth and development, paving the way for a thriving future.”