The Seafood Processor Út Xi: A Tale of Regulatory Woes and Business Woes

Recently, the State Securities Commission (SSC) imposed sanctions on Seafood Processor Út Xi for a series of violations.

Firstly, a fine of 92.5 million VND was issued for failing to disclose information as required by regulations. Specifically, the company did not publish on the SSC’s information disclosure system the explanation for the post-tax profit loss in the 2023 audited financial statements; the notification of the enterprise’s audit engagement for the 2022, 2023, and 2024 financial statements; and the Board of Management’s decision on August 15, 2022, regarding the appointment of the person in charge of the company’s administration.

The company also failed to comply with the prescribed deadlines for information disclosure on the SSC’s system, including the Q4 2022 financial statements; Q1 and Q4 2023 financial statements; 2023 audited financial statements; and explanations for post-tax profit losses in the Q4 2022 financial statements, 2022 audited financial statements, and Q1 and Q4 2023 financial statements.

Secondly, a fine of 65 million VND was imposed for incomplete information disclosure. According to the 2022 Corporate Governance Report, the company did not present the Board of Management’s decision on August 15, 2022, regarding the appointment of the person in charge of corporate governance. Additionally, the 2023 Corporate Governance Report omitted the Board of Management’s resolution on August 18, 2023, which summarized the business performance for the first six months of 2023 and outlined the business direction for the remaining six months.

The total fine imposed on Seafood Processor Út Xi amounts to 157.5 million VND. The decision comes into effect from November 27, 2024.

From a renowned enterprise in Soc Trang…

According to its website, Seafood Processor Út Xi was established in 2002 as a specialized processor and exporter of seafood products, with its primary offerings including shrimp skewers, mixed shrimp, battered shrimp, fresh shrimp, steamed shrimp, and Nobashi shrimp, among others. The company boasts a workforce of over 3,000 employees and an annual production capacity of 20,000 tons of finished products.

Workers processing export shrimp at Seafood Processor Út Xi

|

In terms of its operational model, the company comprises two seafood processing enterprises and a warehousing enterprise, all sharing the same headquarters at 24, Provincial Road 934, Ha Bo Hamlet, Tau Van Commune, Tran De District, Soc Trang Province. Ms. Ly Bich Quyen, a member of the Board of Management and concurrently the General Director, currently serves as the legal representative of the company.

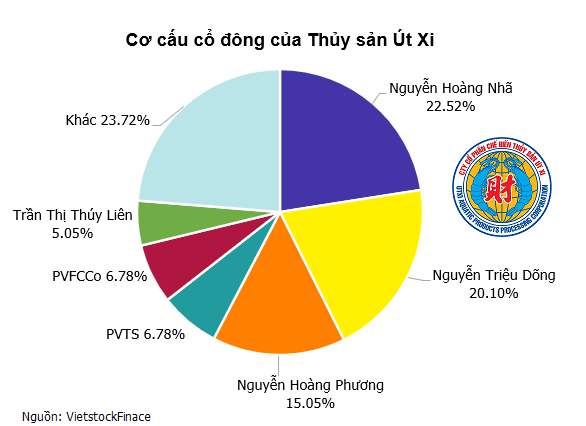

Seafood Processor Út Xi has a chartered capital of 354 billion VND, with major shareholders including Mr. Nguyen Hoang Nha, a member of the Board of Management and Deputy General Director, holding 22.52%; Mr. Nguyen Trieu Dong, Chairman of the Board of Management, with 20.1%; Mr. Nguyen Hoang Phuong, a member of the Board of Management and Deputy General Director, owning 15.05%; Joint Stock Commercial and Service Company of Vietnam National Oil and Gas (PVTS) with 6.78%; and the Fertilizer and Petroleum Chemistry Corporation (PVFCCo) with 6.78%. Ms. Tran Thi Thuy Lien holds 5.05% of the shares.

…to a string of bleak business days

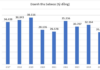

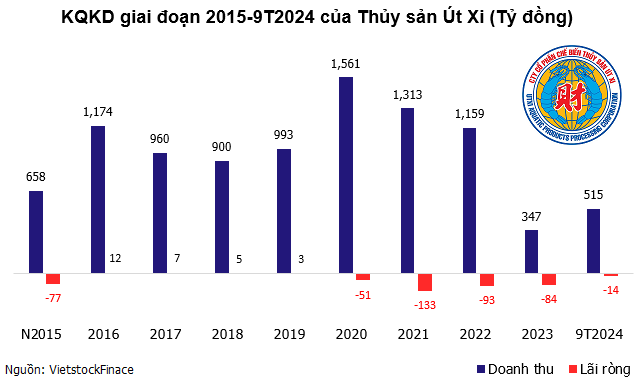

Seafood Processor Út Xi is struggling to stay afloat amid persistent losses. Starting in 2015, the company incurred a net loss of 77 billion VND, marking the first time in its operational history. It managed to return to modest profits from 2016 to 2019, only to slip back into consecutive years of losses from 2020 onwards.

During this challenging period, the company posted a loss of 51 billion VND in 2020, a record loss of 133 billion VND in 2021, and continued losses of 93 billion VND in 2022 and 84 billion VND in 2023. The first nine months of 2024 saw a further loss of 14 billion VND, primarily attributed to rising export transportation costs and unfavorable exchange rate movements, which have made export orders increasingly difficult.

The string of bleak business years has resulted in a cumulative loss for Seafood Processor Út Xi as of September 30, 2024, reaching 427.5 billion VND, with negative equity of nearly 65 billion VND.

As of the end of September 2024, the company’s total assets stood at over 911 billion VND, with the majority tied up in inventory at 593.5 billion VND (65%) and short-term receivables of 198 billion VND (22%). Notably, the company carries a substantial amount of non-performing debt, totaling more than 191 billion VND, while holding only 18 million VND in cash and 537 million VND in bank deposits.

The company’s total liabilities at the end of the period were nearly 976 billion VND, with short-term financial borrowings amounting to 406 billion VND, or 42% of total debt. Of this, over 110 billion VND was borrowed in foreign currency from Agribank, with the remaining 406 billion VND sourced from other lenders.

The Secret Commission: How Banks Push Loans to Sell Insurance

Financial experts have revealed that, in the first half of this year, there has been feedback regarding customers being required to purchase insurance packages to access loan disbursements. The root cause of this issue lies in the high commissions offered by insurance companies for investment-linked insurance products, with some companies paying over 100% in commissions to their partners, leading to this unscrupulous behavior by banks.

The Chairman of the China Securities Regulatory Commission: Vietnamese Securities Hold Great Development Potential

During her business trip to China, on November 25, 2024, the Chairman of the State Securities Commission of Vietnam, Vu Thi Chan Phuong, paid a visit to the China Securities Regulatory Commission (CSRC) and held a working session with Mr. Wu Qing, Chairman of the CSRC. The meeting was also attended by representatives from relevant departments of both the Vietnamese and Chinese securities regulatory authorities.

The Owner of GEM Center and White Palace Fined for Information Disclosure Violations

On November 18, 2024, the State Securities Commission’s Inspectorate (SSC) imposed an administrative penalty on IN Hospitality JSC for violations related to information disclosure.