The total investment, as proposed by the investor, is VND 10,540 billion, including the investor’s capital contribution, loans, and capital mobilization from organizations and individuals as per legal regulations.

It is known that Sun City must contribute more than VND 2,100 billion within 12 months from the date of approval as the investor. The remaining amount of over VND 8,400 billion will be mobilized according to the investment progress. The project implementation period is 8 years; it is expected that from 2024-2026, the legal procedures will be completed and the technical infrastructure will be constructed; from 2026-2032, the construction of the works will be invested and accepted for handover.

Sun City was once a member of Novaland (stock code NVL). In December 2020, Novaland decided to withdraw from Nova Nippon, selling Sun City and Nova Nippon for a total value of over VND 6,500 billion, with a profit of over VND 797 billion compared to the book value.

New Owner: A company directed by a former VPBank executive, recently reported a large profit, but debt consumes up to 93% of total assets

Regarding the new owner of Sun City, at the end of 2020, Import-Export Duc Mai joined hands with two other enterprises to buy all the shares of Nova Nippon, in which Duc Mai owns 41.59% of the capital in Nova Nippon.

Duc Mai was established in June 2018 with an initial charter capital of VND 20 billion, directed by Mr. Luong Phan Son, a former member of the Board of Directors of VPBank.

After buying Nova Nippon, Duc Mai used all of Nova Nippon’s shares (41.59%) as collateral for a bank loan.

Data from HNX shows that on December 22, 2020, Duc Mai Import-Export Joint Stock Company successfully raised VND 1,351.8 billion of DUCMAI2020 bonds with a term of 60 months, with an interest rate of 9.5%/year for the first period, and the subsequent periods are the sum of 1.6%/year and the reference interest rate of that interest rate adjustment period. The bond issuance aims to buy a capital contribution at Nova Nippon Company Limited.

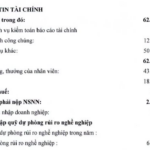

Also noted on HNX, in the first six months of 2024, Duc Mai made a post-tax profit of more than VND 190 billion, while in the same period last year, it lost nearly VND 148 billion. As of June 30, 2024, total assets are close to VND 5,700 billion. Liabilities are more than VND 5,300 billion, of which bond debt accounts for nearly VND 1,400 billion.

The two remaining shareholders who participated in buying Nova Nippon’s capital are also well-known in the business community, especially in the real estate field.

Unblocking the Years-Long Stalled Project: Real Estate Giants Novaland, Dat Xanh, Hoang Quan, Nam Bay Bay and More Are Back with a Bang

Aqua City, Gem Riverside and NBB Garden III have been stagnant for years, but now there’s a glimmer of hope as legal hurdles are finally being cleared. Could this be the breakthrough these real estate giants have been waiting for?

The City’s Revitalization Project: Transforming 4,000 Old Apartments into a New Residential Haven

The Ho Chi Minh City Construction Management and House Development Centre is set to renovate almost 4,000 apartments across the city, according to plans laid out by the People’s Committee of Thu Duc City and relevant districts. This large-scale refurbishment project will provide much-needed relocation accommodations for residents.

“Novaland Appoints Two New Deputy CEOs”

Novaland (HOSE: NVL) has announced the appointment of two new Vice Presidents, Mr. Cao Tran Duy Nam and Ms. Tran Thi Thanh Van.

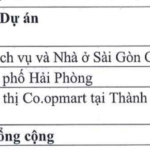

“A Decade of Shareholder Woes: The SCID-Novaland Saga”

For a decade, the Saigon Co.op Investment and Development Joint Stock Company (SCID), a subsidiary of the Ho Chi Minh City Union of Trade Cooperatives (Saigon Co.op), has been reporting on its utilization of 255 billion VND raised from a public offering in 2013. While these reports detail the progress of capital usage, questions remain about the efficiency of these investments and the feasibility of the company’s projects.