Investor sentiment has significantly improved following the market’s consecutive gains in recent sessions. Today’s trading session witnessed a “blossoming” market in terms of both indices and liquidity…

At the close of the November 29 session, the VN-Index rose 8.35 points to 1,250.46. The HNX-Index gained 1.08 points to 224.64, while the UPCoM-Index climbed 0.39 points to 92.74.

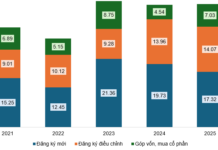

Liquidity on the market saw a marked improvement, with the total value on all three exchanges surpassing VND 14,900 billion. Notably, the HoSE exchange alone accounted for nearly VND 13,500 billion of this figure.

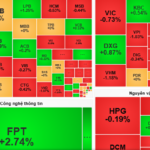

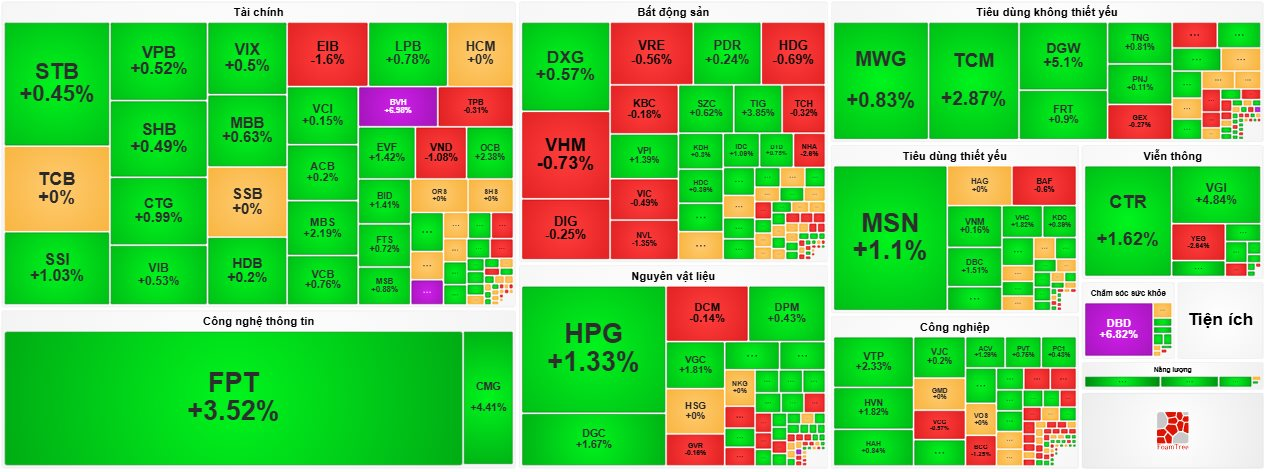

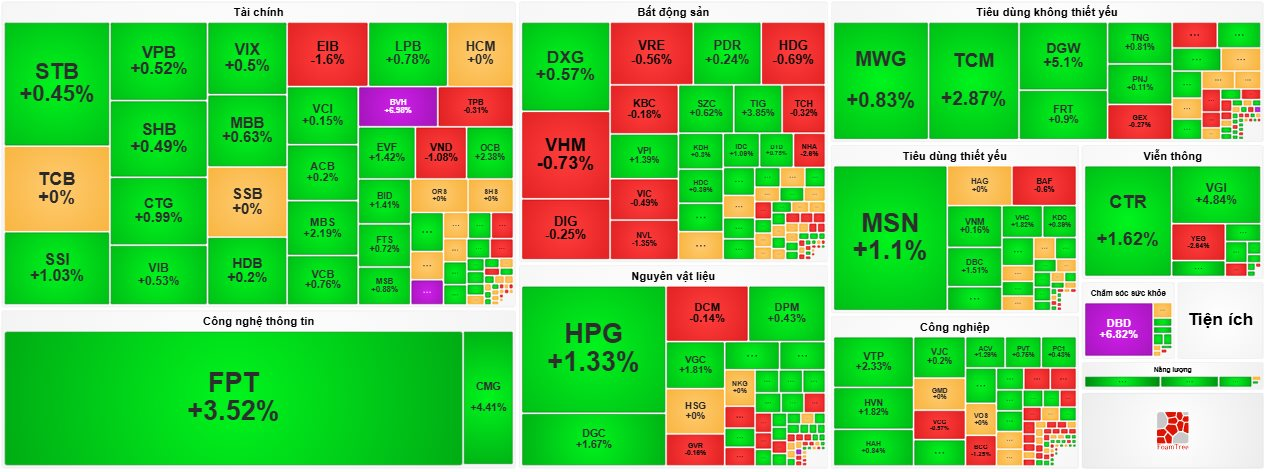

The insurance group stood out among sectors today, with BVH of the Bao Viet Holdings leading the pack, soaring 6.98% to VND 47,500 per share. This was closely followed by MIG of the Military Insurance Corporation, which climbed 6.78% to VND 18,100.

Other notable performers in this sector include BIC (+5.29%), BMI (+4.42%), VNR (+3.06%), ABI (+3.17%), and BVS (+0.8%), among others.

Similarly, the technology group flourished, led by FPT of the FPT Corporation, which rose 3.52% to VND 144,300 per share. This was trailed by CMG (+4.41%), ICT (+2.31%), and ITD (+1.54%). Additionally, CMT, SAM, and SGT witnessed gains of less than 1%.

The pharmaceutical group also posted robust growth today, spearheaded by DBD of Bidiphar, which surged 6.82% to VND 56,400 per share. This was closely trailed by DHT (+2.38%), DVN (+1.6%), DCL (+0.75%), and DHG (+0.5%), to name a few.

The market continues its recovery, with the VN-Index surpassing the 1,250-point mark.

Among the “king” stocks, green dominated with OCB (+2.38%), BID (+1.41%), and VAB (+1.11%) leading the pack. VCB, CTG, SHB, VPB, STB, MBB, HDB, ACB, and MSB, among others, posted gains of less than 1%.

In contrast, EIB of Eximbank witnessed a downturn, breaking its four-session winning streak. This came on the heels of the company’s decision to relocate its head office to Hanoi and dismiss two Vice Chairmen and the Chief Controller. At the close of the November 29 session, EIB dipped 1.6% to VND 18,500 per share. Trailing behind were PGB (-1.24%), SGB (-0.82%), and TPB (-0.31%).

In the real estate sector, the electronic board was split between green and red. TIG took the lead with a 3.85% jump to VND 13,500, followed by VPI (+1.39%), IDC (+1.08%), DXS (+1.58%), and AGG (+1.01%). A slew of stocks witnessed gains of less than 1%, including BCM, DXG, PDR, SZC, KDH, HDC, and NLG.

Conversely, the “Vin” duo led the decliners, with VHM and VIC sliding 0.73% and 0.49%, respectively. This was closely followed by NHA (-2.6%) and NVL (-1.35%). A host of stocks witnessed losses of less than 1%, including DIG, VRE, KBC, HDG, TCH, and EVG.

Moreover, a slew of blue-chip stocks across various sectors witnessed robust gains, including HPG (+1.33%), VGC (+1.81%), DGC (+1.67%), BMP (+2.35%), TCM (+2.87%), DGW (+5.1%), MSN (+1.1%), DBC (+1.51%), CTR (+1.62%), VGI (+4.84%), VTP (+2.33%), and HVN (+1.82%), to name a few.

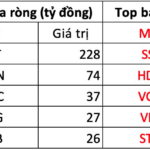

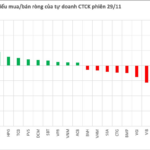

Foreign investors maintained their net buying streak on the Vietnamese stock market, recording a net purchase value of over VND 340 billion in today’s session. FPT topped their buying list, with a net purchase value of VND 238 billion. This was followed by MSN (VND 89.51 billion), CTR (VND 60.63 billion), and DPM (VND 23.52 billion), among others.

On the selling side, foreign investors offloaded VRE the most, with a net sell value of VND 84.66 billion. This was followed by HDB (VND 46.88 billion), VHM (VND 38.28 billion), TCB (VND 31.51 billion), STB (VND 19.94 billion), and VCB (VND 18.78 billion), to name the top losers.

The Stock Brokers’ View: Liquidity “Lethargic”, Sideways Trend Persists

According to Aseansc, the flow of money remains subdued as large-cap stocks stagnate, indicating that the sideways trend may persist in the coming months.