The Global Chip Industry at an “Inflection Point”

At the seminar “Reality, Challenges, and Prospects of Vietnam’s Semiconductor Chip Industry” held on November 29 in Hanoi, Mr. Nguyen Thanh Yen, CEO of CoAsia SEMI, cited statistics from 2021, where one trillion chips were sold worldwide, while the global population of eight billion people consumed an average of 120 chips per person per year, buying about ten chips per month.

“It’s very hard to find a device that doesn’t have a chip in it,” Mr. Yen emphasized the prevalence of microchips in modern society.

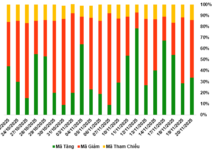

Mr. Yen was particularly intrigued by a graph sketched by Dr. Nguyen Thi Bich Yen, a Vietnamese-American renowned in the global semiconductor industry. According to the graph, the global chip industry took 66 years to reach $500 billion in value in 2021, but it will take just nine more years to accelerate from $500 billion to $1,000 billion by 2030.

According to Mr. Yen, the chip industry is at a crucial “inflection point” before it continues to explode. Looking back, the chip industry’s revenue of $500 billion was driven by the strong growth of computers, laptops, smartphones, 4G, and 5G. In the future, autonomous vehicles, high-performance computers, AI (artificial intelligence), and 6G will be the catalysts for the industry to accelerate towards the $1,000 billion mark.

In the past, cars were often used to illustrate the concept of globalization, but now, chips have taken their place.

Mr. Nguyen Thanh Yen, CEO of CoAsia SEMI. Photo: Binh Minh |

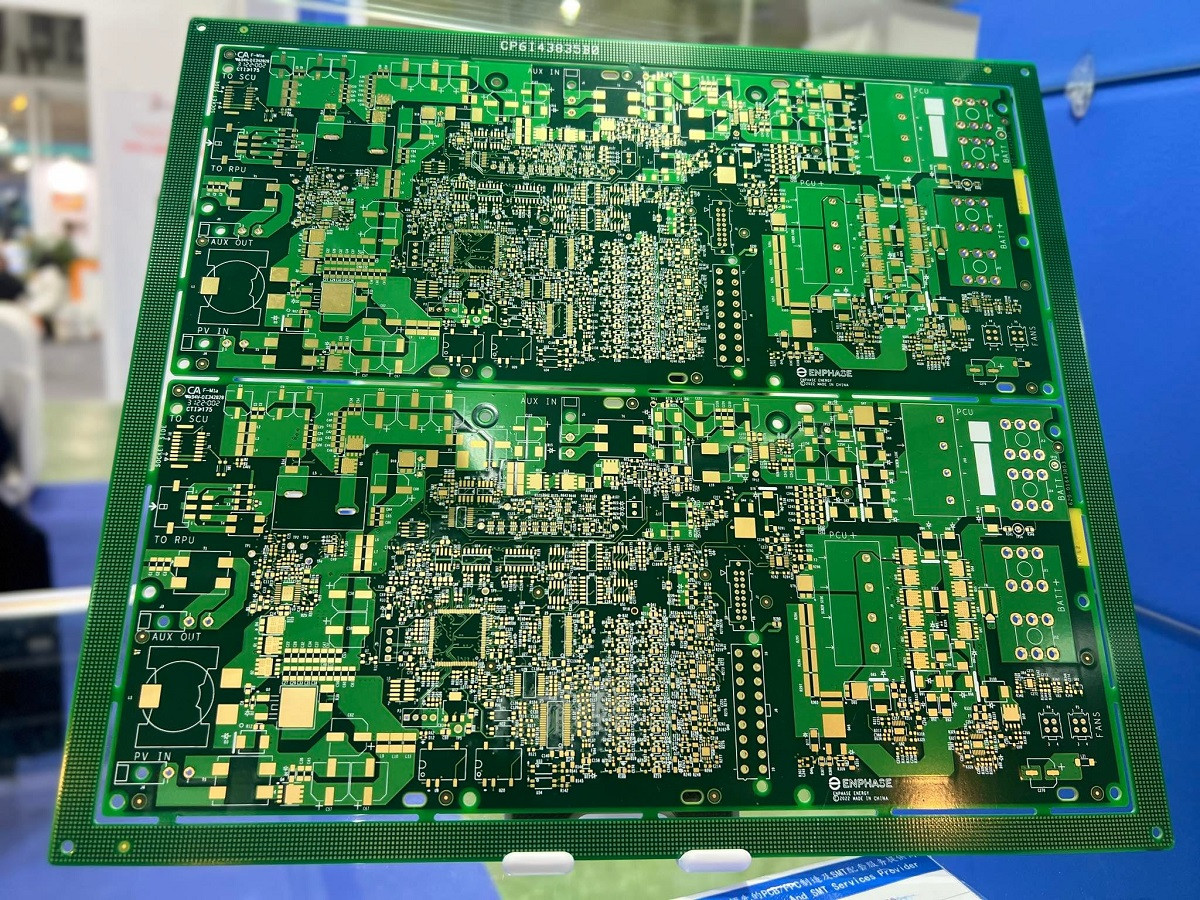

Creating an iPhone chip requires resources and coordination across multiple countries. Chip manufacturing equipment from the Netherlands and IPs (semiconductor intellectual property cores) from the UK are sent to the US. American engineers design the chip and send the design to Taiwan for manufacturing.

During production, sand from Chinese deserts is refined into single-crystal silicon pillars, which are then cut and shipped to Japan. From there, the materials for chip manufacturing are sent to Taiwan, where they produce wafers (silicon semiconductors) that are sent to Malaysia. The wafers are then cut, packaged into chips, and sent back to China for PCBA (printed circuit board assembly) packaging to make iPhones. Finally, the iPhones are shipped back to the US for sale.

It is evident that many of the world’s chip manufacturing processes are concentrated in Asia. It is predicted that Asia will be the hub for shaping the future of the chip industry.

Vietnam’s Opportunities in the Next Three Years

Discussing the prospects of Vietnam’s semiconductor industry, Mr. Yen quoted a research finding by Dr. Nguyen Thi Bich Yen on the significant issues facing the global semiconductor industry in the next three years. The first issue mentioned is the talent shortage.

“The world needs people, and we have a young and motivated workforce. Every year, we have half a million high school graduates enrolling in college. Additionally, we send people abroad for work annually. We certainly have no shortage of workers. I believe that solving the world’s talent crisis is a significant opportunity for Vietnam. However, this window of opportunity will only be open for the next three years. If we don’t seize it, it will quickly slip away,” said Mr. Yen.

There are numerous opportunities to participate in the global semiconductor job chain. In addition to specialized knowledge, those who want to join this chain need to invest in foreign languages and complementary knowledge and skills.

If there is a bug in software, it can often be fixed overnight. However, if there is a mistake in chip design, millions of chips could be wasted, resulting in losses of tens of millions or even billions of dollars, potentially leading to the bankruptcy of a company. Therefore, companies will only hire experienced individuals for chip design.

“After five years of university education, it takes another three to five years to become a chip engineer. Young graduates need to be prepared for a long journey to gain experience. If you want to earn a high salary right after graduation, don’t choose the chip industry because the entry-level salary is not attractive. As a chip design engineer, it took me three and a half years of working in Vietnam to successfully interview for a position at a Singaporean company, and my salary there was only slightly higher than that of a newcomer. It took me six years in Singapore to become a manager with a higher salary. It took me a total of about ten years,” Mr. Yen shared his own experience and offered advice to young people.

As of November 2024, Vietnam has approximately 50 chip design companies, seven related factories for packaging and testing (including factories that have obtained investment licenses, are under construction, are about to operate, or are about to be built), no chip manufacturing factories, a semiconductor industry revenue of nearly $20 billion, and a total of about 26,000 semiconductor engineers.

“Comparing this to the goals set in the Strategy for the Development of Vietnam’s Semiconductor Industry by 2030, with a vision towards 2050, we have only six years left until 2030. We need to make a significant effort to achieve the targets of having an additional 50 chip design companies, one chip manufacturing factory, three chip packaging and testing factories, and about 24,000 semiconductor engineers,” Mr. Yen noted.

Vietnam’s semiconductor industry is facing three significant challenges. Photo: Binh Minh |

Three Significant Challenges for Vietnam

With about 20 years of experience in the semiconductor design industry, Mr. Nguyen Thanh Yen pointed out three significant challenges currently facing Vietnam’s semiconductor industry.

Firstly, the semiconductor industry requires a complete ecosystem, including design, manufacturing, testing, and packaging. However, Vietnam’s semiconductor ecosystem is not yet fully developed.

“People often talk about manufacturing, packaging, and testing, but they forget about the most critical element: the customer. We have design houses and packaging and testing factories, but we also have a potential consumer society of 100 million people with a substantial demand for electronic products. Unfortunately, this vast market is dominated by foreign companies,” Mr. Yen expressed his concern.

Secondly, Vietnam has excellent policies and strategies, but there are still gaps in implementation.

“We prioritize the semiconductor industry, but there have been cases where samples of electronic products shipped from abroad to Vietnam were detained by customs, and we had to go to their warehouse to resolve the issue. Ideally, the samples should have been tested a few days after they were sent, but they were held up at customs for two weeks,” Mr. Yen illustrated.

Thirdly, ownership is one of the most critical characteristics of the semiconductor industry. All 50 chip design companies and seven packaging and testing companies in Vietnam are foreign-invested enterprises (FIEs). They can choose to stay or leave as they please. Our ownership of semiconductor products is essentially zero.

Looking at neighboring countries such as Indonesia, Malaysia, the Philippines, Taiwan, South Korea, and Japan, we can divide them into two groups.

Group 1 includes Indonesia, Malaysia, and the Philippines, which, like Vietnam, focus primarily on attracting as much FDI as possible.

Group 2 includes Japan, Taiwan, and South Korea, which also welcome foreign companies but collaborate on equal terms with foreign partners, ensuring mutual ownership of products.

“Up to now, Indonesia and the Philippines still do not have any semiconductor companies, despite the development of their markets. In contrast, countries like South Korea have Samsung, and Taiwan has TSMC. Ownership is of utmost importance. Vietnam needs to carefully consider which direction to take,” Mr. Yen recommended.

|

Recently, the Prime Minister has issued the Strategy for the Development of Vietnam’s Semiconductor Industry by 2030, with a vision towards 2050, setting very specific goals for three phases: phase 1 until 2030; phase 2 until 2040; and phase 3 until 2050. By 2030, there will be 100 chip design companies, at least one chip manufacturing factory, ten chip packaging and testing factories, and 50,000 workers in the semiconductor industry. By 2040, there will be 200 chip design companies, two chip manufacturing factories, 15 chip packaging factories, and 100,000 workers. And by 2050, there will be 300 chip design companies, three chip manufacturing factories, and 20 chip packaging and testing factories. |

Binh Minh

The $100 Billion Formula: Vietnam’s Semiconductor Industry Revolution

Prime Minister Pham Minh Chinh has signed Decision No. 1018/QD-TTg, issued on September 21, 2024, adopting the Vietnam Semiconductor Industry Development Strategy towards 2030, with a vision to 2050.