The VN-Index closed at 1,241 points on November 27th, a slight decrease of 0.16 points or 0.01% from the previous day’s trading.

The market opened with a positive sentiment on November 27th, continuing the upward trend from the previous sessions. However, the gains were modest, leading to a cautious and exploratory trading approach by investors.

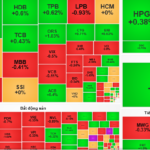

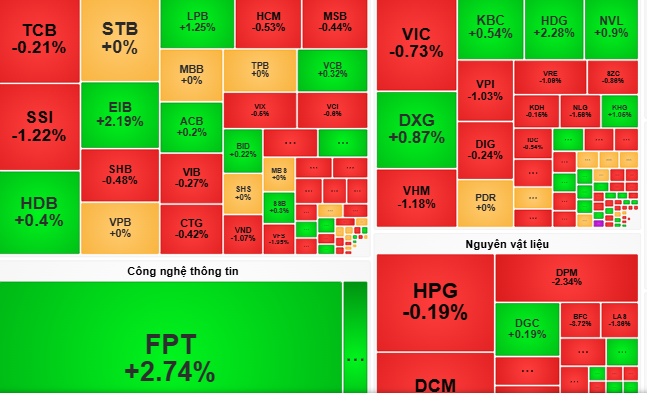

With the market’s back-and-forth movement, stock performance was varied, and fluctuations within sectors remained narrow. Technology stocks stood out, posting gains that helped curb the market’s overall decline.

At the closing bell, the VN-Index stood at 1,241 points, a marginal loss of 0.16 points or 0.01%. Trading volume dipped significantly, with only 366 million shares changing hands on the HoSE exchange.

According to Dragon Capital Vietnam (VDSC), the market’s indecisive nature and clear differentiation in stock performance resulted in limited fluctuations across sectors.

“We anticipate the market to remain range-bound until a clearer picture of supply and demand emerges,” VDSC stated. They advised investors to seize short-term opportunities in stocks showing promising signs while avoiding over-commitment.

VCBS, on the other hand, attributed the day’s profit-taking activities to investors’ cautious approach after consecutive gains. They suggested that investors consider gradual buying opportunities in real estate, banking, and retail sectors if the market experiences a correction in the upcoming sessions.

The Ultimate Guide to Navigating the Stock Market’s Pitfalls: A Safe Path to Profits

Introducing the ultimate guide to successful bottom-fishing: the three key ingredients to mastering this art are Method, Timing, and Target.

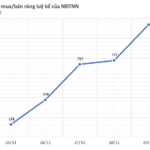

The Foreigners’ Sector: Week Five Buying Spree, Investing $1.3 Billion in a Blue-Chip Stock While Offloading Vietcombank Shares

After a prolonged period of offloading, foreign investors made a surprising comeback in the final week of November, ending the month with strong net buying.