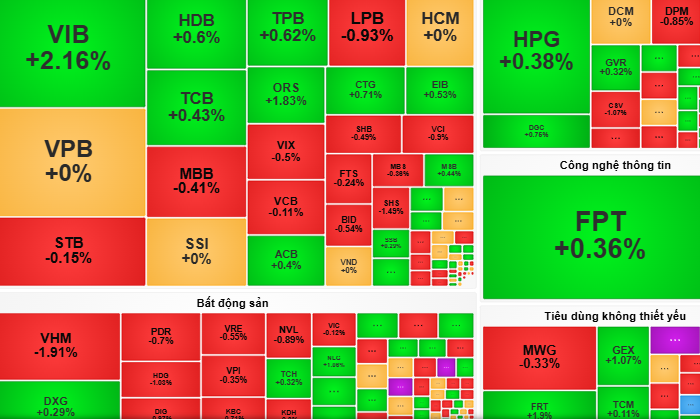

The VN-Index closed at 1,242 on November 28, a slight increase of 0.1 points or 0.01%.

After the hesitant buy-sell signals in the previous session, Vietnamese stocks opened on November 28 with enthusiastic buying pressure and widespread green coverage.

However, after peaking in the first 60 minutes of trading, the margin of increase narrowed due to the re-emergence of selling pressure.

Continuing this trend, the overall index maintained a tug-of-war near the reference level in the afternoon session. However, proactive selling liquidity did not fluctuate unexpectedly.

Selling pressure during the session mainly focused on VHM stock. As a result, the market somewhat maintained a balance. Investors expect profit-taking pressure on stocks to subside in the next session.

At the close, the VN-Index ended at 1,242, up slightly by 0.1 points, equivalent to 0.01%.

With this development, some securities companies forecast that the VN-Index will fluctuate at the 1,240 level before heading towards the 1,270 range.

“The market is testing the resistance level of 1,240 as investors limit disbursement and reduce profit-taking on stocks. Stock players can take advantage of the fluctuations in each session to consider disbursement in stocks that attract cash flow, such as banks, retail, and technology…” – VCBS Securities Company assessed and recommended.

The Joy of Being an FPT Shareholder

For the third time this year, FPT shareholders are set to receive an interim cash dividend. This marks the 36th time that FPT stock has reached new heights since the beginning of 2024, showcasing its consistent performance and strong growth trajectory.