left intent:

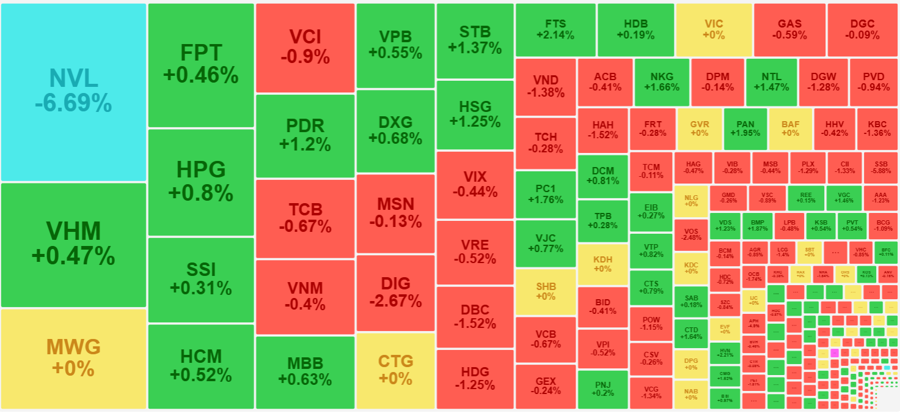

The market improved significantly in the afternoon session, even 15 minutes before entering the ATC phase, the index slightly exceeded the reference. However, by the end, VCB and SSB weakened, causing the recovery effort to fail. Still, hundreds of stocks successfully changed their price color compared to the morning, indicating that the bottom-fishing money also had a certain effect.

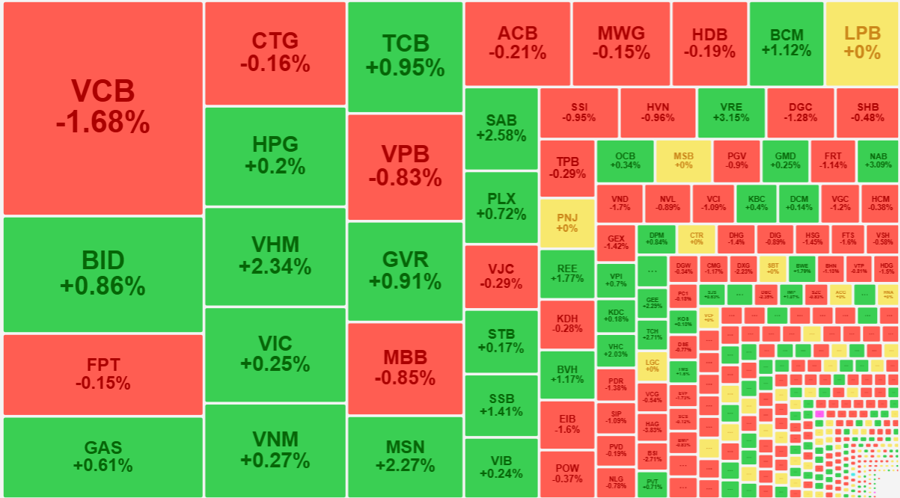

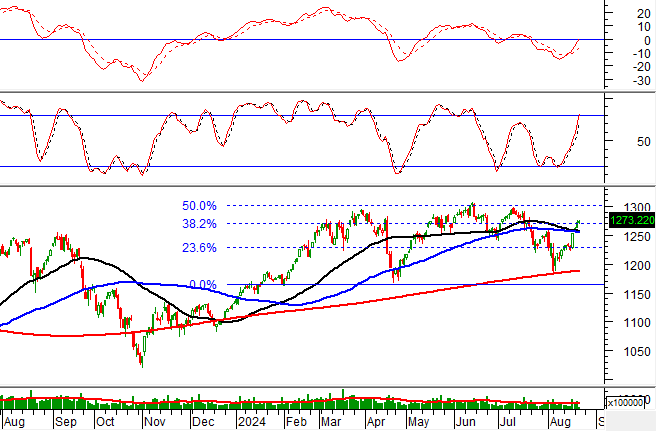

VN-Index closed with a very slight decrease of 1.96 points (-0.16%), much better than the 6.82-point drop at the end of the morning session or a loss of up to 10.44 points at the bottom. VN30-Index decreased by only 0.18 points with 11 gainers and 14 losers. Among these blue chips, 18 stocks increased compared to the morning session, and only four declined.

At 2:15 pm, the VN-Index had risen above the reference by about 1.6 points, but it couldn’t maintain this state until the end of the day. The main reason was the lack of consensus among the pillars, notably VCB, the largest market capitalization stock, which fell by 0.67%. Another bank stock, SSB, which had risen 1.76% in the morning, started to plummet from 2 pm onwards. SSB closed with a 5.88% evaporation, meaning a 7.51% drop in the afternoon alone. These two stocks caused VN-Index to lose 1.44 points out of the total loss of 1.96 points.

The recovery momentum in the index this afternoon was contributed by many pillars, notably VIC and VHM. VHM successfully reversed the morning’s decline, thanks to a significant 1.9% increase, closing up 0.47%. VIC, which ended the morning session down 1.74%, also recovered to the reference point in the afternoon. HPG also gained 1% in the afternoon, closing up 0.8%. In addition, large-cap stocks like BID, CTG, VNM, GAS, and VPB also saw some price improvements.

The upward movement of the VN-Index, although it didn’t end in the green, still created a fairly positive psychological impression. The breadth of the HoSE floor at the end of the session recorded 170 gainers and 218 losers, much better than the morning session (80 gainers and Multiplier type 298 losers). In addition, the group of stocks falling more than 1% narrowed to 74, while there were 107 at the end of the morning session.

Apart from NVL, which still had large-scale sell orders at the floor price, not many stocks were dumped. The most notable were DIG, down 2.67% with a match of 191.6 billion; DBC down 1.52% with a match of 153.1 billion; HDG down 1.25% with 148.2 billion; VND down 1.38% with 113 billion; DGW down 1.28% with 77.5 billion; and HAH down 1.52% with 74.7 billion. Generally, the remaining stocks, although falling quite sharply, had small liquidity. In total, the 74 stocks that fell the most at the end of the day accounted for only 19% of the total trading value on the HoSE floor.

The gainers this afternoon performed much better. Firstly, in terms of quantity, there were only 27 stocks that increased by more than 1% in the morning session, but this number rose to 59 in the afternoon. Secondly, the overall breadth showed that hundreds of stocks successfully reversed and surpassed the reference. Thirdly, in terms of liquidity, many stocks rose in price with high trading volume, such as PDR, up 1.2% with a match of 262.8 billion; STB, up 1.37% with a match of 187.1 billion; HSG, up 1.25% with a match of 172 billion; FTS, up 2.14% with a match of 138.7 billion; PC1, up 1.76% with a match of 93.6 billion; and NKG, up 1.66% with a match of 86.2 billion…

In fact, the positive market movement was not necessarily reflected in the number of stocks that increased sharply. In the downward trend that is still shaping up, investors are rarely willing to chase prices but are more concerned about lower price levels. Raising the buying price, even if it is not enough to pull the stock above the reference, still creates a certain recovery range. Statistics from the HoSE show that about 26.3% of stocks achieved a recovery range of 2% or more compared to their lowest price in the morning. If we consider a minimum recovery range of 1%, this figure rises to 52.3%.

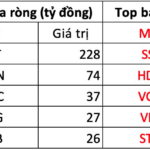

Foreign investors also returned to net buying in the afternoon, albeit lightly, at only VND 49.4 billion. In the morning session, this group was still net selling VND 42.3 billion. FPT was notably bought with a net value of VND 139.7 billion. This was followed by VNM +66.2 billion, VHM +36.4 billion, PDR +27.4 billion, DXG +26 billion, and CTG +20.4 billion. On the net selling side, there were MSN -70.9 billion, MWG -60.3 billion, HPG -54.5 billion, VCB -33.7 billion, VCI -28.7 billion, TCB -27 billion, HDB -26.4 billion, and VPB -21.8 billion…

Liquidity in the afternoon session was not high, even slightly lower by 6.3% on HoSE, reaching only VND 5,446 billion. Although liquidity was quite low, stock prices rebounded significantly, indicating that selling pressure was showing signs of cooling.

The VN-Index Soars Past 1,250 Points, Insurance and Tech Stocks in the Spotlight

An influx of investor buying overwhelmed selling pressure, propelling the VN-Index to a remarkable gain of over 8 points and surpassing the 1,250-point milestone. Insurance and technology stocks were the stars of the show, experiencing a veritable “renaissance” and attracting substantial capital inflows from discerning investors.