In November 2024, VMG Media Joint Stock Company and HyperVerge Technologies Private Limited announced their comprehensive partnership to develop advanced e-KYC authentication solutions.

“VMG Media is oriented to become a pioneer in digital transformation in Vietnam, offering solutions to optimize business processes, enhance operational efficiency, and create sustainable growth opportunities. Our partnership with HyperVerge, with a focus on safety and customer experience, will enable us to bring cutting-edge financial technology services to the Vietnamese market, making financial transactions safer, more accurate, and more convenient for customers,” said Mr. Nguyen Hoang Nam, Chairman of VMG Media’s Board of Directors.

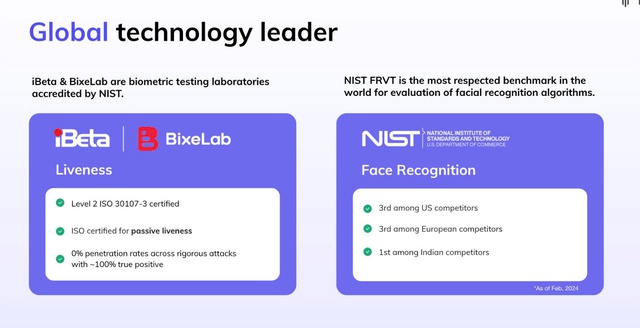

HyperVerge’s e-KYC suite meets NIST and ISO 30107-3 Level 2 standards

HyperVerge, an Indian technology company, is globally renowned for its e-KYC products that meet all evaluation standards set by NIST (National Institute of Standards and Technology) and ISO 30107-3 for identity authentication, anti-spoofing, and liveness detection using its exclusive PassiveLiveness technology. Their products have been tested for detecting deepfake and image injection spoofing techniques, preventing hundreds of thousands of fraud attempts. The AI model employed in their products is trained and evaluated on hundreds of millions of global identity profiles.

VMG Media currently offers chip-based citizen ID authentication services to various bank partners, including Vietcombank and LPBank. The VMG e-ID citizen ID authentication solution verifies information from the National Population Database (RAR) to ensure the validity of customers’ ID cards issued by the police.

By combining HyperVerge’s e-KYC services with VMG’s chip-based citizen ID authentication, VMG can provide its partners with passive liveness biometric authentication, delivering world-leading reliability and quality. While most solutions in the Vietnamese market rely on active liveness technology, requiring users to turn their faces left/right/up/down for recognition, passive liveness technology offers a more seamless experience without the need for such interactions, enhancing customer onboarding and daily transaction authentication.

Mr. Nguyen Duc Minh (right) – Director of Business, SEA HyperVerge

According to Mr. Nguyen Duc Minh, Director of Business for Southeast Asia at HyperVerge, “VMG is our chosen partner in the process of developing the e-KYC market and technology in Vietnam, helping to perfect HyperVerge’s services for our clients in this market.” In the future, VMG’s customers will be able to implement HyperVerge’s most advanced solutions, certified to ISO 30107 – level 2 for e-KYC, offering a superior experience with quick system integration and easily customizable business flows according to each client’s requirements.

VMG Media and HyperVerge will also collaborate to provide ID card forgery detection, facial recognition, video-based identity authentication, and anti-money laundering transaction systems to banks, insurance companies, and financial institutions, enhancing the quality of financial transactions in Vietnam.

The Power of Cashless Payments: Securing a Brighter Financial Future

The State Bank of Vietnam is expeditiously finalizing the draft circulars guiding Decree No. 52 to establish a synchronized and robust legal corridor for cashless payments. This move aims to promote cashless transactions while ensuring security, safety, and protection of users’ rights.