|

Earnings Per Share (EPS) is a company’s net profit (after tax) allocated to each common share outstanding in the market. |

In the context of increasing competition and rising investor expectations, EPS serves as a “guiding star” for investors to differentiate a company’s profitability within the same industry. Of course, nothing is perfect, and EPS alone cannot tell the whole story about a business. Assessing whether a high EPS is desirable or not depends on the specific context and consideration of multiple factors. Investors should also look at other metrics such as P/E, ROE, and cash flow to gain a more comprehensive understanding of a company’s financial health, profit quality, and growth prospects.

|

High EPS often comes with attractive dividends and lofty prices.

Source: VietstockFinance

|

According to VietstockFinance’s data on companies listed on the three exchanges (HOSE, HNX, and UPCoM), the highest EPS for the first nine months of this year belongs to SLS (Son La Sugar Joint Stock Company), reaching VND 29,759 per share, followed by WCS (Western Bus Station Joint Stock Company) with VND 21,749 per share. These companies are renowned for their stable and attractive cash dividend policies in the stock market.

While reigning supreme in terms of EPS for the nine-month period, SLS experienced a slight decrease compared to the previous year. Their cumulative net profit for the first nine months of the 2023-2024 fiscal year (from June 30, 2023, to March 31, 2024) dipped by 2%, totaling over VND 291 billion, as revenue declined by 24%. However, a positive note is that SLS’s gross profit margin improved significantly, rising from 29% to over 34%.

| SLS’s Financial Performance Across Fiscal Years |

For the 2023-2024 fiscal year (June 30, 2023, to September 30, 2024), Son La Sugar recorded revenue of nearly VND 1,412 billion, a decrease of 18% year-on-year. Nevertheless, net profit increased slightly by 1%, reaching over VND 526 billion due to cost-cutting measures. This net profit figure is also a record high for SLS, surpassing the previous record set in the prior fiscal year. With these results, SLS exceeded its revenue and profit plans for the entire fiscal year by 35% and 284%, respectively.

| SLS’s EPS Across Fiscal Years |

Regarding SLS’s prospects, An Binh Securities Company (ABS) believes that the company will continue to perform well in the upcoming fiscal year. SLS operates in Hanoi, Hai Phong, and Vinh Phuc, with Hanoi accounting for 75% of its total revenue. It is the only company capable of producing RE sugar in Northern Vietnam, and only five companies in the entire country can produce this type of sugar. Son La Sugar currently has a medium-sized operation in the Vietnamese sugar industry, with an annual production capacity of over 600,000 tons of sugar (mainly from sugarcane processing) and 8,000 hectares of raw material growing area in Yen Chau, Son La. Notably, the company’s growing region benefits from favorable soil and weather conditions that enhance sugar content in sugarcane.

Amid fluctuating sugar prices due to global supply shortages caused by extreme weather events (such as El Niño-induced droughts and heatwaves), the domestic market in Vietnam remains stable. This stability is due to strict monitoring of imported sugar through anti-dumping duties and other trade remedies. Additionally, unfair competition from Thai sugar has diminished, positively impacting the Vietnamese sugar industry.

ABS also highlights SLS’s advantage in having the highest sugar conversion rate in the country, resulting in lower production costs. Specifically, their sugar conversion rate stands at 114 kg of sugar per ton of sugarcane, compared to the industry average of 100 kg of sugar per ton of sugarcane. Notably, SLS is the only listed company exempt from corporate income tax.

| WCS’s EPS Across Fiscal Years |

Turning to the runner-up, WCS, their EPS for the first nine months of this year is also the highest in the company’s history, thanks to a record-breaking net profit for the same period, increasing by 17% year-on-year to nearly VND 60 billion.

| WCS’s Financial Performance for the First Nine Months Across Fiscal Years |

Western Bus Station, one of the largest bus stations in Ho Chi Minh City, was built and put into operation in 1973. After 1975, the state took over the operations, and the bus station became a part of the Ho Chi Minh City Department of Transportation. In 2006, Western Bus Station officially operated as a joint-stock company, and in 2020, its shares were listed on the Hanoi Stock Exchange (HNX).

A high EPS indicates a substantial profit per share, and when coupled with a stable and attractive cash dividend policy, it instills investor confidence in the company’s ability to generate sustainable profits in the future. This “premium” offering attracts investors, increasing the demand for the company’s shares, while existing investors are less likely to sell, opting instead to “collect dividends.” This dynamic of “limited supply and high demand” contributes to the “premium” price and low liquidity of these companies’ shares.

Strong equity capital enhances the reliability of EPS.

Source: VietstockFinance

|

Since the calculation of EPS is based on net profit and the number of outstanding shares, assessing EPS should consider both profit and equity capital (the number of issued shares reflected in equity capital) to enhance its reliability.

Among the top 20 companies with the highest equity capital in the market, half of them recorded EPS above VND 1,500. Vinhomes Joint Stock Company (VHM) tops the list with an EPS of VND 4,511. Compared to the previous year, this EPS figure decreased by 39% due to a 39% drop in net profit for the first nine months of 2024, totaling VND 19,642 billion, while the number of issued shares remained unchanged at over 43.5 billion.

EPS skyrockets.

Source: VietstockFinance

|

The speed at which BTH’s (Hanoi Electrical Equipment and Transformer Manufacturing Joint Stock Company) profit per share has increased can be likened to a “rocket launch.” It soared from less than VND 20 per share in the first nine months of 2023 to nearly VND 20,000 per share in the same period this year, a staggering 1,231-fold increase. This is also the most significant EPS growth in the market. As a result, BTH has risen from the bottom in terms of EPS to the top 3 companies with the highest EPS for the first nine months of 2024.

| BTH’s Net Profit Across Fiscal Years |

BTH’s EPS transformation is attributed to an extraordinary net profit for the first nine months of 2024, which is several times higher than in previous years.

According to BTH, the net profit surge resulted from recognizing tax-calculated revenue for 293 out of 334 apartments and 2 out of 25 adjacent houses, while in the same period last year, the project was still in the investment phase and had not yet recognized any revenue. Although the company did not specify the revenue source, it is likely associated with the mixed-use service, nursery, and green space project at 55 K2 Street, Cau Dien Ward, Nam Tu Liem District, Hanoi. This is the only real estate project mentioned by BTH in its latest annual report.

|

In 2010, BTH listed its shares on HNX. In 2015, BTH’s shares were forcibly delisted due to three consecutive years of losses from 2012 to 2014. In 2017, BTH registered for trading on UPCoM. At the end of 2017, BTH held an extraordinary general meeting of shareholders to approve the private offering of 21.5 million shares at par value (VND 10,000 per share) to increase its charter capital from VND 35 billion to VND 250 billion. Among the buyers, Hoang Thanh Group purchased more than 11 million shares, increasing their ownership in BTH from 49.49% to 51%, thus gaining control. Additionally, BTH’s general meeting of shareholders agreed to halt production and use the proceeds from the private offering of VND 215 billion to maintain commercial activities and invest in the construction of the mixed-use service, housing, nursery, and green space project on the company’s headquarter land. Hoang Thanh Group is a well-known real estate developer in Hanoi, with projects such as Mulberryland, a joint venture with CapitalLand (Singapore), ParkCity, a collaboration with Desa Park City (Malaysia), and Hoang Thanh Tower at 114 Mai Hac De Street… |

Source: VietstockFinance

|

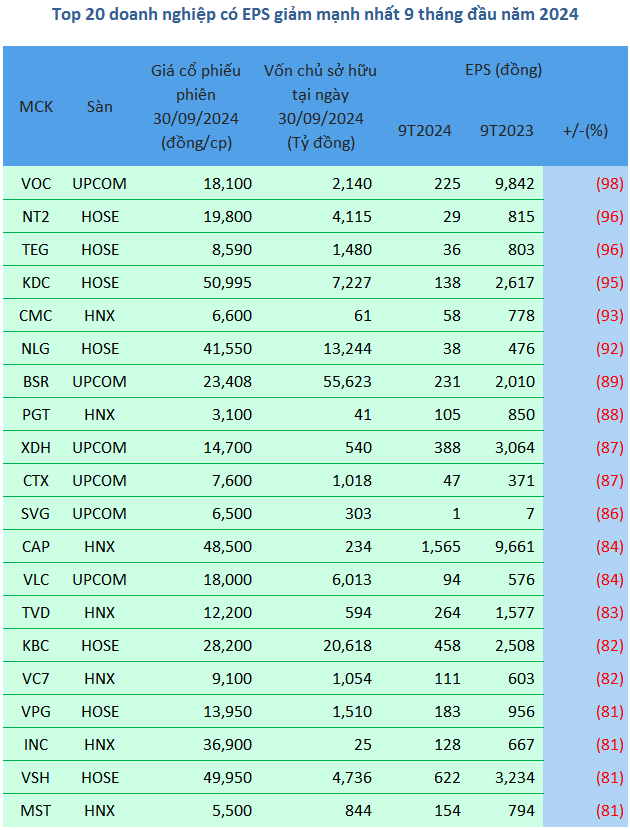

In contrast to BTH’s stellar performance, the Vietnam Vegetable Oil Industry Corporation (Vocarimex, UPCoM: VOC) experienced the most significant decline in EPS for the first nine months of this year, plummeting from VND 9,842 to just VND 225. As of September 30, 2024, the number of issued shares remained unchanged at 1.22 billion. VOC attributed this profit drop to a restructuring of its business model to adapt to fluctuations in supply sources and the impact of raw material prices.

Khang Di