|

EPS, or Earnings Per Share, is a critical metric for investors, especially in today’s highly competitive market with ever-increasing investor expectations. It represents the net profit (after tax) of a business allocated to each common share outstanding in the market. |

While EPS serves as a valuable “compass” for investors to gauge a company’s profitability within its industry, it is not a perfect indicator on its own. A high EPS figure may not always tell the whole story, and it’s essential to consider other factors and place it in the right context. Investors should also examine other metrics such as P/E, ROE, and cash flow to gain a more comprehensive understanding of a company’s financial health, profit quality, and growth prospects.

|

Companies with high EPS often offer attractive dividends and premium stock prices.

Source: VietstockFinance

|

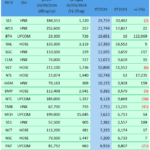

According to VietstockFinance’s data on companies listed on the three main exchanges (HOSE, HNX, and UPCoM), the highest EPS for the first nine months of this year belongs to SLS (Son La Sugar Joint Stock Company), reaching VND 29,759 per share, followed by WCS (Western Bus Station Joint Stock Company) with VND 21,749 per share. Both companies are renowned for their stable and attractive cash dividend policies, making them favorites among investors.

While SLS maintained its top position in terms of EPS for the nine-month period, its EPS showed a slight decrease compared to the previous year. This was due to a 2% decline in cumulative net profit for the 2023-2024 fiscal year (from June 30, 2023, to March 31, 2024), which stood at over VND 291 billion. However, the positive aspect was an improvement in SLS’s gross profit margin, increasing from 29% to over 34%.

|

|

For the 2023-2024 fiscal year (June 30, 2023, to September 30, 2024), Son La Sugar recorded a net revenue of nearly VND 1,412 billion, an 18% decrease compared to the previous year. However, net profit increased slightly by 1% to over VND 526 billion due to cost-cutting measures. This profit level marked a record high for SLS, surpassing the previous year’s performance. With these results, SLS exceeded its revenue and profit plans for the entire fiscal year by 35% and 284%, respectively.

|

|

Looking ahead, An Binh Securities Company (ABS) expects SLS to maintain its positive business performance in the next fiscal year. The company has a strong presence in Hanoi, Hai Phong, and Vinh Phuc, with Hanoi alone accounting for 75% of its total revenue. As the only company capable of producing RE sugar in Northern Vietnam and one of only five such companies in the entire country, Son La Sugar has a significant advantage in the industry. With a production capacity of over 600,000 tons of sugar per year (mainly from sugar cane processing) and 8,000 hectares of raw material growing area in Yen Chau, Son La, the company is well-positioned for growth. Additionally, the favorable soil and weather conditions in Son La provide a natural advantage for high-sugar content in the region’s sugar cane.

ABS also highlights the company’s competitive edge in terms of its high sugar conversion ratio from sugar cane, currently the highest in the country at 114 kg of sugar per ton of sugar cane, compared to the industry average of 100 kg. Furthermore, SLS is the only listed company in Vietnam that is exempt from corporate income tax, providing a significant boost to its profitability.

|

|

Turning to the runner-up, WCS, its EPS for the nine-month period also reached a record high, thanks to a 17% year-on-year increase in net profit to nearly VND 60 billion, the highest in the past 16 years.

|

|

Western Bus Station, one of the largest bus stations in Ho Chi Minh City, was built and put into operation in 1973. After 1975, the station was taken over by the state and operated under the management of the Ho Chi Minh City Department of Transport. In 2006, the station was transformed into a joint-stock company, and in 2020, its shares were listed on the Hanoi Stock Exchange (HNX).

A high EPS indicates a substantial profit per share, and when coupled with a stable and attractive cash dividend policy, it instills investor confidence in the company’s ability to generate sustainable profits in the future. This “premium” offering attracts investors, increasing the demand for the company’s shares, while existing investors are less likely to sell, opting instead to “collect dividends.” This dynamic of “limited supply and high demand” contributes to the premium pricing and low liquidity of these companies’ stocks.

A strong owner’s equity makes EPS more reliable.

Source: VietstockFinance

|

Since EPS is calculated based on net profit and the number of outstanding shares, it is essential to consider both profit and owner’s equity (represented by the number of issued shares) when evaluating EPS. This dual consideration enhances the reliability of the EPS metric.

Among the top 20 companies with the highest owner’s equity in the market, half of them recorded EPS above VND 1,500. Vinhomes Joint Stock Company (VHM), with its substantial owner’s equity, also boasts a high EPS of VND 4,511. Compared to the previous year, this figure decreased by 39% due to a 39% drop in net profit for the first nine months of 2024, amounting to VND 19,642 billion. During this period, the number of issued shares remained unchanged at over 43.5 billion.

EPS skyrockets like a “missile”

Source: VietstockFinance

|

The speed at which BTH’s (Hanoi Electrical Equipment Manufacturing and Trading Joint Stock Company) EPS took off could be likened to that of a “missile.” Soaring from less than VND 20 per share in the first nine months of 2023 to nearly VND 20,000 per share in the same period this year, BTH’s EPS witnessed a staggering 1,231% increase, the highest in the market. As a result, BTH rose from the bottom in terms of EPS to secure a spot in the top 3 companies with the highest EPS for the first nine months of 2024.

|

|

BTH’s remarkable EPS transformation can be attributed to its explosive net profit for the nine-month period, which was several times higher than in previous years.

According to BTH, this surge in net profit was driven by the recognition of taxable income from the sale of 293 out of 334 apartments and 2 out of 25 adjacent houses. While the company did not specify the project, it is likely referring to its real estate project—a mixed-use development of services, housing, kindergarten, and green space at 55 K2 Street, Cau Dien Ward, Nam Tu Liem District, Hanoi. This is the only real estate project mentioned in the company’s latest annual report.

|

In 2010, BTH listed its shares on the HNX. However, in 2015, its shares were forcibly delisted due to consecutive losses from 2012 to 2014. In 2017, BTH registered for trading on the UPCoM. At the end of 2017, BTH held an extraordinary general meeting of shareholders to approve the private offering of 21.5 million shares at par value (VND 10,000 per share) to increase its charter capital from VND 35 billion to VND 250 billion. Among the buyers was Hoang Thanh Group, which purchased over 11 million shares, increasing its ownership in BTH from 49.49% to 51%, thus gaining control of the company. Additionally, the BTH general meeting agreed to halt production and use the proceeds from the private offering of VND 215 billion to maintain commercial activities and invest in the construction of a mixed-use project at the company’s headquarters. Hoang Thanh Group is a well-known real estate developer in Hanoi, with projects such as Mulberryland (in collaboration with CapitalLand from Singapore), ParkCity (in partnership with Desa Park City from Malaysia), and Hoang Thanh Tower at 114 Mai Hac De Street. |

Source: VietstockFinance

|

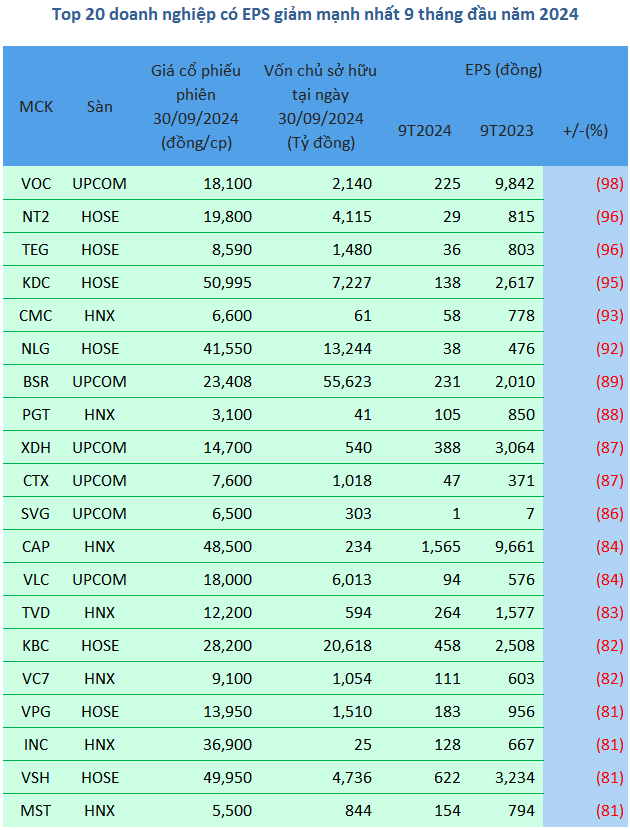

In contrast to BTH’s stellar performance, Vocarimex (Vietnam Vegetable Oil Industry Corporation, trading on UPCoM under the ticker VOC) experienced a drastic 98% drop in net profit, causing its EPS to plummet from VND 9,842 to just VND 225, the most significant decline in the market for the nine-month period. As of September 30, 2024, the number of issued shares remained unchanged at 1.22 billion.

Vocarimex attributed this decline in profit to the restructuring of its business model to adapt to fluctuations in supply and the impact of raw material prices.

Khang Di

Handico6 Switches Dividend Payout from Stock to Cash

The Hanoi No. 6 Housing Investment and Development JSC (Handico6, UPCoM: HD6) has just announced a cash dividend for the year 2023. The record date for this dividend is set as December 9, 2024, meaning that shareholders who own the stock on this date will be eligible to receive the dividend payment.

KBC Subsidiary Pours in Massive Capital for the Loc Giang Industrial Park Project

The Loc Giang Industrial Park spans an impressive 466 hectares and is strategically located in the communes of Loc Giang, An Ninh Dong, and Tan My, in Duc Hoa District, Long An Province. The mastermind behind this development is none other than Saigon Northwest Urban Development Joint Stock Company, a prominent name in the industry.