Financial Preparation is Key to a Secure Future

Mr. Thinh, a 60-year-old laborer from Ha Dong, wiped the sweat from his brow as he shared his story. Without a pension, he relies on odd jobs at construction sites to get by. His wife works as a part-time housekeeper, and their two adult children have their own families but struggle financially, sometimes needing their parents’ support.

A retired couple enjoying their golden years with financial security.

Mr. Thinh’s story is not unique; many retired workers in Vietnam face similar challenges. As of late 2022, there were approximately 14.4 million people in Vietnam above retirement age, but only about 5.1 million, or 35%, received a monthly pension. The remaining 65% have no pension to rely on, forcing many to continue working to make ends meet. This situation highlights the importance of financial planning and healthcare awareness for a secure future.

Ms. Hien, a 63-year-old retiree from Thanh Xuan, shares a similar sentiment. Her pension barely covers her basic needs, and with the economic crisis and market fluctuations driving up living costs, she struggles to make ends meet. She regrets not having a financial plan earlier in life.

Long-Term Financial Planning: What are the Best Options?

Currently, the retirement age in Vietnam is 61 for men and 56 years and 4 months for women, leaving us with over 35 years to plan for a comfortable retirement. Instead of spending on non-essentials, consider investing in sustainable assets to achieve financial freedom. This not only secures your future but also provides peace of mind, allowing you to fully enjoy your golden years.

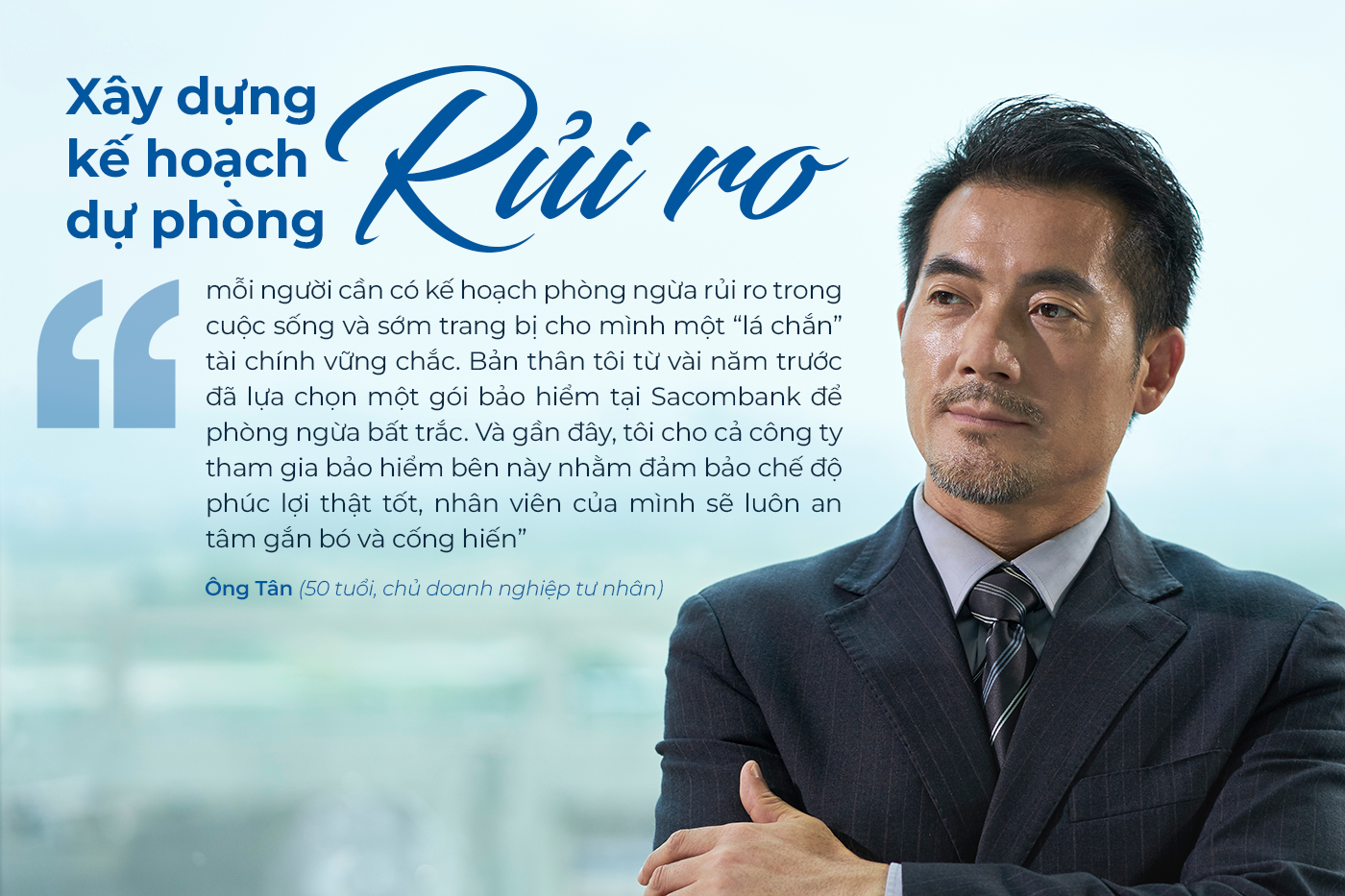

Life is full of surprises, and risks can affect anyone. That’s why it’s essential to have a safety net, such as insurance, to help you through difficult times and reduce financial burdens. Sacombank offers a comprehensive ecosystem of financial solutions, including health protection, critical illness coverage, financial accumulation, and retirement planning. They also provide attractive promotions, such as the ongoing “When Life is a Journey” program, which offers cashbacks and 24K gold gifts to individual and corporate insurance customers until the end of 2024.

No one understands the value of health more than a primary school teacher, Ms. Lan. She has witnessed the trend of dangerous illnesses affecting younger people, including her friends, colleagues, and loved ones. That’s why she prioritizes a healthy lifestyle, proper nutrition, regular check-ups, and, most importantly, financial preparedness for herself and her family.

From August 22 to November 30, 2024, customers who purchase K-Care insurance will receive a 10% cashback, increasing to 15% if they also sign up for the premium payment authorization service. Additionally, with just a 5-minute online registration on the Sacombank Pay app, customers can obtain K-Care insurance to financially prepare for critical illnesses, promoting a healthy lifestyle, balanced nutrition, and regular health check-ups.

Mr. Nam, a 69-year-old healthcare professional, has always prioritized his family’s well-being, both financially and health-wise. With Sacombank’s support, he confidently builds a solid foundation for the future.

Mr. Nam also shared that while he saved for his granddaughter’s education fund, he also received healthcare support and ensured his well-being. Recently, he purchased life insurance for his granddaughter, who just enrolled in college, and with a deposit balance of over 50 million VND at Sacombank, he received an additional gift of 1 tael of 24K SBJ gold, securing her future.

Life is a long journey filled with challenges, but with Sacombank by your side, you can navigate towards a prosperous and happy future. Their comprehensive protection solutions act as a strong shield, providing financial peace of mind and empowering you to confidently stride towards a brighter tomorrow.

Sacombank’s Promotional Program: “When Life is a Journey”

Until November 30, 2024, corporate customers who purchase at least 4 insurance policies for their employees will receive a cashback of up to 15% of the total first-year premium, with a maximum of VND 20 million. Individual customers who purchase insurance policies with a first-year premium of at least VND 15 million will receive a cash gift ranging from VND 300,000 to VND 500,000 and a gift of up to 1 tael of 24K SBJ gold if they have a term deposit balance of VND 50 million or more at Sacombank. Customers who purchase K-Care cancer insurance will receive a 10% cashback, increasing to 15% if they also sign up for the premium payment authorization service. Additionally, with just a 5-minute online registration on the Sacombank Pay app, customers can obtain K-Care insurance with an affordable daily premium of only VND 6,000, preparing them financially to face cancer.

From now until December 31, 2024, existing life insurance customers (either the policyholder or the insured of a policy issued before August 22, 2024) who successfully refer their friends or family to purchase an insurance policy at Sacombank with a first-year premium of at least VND 15 million will receive a gift of 5% of the referred policy’s premium (up to VND 5 million per policy). Additionally, customers who pay the renewal premium for two insurance policies and sign up for installment payments at Sacombank branches will receive a 100% refund of the installment conversion fee, making it easier to continue their long-term financial plans.

Why Fining Banks for Forcing Insurance on Borrowers Matters?

If banks bundle non-mandatory insurance products with their services, they could face hefty fines ranging from 400 million to 500 million VND.

“Techcombank Weighs Sale of 15% Stake to New Strategic Investor if Foreign Owners Exit”

“Techcombank is on the lookout for a strategic investor with a particular set of skills. We are seeking a partner with advanced technological capabilities and established connections within key trade corridors, including Singapore, Japan, and South Korea. With their expertise, we aim to enhance our digital offerings and expand our reach, solidifying our position as a leading bank in Vietnam and beyond.”

The Secret Commission: How Banks Push Loans to Sell Insurance

Financial experts have revealed that, in the first half of this year, there has been feedback regarding customers being required to purchase insurance packages to access loan disbursements. The root cause of this issue lies in the high commissions offered by insurance companies for investment-linked insurance products, with some companies paying over 100% in commissions to their partners, leading to this unscrupulous behavior by banks.

Is There a Possibility of No Base Salary Increase, Yet Retirement Benefits Continue to Rise Post-2024?

From July 1, 2025, retirement pensions will be adjusted based on the consumer price index, in line with the state budget and social insurance fund capabilities. This necessary step ensures that pensioners’ purchasing power remains protected, reflecting our commitment to their well-being.