Pacific Petroleum Transport Joint Stock Company (PV Trans Pacific, Stock Code: PVP, HoSE: PVP) has just announced a report on the change in ownership of major shareholder Le Ngoc Anh, holding 5% or more of the shares/closed-end fund certificates.

According to the report, investor Le Ngoc Anh purchased 189,600 PVP shares. Prior to this transaction, the investor held over 6.21 million PVP shares, equivalent to 5.99% of Pacific Petroleum Transport’s charter capital. As a result of this transaction, the number of shares held by the investor has increased to more than 6.4 million, equivalent to 6.17% ownership.

Illustrative image

The transaction date that changed the ownership ratio was November 26, 2024.

Thus, after the transaction, the group of shareholders and related parties of investor Le Ngoc Anh owned a total of over 7.4 million PVP shares, equivalent to 7.17% of the charter capital of PV Trans Pacific. Of this, Le Ngoc Anh’s two sons, Mr. Le Ngoc Y and Mr. Le Minh Duc, held 551,910 PVP shares (0.53% capital) and 484,800 PVP shares (0.47% capital), respectively.

In terms of business results, according to the company’s Q3/2024 financial report, Pacific Petroleum Transport recorded net revenue of VND 359.16 billion, down 36.1% over the same period in 2023; financial activity revenue of nearly VND 21.31 billion, up 14.1%. After deducting taxes and expenses, the company reported a net profit of over VND 68.9 billion, up 23.2%.

For the nine months ended September 30, 2024, Pacific Petroleum Transport recorded net revenue of VND 1,092.21 billion, down 11% year-on-year, and after-tax profit of VND 174.39 billion, up 11.1% over the same period in 2023.

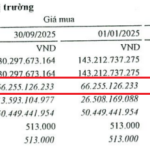

As of September 30, 2024, Pacific Petroleum Transport’s total assets stood at VND 2,774 billion, up 2.2% from the beginning of the year. This included fixed assets of VND 1,246.6 billion, accounting for 44.9% of total assets; short-term financial investments and cash of VND 1,163.5 billion, or 41.9% of total assets; and short-term receivables of VND 239.6 billion, or 8.6% of total assets.

On the liabilities side, Pacific Petroleum Transport’s total liabilities were nearly VND 954.7 billion, a slight decrease of 2.83% from the beginning of the year. This included short-term and long-term borrowings of nearly VND 465.1 billion, down almost 22%.

“A Stunning Turnaround: Novaland’s Q3 Profits Soar to Over 3,000 Billion VND”

Despite an exceptional surge in profits during the third quarter of 2024, Novaland Group (Novaland), listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘NVL’, faces the grim prospect of historical annual losses. With a staggering cumulative loss of over VND 4,000 billion in the first nine months of the year, the real estate giant is struggling to stay afloat.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.