[IR AWARDS] November 2024 Information Disclosure Schedule to Remember

[IR AWARDS] October 2024 Information Disclosure Schedule to Remember

-

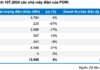

December 2nd: PMI Announcement

-

December 6th: Portfolio Structure Disclosure (FTSE ETF)

-

December 14th: Portfolio Structure Disclosure (VNM ETF)

-

December 19th: Fed Releases FOMC Meeting Results

VN30F2412 Futures Contract Expiry

-

December 23rd: Effective Date of Portfolio Structure Changes (FTSE ETF, VNM ETF)

Timely and compliant information disclosure in the stock market is the fundamental responsibility of public companies towards their shareholders and investors. This is also the first criterion in the annual IR Awards program, jointly organized by Vietstock and the Finance and Life e-Magazine, to honor listed companies with the best IR practices.

Notable Penalties for Information Disclosure Violations in November 2024

In the past month (November 2024), the State Securities Commission (SSC) penalized DMC Northern Petrochemical Joint Stock Company (UPCoM: PCN) for untimely information disclosure according to legal regulations. Additionally, Construction Joint Stock Company No. 1 (UPCoM: CC1) was fined for incomplete information disclosure, not meeting legal requirements.

The SSC also sanctioned Ladophar Joint Stock Company (HNX: LDP), DMC Northern Petrochemical Joint Stock Company (UPCoM: PCN), and FLC Investment, Mining, and Asset Management Joint Stock Company (UPCoM: GAB) for failing to disclose information as mandated by law.

|

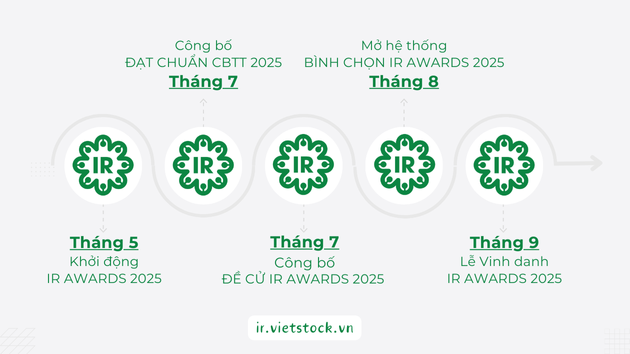

IR AWARDS 2025 IR Awards is an annual program to recognize listed companies with the best IR practices. Since 2011, it has been jointly organized by Vietstock, the VAFE Association, and the FiLi e-Magazine. IR Awards acknowledges and celebrates companies that meet the standards for information disclosure in the stock market. This is achieved through a comprehensive survey, and the announcement of the annual list of Companies Meeting Information Disclosure Standards. IR Awards recognizes and honors companies with the best IR practices for the year. This is determined through quantitative assessments, professional investor and financial institution voting, and the announcement of results at the annual IR Awards Ceremony. |

Vietstock Data Room

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

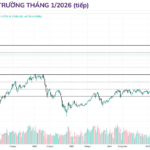

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

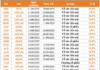

Foreign Investors Net Buy for the 6th Straight Session, Strong Demand for FPT Shares

The market continues to rally despite uncertain cash flows, with today’s liquidity not exceptionally high. The three exchanges witnessed a matching volume of nearly VND 15,000 billion, including net foreign buying of VND 359.7 billion. Specifically, in terms of matched orders, they were net buyers to the tune of VND 226.9 billion.

Stock Market Blog: Just an Intraday Adjustment, the Market is Strong

It appears that there are visible shifts in the behavior of those with purchasing power. Buyers have now accepted higher prices after multiple instances of the market “dipping” rather than taking a significant downturn. The market is trending in a direction where procrastinating with caution will only lead to worse buying opportunities.