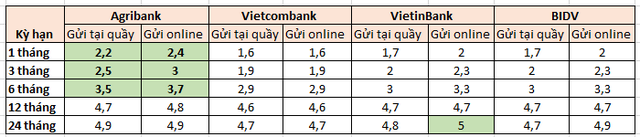

There have been notable fluctuations in interest rates among the Big 4 banks, with Agribank making a significant move in November by officially adjusting its savings rates for both counter and online deposits.

As of now, Agribank’s counter savings rates for 1-month, 3-month, 6-month, 12-month, and 24-month terms are 2.2%, 2.5%, 3.5%, 4.7%, and 4.8% per year, respectively.

For online savings, the rates for the same periods are slightly higher at 2.4%, 3%, 3.7%, 4.8%, and 4.9% per year.

In contrast, Vietcombank’s savings rates have remained unchanged since April. Their counter and online savings rates for 7-day and 14-day terms are set at 0.2% per year. For 1 to 2-month terms, the interest rate is 1.6% per year, while for 3-month terms, it is 1.9% per year.

For longer-term deposits, Vietcombank offers 2.9% per year for 6 to 9-month terms and 4.6% per year for 12-month terms. The highest interest rate they offer is 4.7% per year for 24 to 60-month terms.

The latest savings rates at the Big 4 banks. (Compiled by Tung Lam)

BIDV’s savings rates have also remained stable for several months. The bank continues to offer rates ranging from 1.7% to 4.7% per year for counter deposits, with interest paid at maturity.

For 1 to 2-month terms, customers will earn an interest rate of 1.7% per year. The rate remains unchanged at 2% per year for 3 to 5-month terms. For 6 to 9-month terms, the rate is set at 3% per year. The most favorable rate of 4.7% per year is offered for 12 to 36-month terms.

However, for online deposits, BIDV adjusted its rates in May. The rates for 1 to 2-month, 3 to 5-month, 6 to 11-month, 24 to 36-month, and 12 to 18-month terms are 2%, 2.3%, 3.3%, 4.8%, and 4.7% per year, respectively.

VietinBank’s savings rates for individual customers currently range from 0.2% to 4.8% per year for counter deposits with interest paid at maturity.

For terms of less than 1 month, the rate is 0.2% per year. For terms of 1 month to less than 3 months, the rate is 1.7% per year. Terms of 3 months to less than 6 months earn an interest rate of 2.0% per year, while terms of 6 months to less than 12 months are offered a rate of 3% per year. For terms of 12 months to less than 24 months, the rate is set at 4.7% per year.

The highest rate currently offered by VietinBank for individual customers making counter deposits is 4.8% per year for terms of 24 months and above.

VietinBank adjusted its online savings rates in June. The rates for 1 to 2-month, 3 to 5-month, 6 to 11-month, 12 to 18-month, and 24 to 36-month terms are 2%, 2.3%, 3.3%, 4.7%, and 5% per year, respectively.

Prime Minister Directs Action on Bank Interest Rates; Fate of B1 and B2 Driver’s Licenses

Prime Minister Calls for Lower Bank Interest Rates; Nearly VND 670,000 Billion to be Pumped into the Economy; Important Updates on the Fate of B1 and B2 Car Driving Licenses; Gold Prices Fluctuate, Leaving Many Anxious. These were the notable highlights from the past week.

The National Assembly Approves Additional Capital Injection of VND 20.7 Trillion for Vietcombank

Vietcombank has significantly increased its charter capital, issuing an additional 27,666 billion VND in shares. With this move, the bank’s total charter capital has reached an impressive 83,557 billion VND, making it the highest in the Vietnamese banking system to date. This substantial increase in capital underscores Vietcombank’s strong position and dynamic growth in the market.

CTS Approves Limit Loan of 800 Billion VND

On November 25th, the Board of Directors of Vietnam Industrial and Commercial Bank Securities Joint Stock Company (HOSE: CTS) approved a resolution to sign a loan agreement for a limit of VND 800 billion at ABBank Hanoi Branch.