**VDP Announces Plans for an Extraordinary General Meeting and Interim Dividend Payment**

In a recent announcement, VDP revealed its plans to hold an extraordinary general meeting in 2025 to seek approval for adjustments to its business operations, specifically related to the real estate industry.

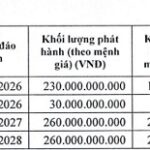

The company also intends to finalize the list of shareholders eligible for the first interim dividend payment for 2024, with a proposed rate of 10% in cash (shareholders owning 1 share will receive VND 1,000). The payment is expected to be made starting January 16, 2025.

With an estimated 22.1 million outstanding shares and a payout ratio of 10%, VDP is expected to distribute over VND 22 billion in interim dividends to its shareholders.

At the 2024 Annual General Meeting, shareholders approved a dividend plan for 2024, with a target rate of over 25% of charter capital. Consequently, the company will disburse the remaining dividend, amounting to over 15%.

Source: VietstockFinance

|

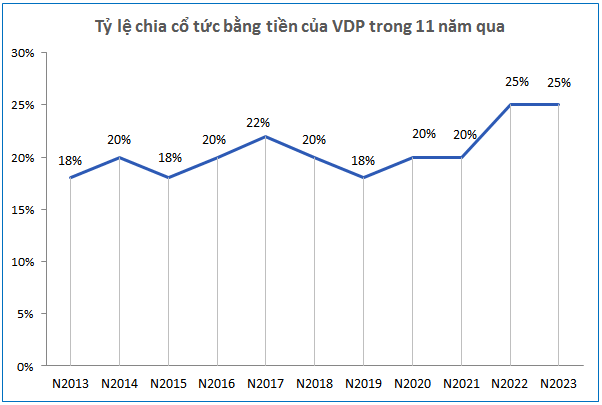

Maintaining a consistent dividend payout ratio of 25% in cash over the past two years (2022-2023), VDP aims to continue this trend in 2024. If the company achieves its target dividend ratio for 2024, as presented at the Annual General Meeting, it will be the highest dividend rate in the company’s history.

Source: VietstockFinance

|

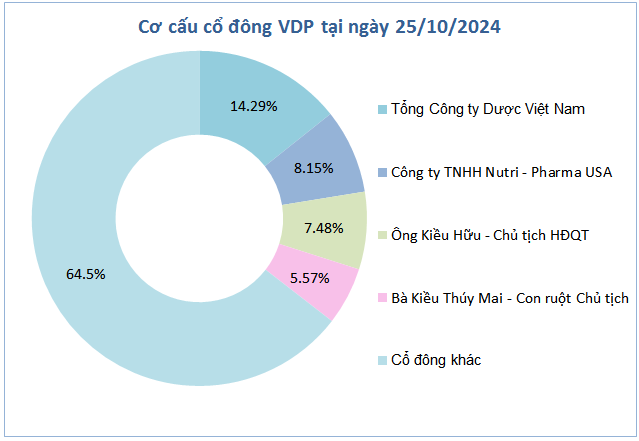

As of October 25, 2024, VDP has two major organizational shareholders and two major individual shareholders, collectively holding nearly 35.5% of its charter capital. Specifically, the Vietnam Pharmaceutical Corporation owns 14.29% of the capital, while Nutri-Pharma USD Co., Ltd. holds 8.15%. The former is expected to receive nearly VND 3.2 billion, while the latter is estimated to receive approximately VND 1.8 billion in interim dividends for the first period of 2024. Additionally, the company’s Chairman, Kieu Huu, and his daughter, who together hold 13.05% of the capital, are projected to receive nearly VND 2.9 billion.

| VDP’s Financial Performance for the Past Nine Months |

In terms of financial performance, VDP concluded the first nine months of the year with a 13% year-on-year decline in revenue, amounting to over VND 640 billion. Consequently, net profit decreased by 17% to VND 49 billion. Compared to the annual targets of VND 1,136 billion in revenue and VND 100 billion in after-tax profit, the company has accomplished 57% and 61% of these goals, respectively.

The Roaring Tide of Insurance Stocks: What’s the Driving Force?

Similar to the end of August this year, insurance stocks once again reacted strongly to the news of the State Bank “loosening credit room”.

The Soaring Success of Bidiphar Stock (DBD): Trading Prices Soar Over 30% Higher Than the Start of the Year

DBD stock of Binh Dinh Pharmaceutical – Medical Equipment Joint Stock Company hit its second consecutive ceiling, setting a new all-time high since its listing. Moreover, the share price of this pharmaceutical stock has surged over 30% since the beginning of the year, marking a significant milestone for the company.