Nearly 52% of Armephaco’s Capital Changed Hands in Just 2 Days

On November 19 and 20, 2024, up to 51.72% of the capital at Armephaco Joint Stock Company (UPCoM: AMP) changed hands after two major shareholders, Mr. Le Minh Thang and Nguyen Anh Dung, sold all their shares. In contrast, two new major shareholders emerged: Chairman Pham Cong Doan and a newly established organization, Viet Leader.

Specifically, from November 19, Mr. Dung sold all of his nearly 1.8 million AMP shares (13.68% stake), while Viet Leader Asset Investment Company bought nearly 1.1 million shares (8.35% stake).

During this session, AMP recorded nearly 1.7 million shares in matching transactions, valued at nearly VND 20 billion (VND 11,800/share). In contrast, only 98,000 shares were traded through order matching. It is likely that Mr. Dung and Viet Leader exchanged a large number of shares.

The ownership structure of AMP continued to fluctuate on November 20 when the largest shareholder, Mr. Le Minh Thang, sold all of his nearly 5 million shares (38.04% stake). Conversely, Chairman Pham Cong Doan and Viet Leader respectively purchased 3 million and nearly 2 million shares, totaling exactly the number of shares sold by Mr. Thang.

After the transaction, Mr. Doan, who initially held no shares, now owns 3 million shares (23.08% stake), while Viet Leader further increased its holdings to more than 3 million shares (23.31% stake). AMP still maintains the number of large shareholders at 4, with the remaining two being the Ministry of Defense holding 29% and Mrs. Nguyen Thi Huong holding 8.6%.

SC5’s Top Executive Completes Deal to Acquire Over 40% of the Company’s Capital

Mr. Nguyen Dinh Dung, Vice Chairman of the Board of Directors and General Director of Construction Joint Stock Company No. 5 (HOSE: SC5), purchased 4.66 million shares through a matching transaction on November 22 from seven shareholders: Mr. Phi Nguyen Trung Duc, Mrs. Phan Thi Ngoc Ha, Mr. Doan Trung Kien, Mrs. Bui Ngoc Lan, Mr. Bui Duc Manh, Mrs. Tran Thi Truc Thanh, and Mr. Nguyen Van Cuong.

With this transaction, Mr. Nguyen Dinh Dung increased his ownership in SC5 from 24.23% (3.63 million shares) to 55.53% (8.3 million shares).

On the same day, Mr. Pham Van Tu, a member of the Board of Directors and Deputy General Director of SC5, also purchased 1.4 million shares through a matching transaction from three shareholders: Mr. Pham Duc Lam, Mr. Phung Huynh Chi Dat, and Mrs. Huynh Thi Hue. This transaction increased Mr. Tu’s ownership in the Company from 10.17% (1.5 million shares) to 19.33% (2.9 million shares).

Regarding their relationship, Mr. Tu is the husband of Mrs. Pham Thi Lien, Deputy General Director of SC5. Combined, Mrs. Lien and the Deputy General Director of SC5 currently hold 26% of the Company’s capital, equivalent to 3.9 million shares.

On November 22, SC5 recorded matching transactions equivalent to the total number of shares that the two executives reported purchasing, accounting for more than 40% of the Company’s capital. The transaction value reached nearly VND 109 billion, corresponding to VND 18,000/share. At the close of this session, the SC5 share price rose to its ceiling price of VND 20,300/share, 13% higher than the matching transaction price.

TEG’s Chairman Fully Divests

Mr. Dang Trung Kien, Chairman of the Board of Directors of Energy and Real Estate Joint Stock Company (HOSE: TEG), reported selling all of his more than 5.2 million shares during the period from November 22 to 25, representing 4.31% of TEG‘s capital.

On November 22, TEG recorded matching transactions equivalent to the number of shares that Chairman Dang Trung Kien reported selling. The transaction value reached nearly VND 39 billion, corresponding to VND 7,460/share, which was 7% lower than the closing price of that session.

While the Chairman of TEG fully divested, two members of the Board of Directors, Mr. Le Dinh Ngoc and Mr. Mac Quang Huy, respectively purchased nearly 1.8 million and 1.1 million shares on November 22. As a result, Mr. Ngoc and Mr. Huy increased their ownership in TEG to 2.67% (3.2 million shares) and 1.64% (nearly 2 million shares), respectively.

Thus, it is highly likely that the two Board members received the shares of TEG from Chairman Dang Trung Kien since only 3,800 shares were traded through order matching during the November 22 session.

Vinahud’s Chairman Aims to Accumulate More Than 20% of Capital

Mr. Truong Quang Minh, Chairman of the Board of Directors of Vinahud Housing and Urban Development Investment Joint Stock Company (UPCoM: VHD), has just registered to purchase nearly 7.7 million VHD shares for personal investment. The transaction is expected to take place from December 2 to 31, 2024.

If successful, Mr. Minh will increase his ownership in Vinahud from 4.51% to 24.74% of the capital, equivalent to 9.4 million shares. It is likely that the Chairman will receive the shares through a private transaction, as Vinahud’s liquidity is low, with an average of just over 1,700 shares traded daily since the beginning of the year.

The reason for this is Vinahud’s concentrated shareholder structure. As of the end of 2023, there were four major shareholders: Mr. Tran Quang Tuan (26.23%), Nguyen Dinh Ngon (24%), Nguyen Ho Nam (22.8%), and Vu Nam Chung (9.58%).

In the stock market, the share price of VHD decreased from the VND 15,000/share range in late October to a year-to-date low of VND 6,200/share on November 26, plummeting more than 58% in almost a month. Immediately after that, the VHD share price unexpectedly rose to its ceiling price for two consecutive sessions (November 27-28) to VND 8,100/share. Based on this price, Chairman Truong Quang Minh would need to spend a minimum of VND 62 billion to purchase the aforementioned number of shares.

Japanese Shareholder Plans to Invest Nearly VND 200 Billion to Accumulate Hataphar’s Shares

ASKA Pharmaceutical, the largest shareholder of Hanoi Pharmaceutical Joint Stock Company (HNX: DHT), continues to register to purchase an additional 2.2 million DHT shares from December 3 to 31, 2024, to increase its ownership. Mr. Hiroyasu Nishioka and Keisuke Oshio are the representatives of ASKA’s invested capital in DHT and are also members of the Board of Directors.

Previously, ASKA successfully purchased 500,000 shares during the period from November 20 to 26. With an average price of over VND 85,000/share, the enterprise is estimated to have spent nearly VND 43 billion to complete the transaction.

After the successful purchase, ASKA currently owns more than 29.3 million DHT shares, equivalent to more than 35.6% of the charter capital. If the newly registered transaction is completed, the enterprise will increase its ownership to 38.2%, equivalent to nearly 31.5 million shares. As of the close of November 29, the share price of DHT was VND 90,500/share. Based on this price, the transaction value is estimated to be approximately VND 195 billion.

|

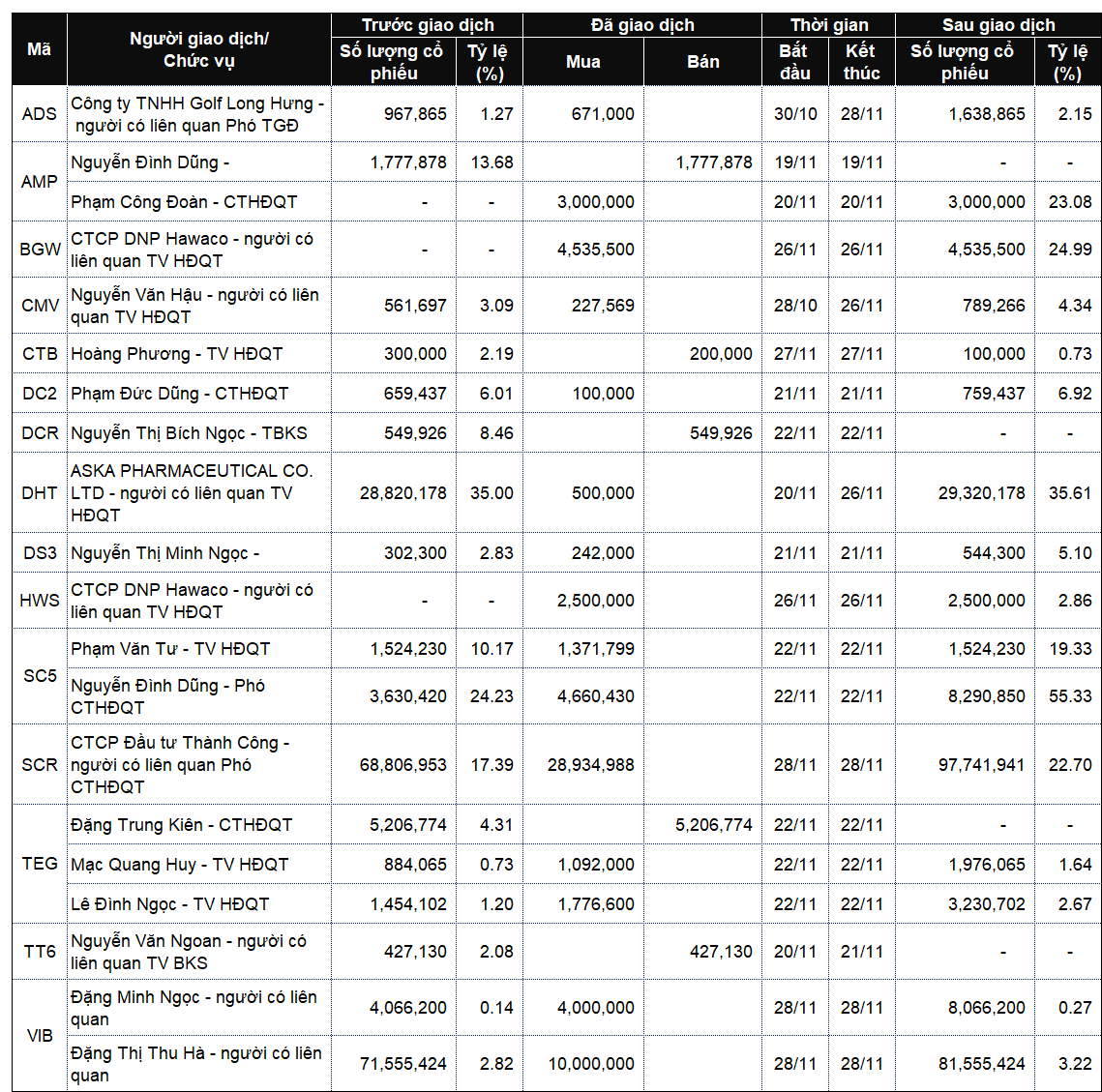

List of Company Leaders and Their Relatives’ Transactions from November 25 to 29, 2024

Source: VietstockFinance

|

|

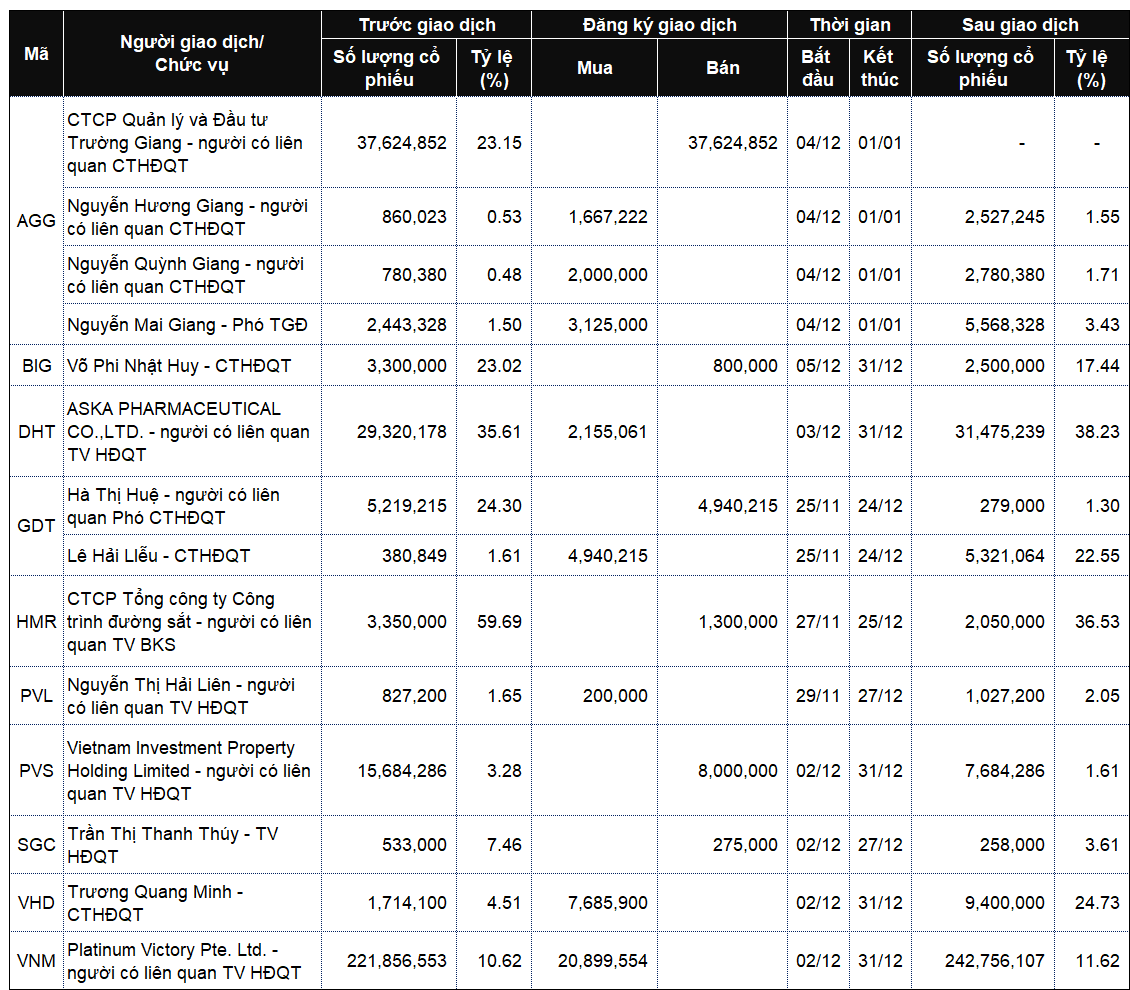

List of Company Leaders and Their Relatives’ Registered Transactions from November 25 to 29, 2024

Source: VietstockFinance

|

The VinaCapital Vietnam Opportunity Fund (VOF) Seeks to Accumulate 7.7 Million Vinahud (VHD) Shares

Mr. Truong Quang Minh, Chairman of Vinahud, showcases his confidence in the company’s prospects by registering to purchase nearly 7.7 million VHD shares for his personal investment. This substantial acquisition, planned to take place between December 2nd and 31st, 2024, underscores Mr. Minh’s faith in Vinahud’s future trajectory and potential for growth.