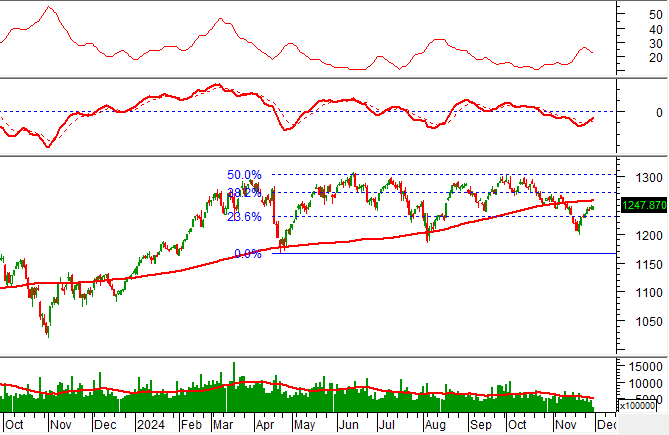

Technical Signals for the VN-Index

During the trading session on the morning of November 29, 2024, the VN-Index witnessed a rise in points, accompanied by a slight increase in trading volume. This indicates an improvement in investor sentiment.

Additionally, the VN-Index is currently testing the Fibonacci Projection 23.6% threshold (equivalent to the 1,225-1,240-point region) while the MACD indicator signals a buy opportunity. A successful breakthrough of this resistance level would further strengthen the recovery momentum.

However, the ADX indicator is moving within the grey zone (20 < adx < 25), which suggests a weak trend.

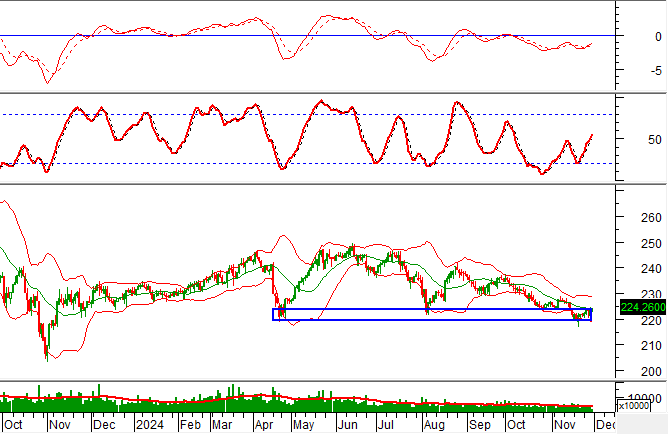

Technical Signals for the HNX-Index

On November 29, 2024, the HNX-Index witnessed a positive session, with improved liquidity in the morning, indicating a return of investor optimism.

Currently, the HNX-Index is retesting its April 2024 lows (around 220-225 points) while the MACD indicator signals a buy opportunity. This suggests that the short-term outlook could improve in the upcoming sessions.

CMG – CMC Technology Group Joint Stock Company

On the morning of November 29, 2024, CMG witnessed a surge in price alongside a significant increase in trading volume. It is expected to surpass the 20-day average by the end of the session, reflecting the returning optimism among investors.

At present, the stock price has broken above the Middle line of the Bollinger Bands, and the Stochastic Oscillator indicator signals a buy opportunity, suggesting that the short-term bullish trend may continue in the upcoming sessions.

Additionally, the stock price continues to rally after successfully testing the group of SMA 100-day and SMA 200-day lines, indicating the presence of optimistic mid- and long-term prospects.

TCM – Thanh Cong Textile Garment Investment Trading Joint Stock Company

During the morning session of November 29, 2024, TCM witnessed a price increase alongside trading volume surpassing the 20-session average, indicating optimistic investor sentiment.

Furthermore, the stock price broke out of the short-term downward trendline, and the MACD indicator maintained a buy signal, suggesting that a recovery scenario is likely in the upcoming sessions.

Technical Analysis Team, Vietstock Consulting Department

The Roaring Tide of Insurance Stocks: What’s the Driving Force?

Similar to the end of August this year, insurance stocks once again reacted strongly to the news of the State Bank “loosening credit room”.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.