As Starbucks’ new CEO, Brian Niccol, looks to implement changes in business strategy, the company’s operations in China will likely be at the top of his priority list. The American coffee chain is considering strategic options, including a potential sale of its China business.

The China market has become a burden for Starbucks. Revenue from the country accounts for less than 10%, while nearly 20% of the company’s stores are located there. In the third quarter, sales at stores in China fell an average of 14% year-over-year, even worse than the 6% decline seen in the US.

Media outlets attribute the stunning comeback of Luckin Coffee, a domestic brand once delisted from Nasdaq, as the main culprit. Luckin’s ultra-low-cost coffee, priced at just 9.9 RMB ($1.4), is eating into Starbucks’ basic drink sales, just as the Chinese economy weakens and consumers become more cautious with their spending.

But for Starbucks, Luckin is just the tip of the iceberg. This Chinese brand is also embroiled in a never-ending price war with its arch-nemesis, Cotti Coffee. Interestingly, Cotti was founded by the very same people who started Luckin, only to leave the company amid accounting scandals that led to its delisting from Nasdaq.

Emulating Luckin’s approach, this 2-year-old brand is expanding rapidly, attracting young coffee enthusiasts with its affordable ready-to-drink offerings. It already operates 10,000 stores, surpassing Starbucks’ 7,600 outlets.

Indeed, Luckin’s financial situation is also challenging. Its sales per store have declined this year. Yet, they show no signs of slowing down, with plans to operate 50,000 stores by 2025. In other words, the price war will rage on.

For a large market that is still relatively new to coffee consumption, penetration is key. The reason Cotti and Luckin could expand so quickly is their heavy reliance on franchising. Young entrepreneurs, unwilling to risk much in a gloomy market, can “play it safe” by opening a Cotti Express, often a small storefront in malls and subway stations with a low break-even point. In contrast, Starbucks operates its stores, slowing down its store opening pace.

In recent months, Starbucks has followed in the footsteps of some other global brands by penetrating smaller cities, where competition is lower. It remains to be seen whether this strategy will pay off. In these small towns, the novelty of Starbucks could quickly wear off as more competitors emerge.

Meanwhile, Starbucks’ most profitable products, Frappuccinos, and cold, sugary drinks are facing a challenge in China. Local bubble tea chains can easily satisfy sugar cravings. Names like Chabaidao and Chagee introduce new drinks weekly, offering exotic herbal and fruity teas topped with fresh cream.

Niccol is scheduled to visit China in early December to gain a deeper understanding of the situation on the ground. If the ultimate decision is to sell the business, it wouldn’t be too surprising. Starbucks, a brand born in the 1970s, needs to nurture and monetize its brand, rather than toil in the trenches, opening stores one by one, as it currently does.

The Ultimate Transformation: Perfecting Purity and Slashing Costs for a Key Semiconductor and EV Material

This particular material, when of high purity, finds extensive use in the nuclear energy and aerospace sectors.

“BIG Set to Smash Year-End Revenue Targets, Thanks to Durian; 5.2% Dividend Payout Imminent”

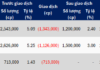

The Hanoi Stock Exchange (HNX) has announced the record date for the cash dividend of Big Invest Group Joint Stock Company (BIG) listed on UPCoM. As of December 4, 2024, shareholders are entitled to a generous 5.2% dividend yield. The company’s leadership has also revealed impressive revenue growth projections for 2024, largely driven by the China-focused durian import-export business, especially during the pre-Lunar New Year peak season.

“Securities Industries Unite: Vietnam and China Strengthen Ties with Information Sharing Agreement”

The Chairman of the Vietnam Securities Commission (VSC) drew parallels between the country’s securities regulatory body and that of China, emphasizing the need for more frequent exchanges to foster shared learning and growth.