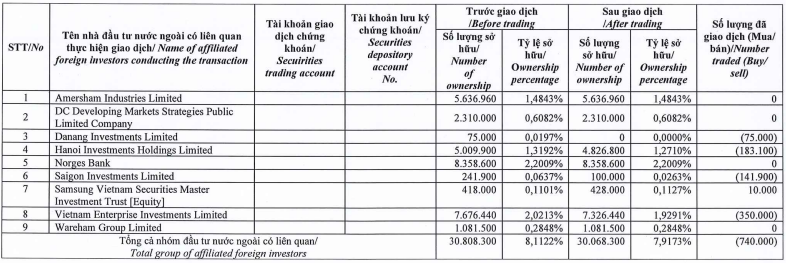

On November 26, 5 out of 9 member funds of the Dragon Capital group traded DGC stocks, resulting in a net sale of 740,000 shares, with Vietnam Enterprise Investments Limited leading in volume with 350,000 shares.

Following the transactions, Dragon Capital’s ownership in DGC decreased from over 30.8 million shares (over 8.1%) to over 30 million shares (over 7.9%).

Based on the closing price of VND 106,700/share on November 26, the foreign shareholder group is estimated to have earned approximately VND 79 billion from the deal.

|

Dragon Capital Group Sold 740,000 DGC Shares on November 26, 2024

Source: DGC

|

Recently, Dragon Capital has continuously bought and sold DGC shares. However, overall ownership of the group has increased compared to about 6% at the beginning of 2024.

Regarding DGC, the stock has experienced several strong increases and decreases since the beginning of 2024. As of the latest session on November 29, it closed at VND 109,500/share, a slight increase of 3.4% with an average trading volume of nearly 1.2 million shares since the beginning of the year.

| DGC Share Trading from the Beginning of 2024 |

Huy Khai

“Dragon Capital Divests 5.5 Million DXG Shares of Dat Xanh Group”

Dragon Capital has offloaded 5.5 million DXG shares, reducing its ownership stake in Dat Xanh Group from 10.0833% to 9.3201%.

Investing in Funds: Buyers Still “Cautious”

Last week (04-08/11/2024), cautious investors increased their equity holdings as the VN-Index experienced volatility, fluctuating between downward pressure pushing it towards the 1,240-point range and a strong recovery during the US election session, followed by further adjustment pressures.