Nova Land Investment Group JSC (NVL-HOSE) has announced a delay in interest payment on its bonds.

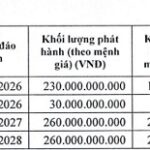

Specifically, on November 25, 2024, the company was due to make interest payments on two bond series, NVL2020-03-190 and NVL2020-03-140, totaling VND 10.4 billion and VND 7.6 billion, respectively.

However, Novaland has not yet been able to make these interest payments. The company stated that it is arranging funds to fulfill its obligations and committed to completing the payments by December 4-5, 2024.

Recently, Novaland’s Board of Directors made an unconditional commitment to fulfill the payment obligations of Delta – Valley Binh Thuan Co., Ltd. (Delta – Valley) to Military Commercial Joint Stock Bank (“MB”) under the credit documents signed between MB and Delta-Valley regarding a loan with a credit limit of VND 450 billion.

The purpose of this loan is to settle debts and cover the investment and construction costs of Hotel H4 in the Ocean Valley Tourism Complex project, with Delta – Valley as the investor.

Novaland has pledged to use all its resources to ensure continuous operations, including but not limited to liquidating assets to supplement operating capital. The company also committed to maintaining its direct and/or indirect ownership stake in Delta – Valley at no less than 75% throughout the period of MB’s loan to Delta – Valley.

Additionally, Novaland will provide financial support to Delta – Valley for project development in case of insufficient investment capital.

Previously, Novaland provided an update on the legal progress of projects and the progress of pink book issuance for projects in the center of Ho Chi Minh City.

According to the update, on November 19, 2024, the People’s Committee of Dong Nai province issued Decision No. 3479/QD-UBND approving adjustments to the general planning of Bien Hoa city by 2030, with a vision towards 2050. These adjustments focused on population size and land-use indicators in Sub-area C4, which is part of the Urban Area West of Bien Hoa – Vung Tau Highway. This is a significant step towards resolving legal issues for multiple projects, particularly the Aqua City project, which is a key project for Novaland.

Regarding the progress of pink book issuance, Novaland expects to issue pink books for 7,041 units in urban real estate projects in Ho Chi Minh City’s center in 2025. This includes 3,117 units at Sunrise Riverside, 2,894 units at The Sun Avenue, 406 units at Kingston Residence, 208 commercial lots at Lucky Palace, 170 officetel units at Sunrise City, and 246 officetel units at Orchard Garden.

According to the recently published consolidated financial statements for Q3 2024, Novaland recorded consolidated net revenue of VND 2,010 billion, nearly doubling the figure from the same period last year (VND 1,073 billion).

Notably, the company’s financial income for Q3 surged compared to the previous year, increasing from VND 1,617 billion to nearly VND 3,900 billion.

After deducting expenses, net profit increased dramatically from VND 136.75 billion to over VND 2,950 billion, 21.5 times higher than the same period last year. Of this, profit after tax attributable to the parent company’s owners was over VND 3,100 billion.

According to the company’s explanation, the increase in consolidated net profit of VND 2,813,561,729,646 compared to the same period last year was mainly due to higher financial income. This includes a financial income item for the first six months of 2024, which the auditing firm reduced in the six-month review report, amounting to VND 3,045,661,559,608, and was actually fully received by the Group in Q3 2024.

For the first nine months of 2024, NVL recorded net revenue of VND 4,295 billion, 1.5 times higher than the same period last year (VND 2,731 billion). However, the cumulative net profit for the first nine months was negative, at nearly VND 4,377 billion. The loss attributable to the parent company’s owners was over VND 4,100 billion, compared to a loss of VND 841 billion in the same period in 2023.

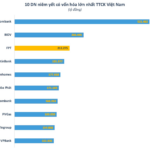

The FPT Market Cap Matches the Combined Value of Five Major Banks; Truong Gia Binh’s Stock Holdings Near VND 15,000 Billion

FPT shares surge to new heights, with a market capitalization surpassing 212,000 billion VND, an impressive feat that even surpasses the combined value of five mid-sized banks: SHB, MSB, VIB, Eximbank, and TPBank.

Brother Overcomes Obstacles as Concert “Sells Out” in Just 40 Minutes: What Benefits Does Techcombank Reap as the Diamond Sponsor?

The experts dissect the benefits for Techcombank in becoming the Diamond Sponsor for Concert 1 and the Co-organizer for the challenging yet rewarding journey of “Brother Overcoming Obstacles” at Concert 2.