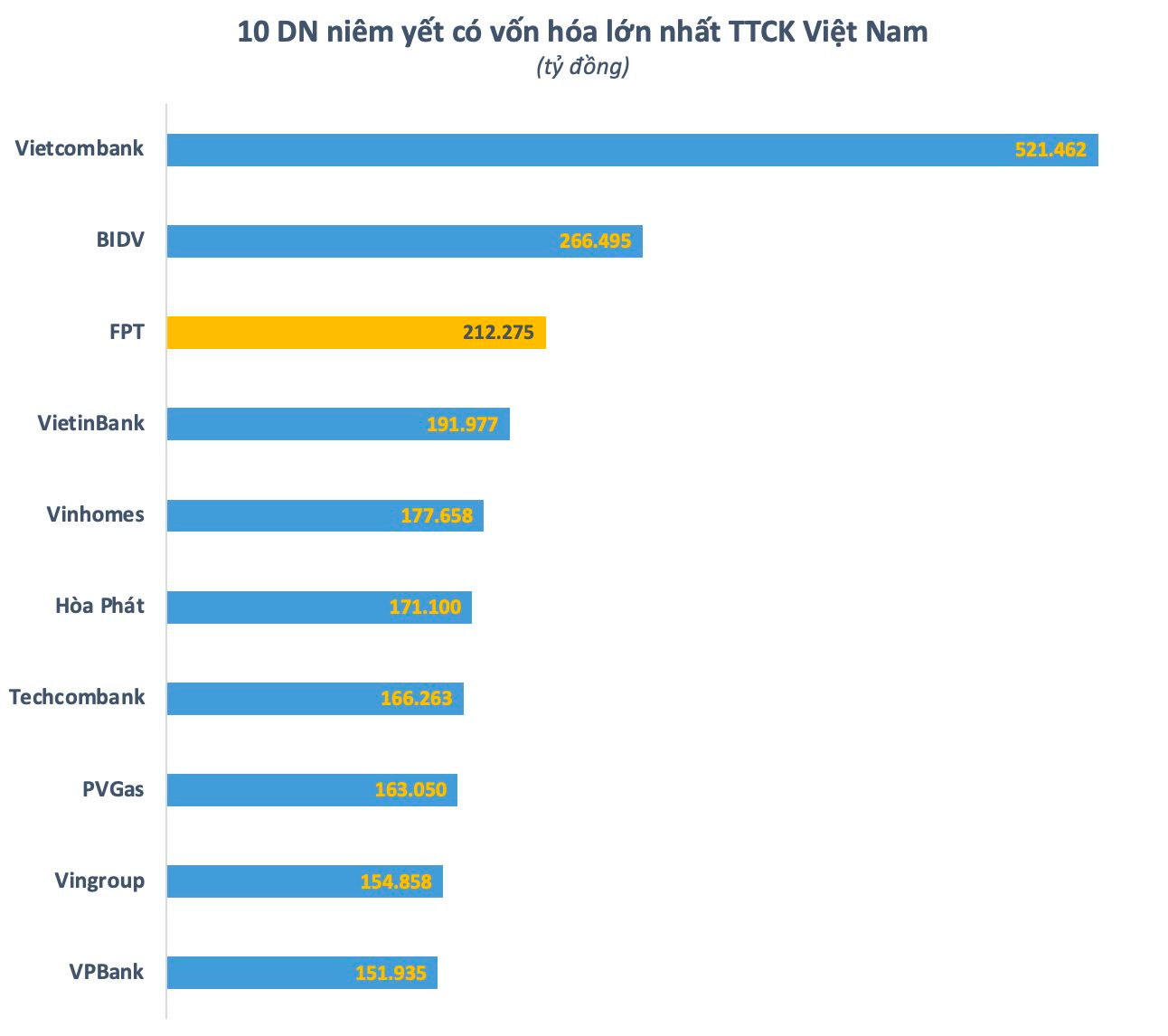

FPT stock has witnessed a remarkable surge, climbing 3.5% to reach a peak of 143,300 VND per share. This has propelled the company’s market capitalization to a record-breaking 212 trillion VND (approximately 8.5 billion USD), reflecting a staggering 74% increase since the beginning of 2024.

With this impressive performance, FPT has emerged as the largest private enterprise on the Vietnamese stock market, surpassed only by four state-owned giants: Vietcombank, BIDV, ACV, and Viettel Global. Remarkably, FPT’s market cap even surpasses the combined value of five mid-sized banks, including SHB, MSB, VIB, Eximbank, and TPBank.

FPT’s market capitalization surpasses that of mid-sized banks.

The stock’s remarkable ascent can be largely attributed to the strong comeback of foreign investors after the room limit exceeded 3%. Over the course of just six trading sessions, from November 22nd to the present, foreign investors have consistently purchased nearly 13 million FPT shares, resulting in a net buy value of approximately 1,200 billion VND.

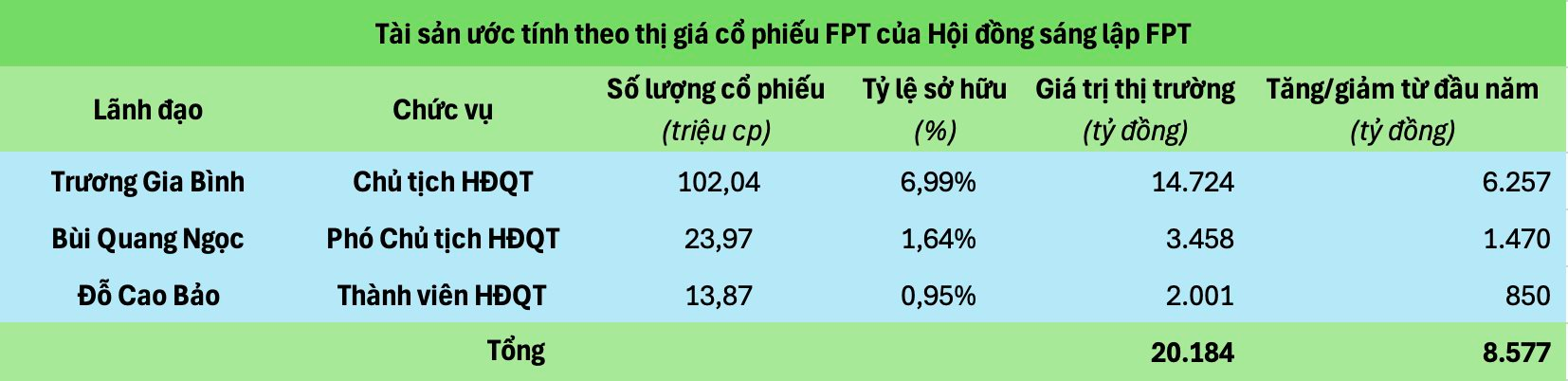

This breakthrough has brought immense joy to FPT’s shareholders, particularly the founding members of the corporation, including Chairman of the Board of Directors Truong Gia Binh, and his long-time associates Bui Quang Ngoc and Do Cao Bao. The trio holds a significant portion of their wealth in FPT shares, and their collective net worth is estimated to have soared to nearly 20.2 trillion VND, an increase of 8.6 trillion VND since the beginning of 2024.

For these “founding fathers” of FPT, the monetary value of their shares may not be their primary concern. Instead, it is likely that the sustainable growth and success of the corporation, which they have dedicated their efforts to since its inception, brings them the greatest satisfaction.

FPT’s consistent dividend payments bring joy to shareholders.

FPT shareholders are not only witnessing the growth of their assets on the stock market but also benefiting from consistent cash dividend payments. On December 3rd, FPT will finalize the list of shareholders eligible for the first 2024 interim cash dividend payment, with a rate of 10%. With approximately 1.5 billion shares currently in circulation, FPT is expected to disburse approximately 1,500 billion VND. The payment date is scheduled for December 13, 2024, just ten days after the record date.

This marks the second dividend payment FPT shareholders have received this year. Previously, in mid-June, the company distributed the remaining 10% cash dividend for 2023. Additionally, FPT rewarded its shareholders with a 15% stock dividend (for every 20 shares held, investors received 3 new shares).

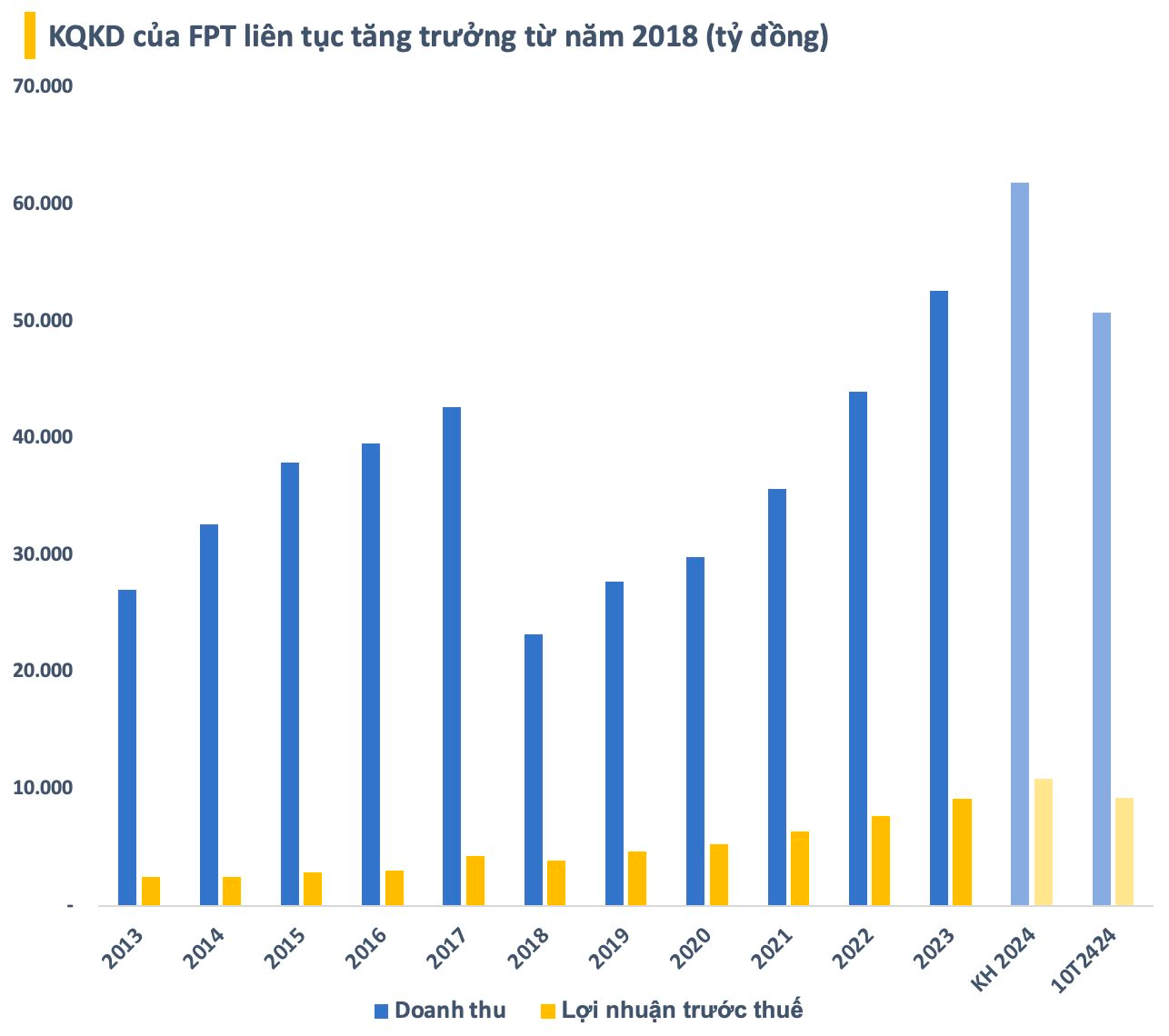

In terms of financial performance, FPT reported impressive results for the first ten months of the year. The company achieved revenue of 50,796 billion VND and pre-tax profit of 9,226 billion VND, representing increases of 19.6% and 20%, respectively, compared to the same period in 2023. After-tax profit attributable to the company’s shareholders and EPS reached 6,566 billion VND and 4,494 VND per share, respectively, reflecting a 21% increase year-over-year.

For the full year 2024, FPT has set ambitious business targets, aiming for record-high revenue of 61,850 billion VND (~2.5 billion USD) and a pre-tax profit of 10,875 billion VND. These goals represent an approximate 18% increase compared to the company’s performance in 2023. Given the results achieved in the first ten months, FPT has already accomplished 82% of its revenue target and 85% of its profit goal.

FPT’s collaboration with NVIDIA to establish an AI and Cloud services factory holds promising prospects.

In mid-November, FPT, in partnership with NVIDIA, officially launched an AI and Cloud services factory in Vietnam and Japan. Agriseco Securities, in a recent analysis report, expressed optimism about FPT’s long-term prospects, citing the company’s foreign technology services segment as a key growth driver.

VTIS 2024: “December’s Convergence” for Hundreds of Vietnamese and International Speakers

This December, senior leaders from ministries, sectors, and over 100 speakers from top domestic and global organizations, including FPT Corporation and SSI Securities Corporation, will converge for a grand-scale event focusing on technology and finance.