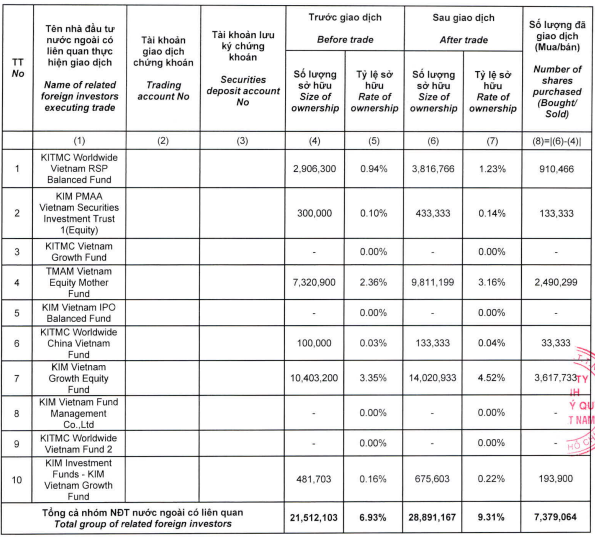

Six out of ten members of the group purchased additional GMD shares, with the largest purchases made by KIM Vietnam Growth Equity Fund, buying over 3.6 million shares, and TMAM Vietnam Equity Mother Fund, buying nearly 2.5 million shares.

Analyzing the GMD stock transactions on November 21st reveals that only 994,000 shares were matched, and over 177,000 shares were traded through negotiation, suggesting that KIM’s transactions may not have been conducted through these standard methods.

Considering the closing price of GMD on November 21st was 65,000 VND per share, it can be estimated that the KIM group likely invested approximately 480 billion VND in this deal.

|

KIM Vietnam’s Transactions on November 21, 2024

Source: GMD

|

Not long before this, on November 8th, three members of the KIM group, including KIM Vietnam Growth Equity Fund, KITMC Worldwide Vietnam RSP Balanced Fund, and KIM Investment Funds – KIM Vietnam Growth Fund, sold a total of over 675,000 GMD shares to reduce the group’s ownership below the 7% threshold.

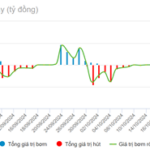

These transactions by KIM occurred amidst a slight correction in the GMD stock price, following a prolonged upward trend since November 2022.

| GMD Stock Price Corrects Slightly After Uptrend |

KIM Vietnam, or the Korea Investment Management Company, primarily engages in securities investment fund management, securities portfolio management, and securities investment consulting.

As of Q3 2024, KIM Vietnam reported total assets of over 99 billion VND, a 26% increase compared to the same period last year. Additionally, KIM Vietnam managed a portfolio of nearly 19,345 billion VND in off-balance-sheet items, mainly from foreign trust investors.

In the first nine months of 2024, the company generated nearly 85 billion VND in net revenue and over 16 billion VND in net profit, increases of 32% and 82%, respectively, compared to the same period last year. Notably, the portfolio management segment contributed over 26 billion VND to the revenue structure, constituting almost its entirety.

Recently, a foreign shareholder of GMD, SSJ Consulting (Vietnam) Co., Ltd., sold all of its nearly 29.7 million GMD share purchase rights during the November 7-8, 2024, period. The transaction was executed through the Vietnam Securities Depository and Clearing Corporation (VSDC).

These purchase rights arose from GMD‘s public offering of nearly 104 million shares, at a ratio of 3:1. With one share entitling the holder to one purchase right, and three purchase rights allowing the purchase of one new share, SSJ’s sale of nearly 29.7 million purchase rights translates to approximately 9.9 million GMD shares.

Notably, SSJ relinquished its purchase rights despite GMD offering shares at a price of 29,000 VND per share, significantly lower than the market price.

Japan’s Major Shareholder Plans to Offload Nearly 29.7 Million Share Purchase Rights in GMD

Post-inspection, C4G altered its capital allocation plans for the 2022 and 2023 issuances.

On November 26, 2024, Joint Stock Company CIENCO4 Group (UPCoM: C4G) reported changes to its plan for utilizing capital raised from two issuances in 2022 and 2023. The company also supplemented and finalized its 2022 and 2023 financial statements to address conclusions from an inspection by the State Securities Commission of Vietnam (SSC) on October 11, 2024.

The Artful Tap: Crafting Captivating Copy for a Cashless Society

Last week (November 18-25, 2024), the State Bank of Vietnam (SBV) continued its measured issuance of treasury bills while actively employing the open market operation (OMO) channel for term deposits to maintain reasonable liquidity.

VinFast Unveils Smaller, More Affordable Model than VF3: Stock Surges as $10 Billion Valuation Nears Top 5 Global EV Makers

This product is designed for service-based businesses, such as taxi companies and ride-sharing platforms. With its cutting-edge features and intuitive design, it revolutionizes the way these businesses operate, helping them streamline their services and elevate the customer experience to new heights.