On December 6th, the Soc Trang Seafood Joint Stock Company (Stapimex) will finalize the list of shareholders to implement the second interim cash dividend for 2024 at a rate of 60%, meaning that for every 1 share owned, shareholders will receive VND 6,000.

The expected payment date is from December 16th to 20th, 2024. With more than 7 million shares in circulation (according to the 2023 audited financial statements), the company will spend approximately VND 42 billion to pay dividends to shareholders.

Earlier, in July, the company paid the first interim dividend for 2024 in cash at a rate of 50%. After completing the second interim dividend, the total dividend rate for Soc Trang Seafood Joint Stock Company’s shareholders is 110%, equivalent to more than VND 77 billion – the highest amount ever.

As of December 31, 2023, Stapimex had three individual shareholders holding nearly 44% of its charter capital, of which Mr. Ta Van Vung, Member of the Board of Directors and General Director, held 21.33% of the capital and is expected to receive nearly VND 9 billion in the second interim dividend for 2024. Ms. Nguyen Thi Bay, wife of Mr. Tran Van Pham, Chairman of the Board of Directors, holds more than 1.2 million shares (17.61%), expected to receive more than VND 7 billion, and Mr. Tran Nguyen Hoang Phu, Deputy General Director, holds nearly 300,000 shares and is expected to receive more than VND 2 billion.

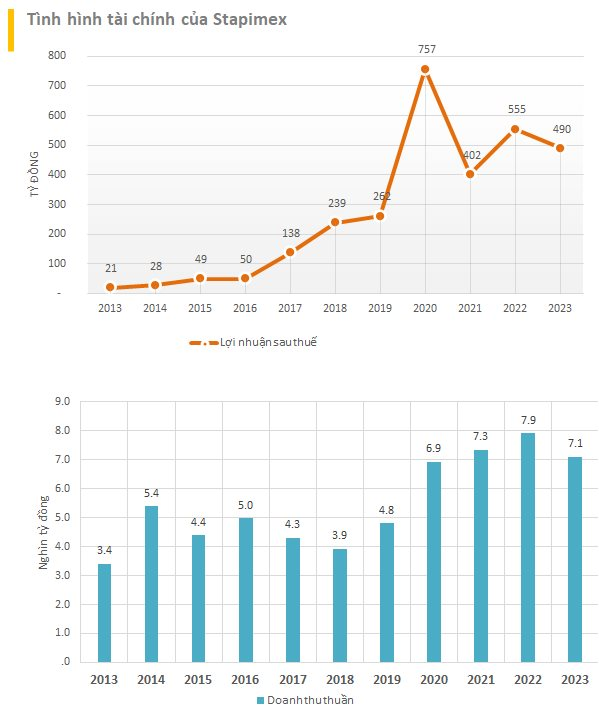

According to our information, Stapimex is a long-established enterprise in Vietnam, founded in 1978, specializing in shrimp farming, processing, and export. Regarding business performance, Stapimex’s 2023 audited financial statements recorded a revenue of VND 7,101 billion, a 10% decrease compared to the previous year. As a result, after-tax profit decreased by 12% to VND 490 billion. Nevertheless, this figure helped Stapimex surpass “shrimp king” Minh Phu to become the top profitable company in the industry once again.

Despite the decline due to market difficulties, 2023 marked another year where Stapimex outperformed Minh Phu in terms of profit. As of the end of 2023, Stapimex’s charter capital was only VND 77.5 billion, with owner’s equity of VND 2,613 billion, derived from accumulated after-tax profit (over VND 995 billion), capital surplus (over VND 109 billion), and Development Investment Fund (VND 1,453 billion).

For 2024, Stapimex sets targets for output of finished products to reach 30,000 tons, export turnover to reach USD 340 million, and profit to reach VND 500 billion.

Stapimex also boasts an impressive EPS compared to its peers in the industry, and the company has a tradition of paying high cash dividends. During the period from 2015 to 2019, Stapimex distributed cash dividends at a rate of 50%. This rate increased to 100% in the following period from 2020 to 2022.

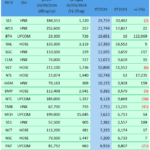

Who Will Claim the EPS Throne in Q3 2024?

Once again, the companies with the highest EPS for the first nine months of this year are the usual suspects – renowned for their attractive cash dividend policies. And perhaps it is this very reputation that has kept their stock prices soaring in the stock market.

“BIG Set to Smash Year-End Revenue Targets, Thanks to Durian; 5.2% Dividend Payout Imminent”

The Hanoi Stock Exchange (HNX) has announced the record date for the cash dividend of Big Invest Group Joint Stock Company (BIG) listed on UPCoM. As of December 4, 2024, shareholders are entitled to a generous 5.2% dividend yield. The company’s leadership has also revealed impressive revenue growth projections for 2024, largely driven by the China-focused durian import-export business, especially during the pre-Lunar New Year peak season.