An Giang, located in the southwestern region of Vietnam, is a province at the headwaters of the Mekong Delta. It is approximately 200 km from Ho Chi Minh City and shares its borders with Dong Thap to the east, Can Tho to the southeast, Kien Giang to the west, and Cambodia to the northwest, with a border length of nearly 100 km. As of June 30, 2024, An Giang’s population exceeded 1.9 million people, making it the most populous province in the Mekong Delta region.

In November 2023, the Prime Minister approved the master plan for An Giang province for the period of 2021-2030, with a vision towards 2050. The general objective is to develop the province into one of the dynamic, harmonious, and sustainable economic centers in the Mekong Delta region by 2030. An Giang aims to become a leading center for agricultural, aquatic, and medicinal research and production, utilizing advanced technology, as well as a prominent eco-tourism hub and a key trading gateway to Cambodia.

An Giang’s economy has been growing rapidly, with a shift in economic structure towards a faster-growing trade and service sector and a decreasing contribution from agriculture. As one of the four key economic provinces in the Mekong Delta, agriculture, aquaculture, and vegetable farming are the three main industries driving the province’s economy.

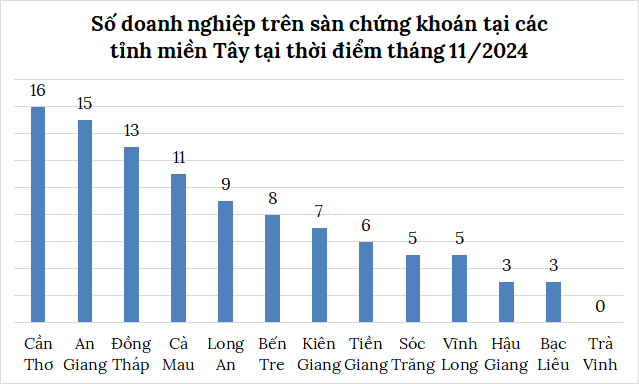

It is, therefore, understandable that most of the listed companies headquartered in An Giang are in the food industry. With 15 listed companies, An Giang ranks second in the Mekong Delta region, just behind Can Tho, which has 16 listed entities.

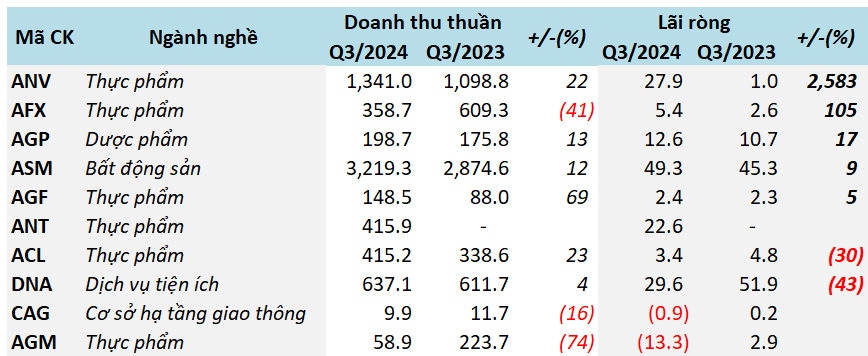

Source: VietstockFinance

|

According to statistics from VietstockFinance, out of more than 1,600 listed companies on the stock exchange (HOSE, HNX, and UPCoM), 15 companies headquartered in An Giang have published their Q3/2024 financial statements, mostly small and medium-sized enterprises. Among them, 6 companies reported profit growth, 2 experienced declines, and 2 turned losses into profits.

Most food companies witnessed growth

Navico (HOSE: ANV), the world’s second-largest producer and exporter of tra fish with a fully integrated production chain, led the pack in profit growth, achieving a near 28-billion-VND profit in Q3, 27 times higher than the same period last year. ANV attributed this increase to a 22% rise in revenue to 1,341 billion VND due to higher sales of semi-finished products.

Despite a 41% decline in revenue to nearly 359 billion VND due to volatile commodity prices, AFX still managed to double its net profit to over 5 billion VND compared to the previous year. This was achieved through reduced interest expenses and increased financial revenue, mainly from late payment penalties.

AFX is a leading company in the fields of rice, agricultural products, and animal feed in the Mekong Delta region. The company primarily exports rice and agricultural products to Asian markets and imports raw materials for animal feed production from Latin America, Asia, and Europe.

Agimexpharm (UPCoM: AGP), by effectively managing input costs and offering numerous promotions to stimulate sales through pharmacy channels, achieved a 13% increase in revenue to nearly 199 billion VND and a 17% rise in net profit to almost 13 billion VND. It is the only pharmaceutical company in the group to report growth.

Sao Mai Group (HOSE: ASM) boasted the highest revenue and profit among An Giang-based companies in Q3, with figures surpassing 3,200 billion VND and 49 billion VND, respectively. For the first nine months, ASM recorded a revenue of 9,154 billion VND and a net profit of over 196 billion VND, remaining relatively stable compared to the previous year.

Although its primary business is real estate, this sector contributed less than 1% to ASM’s total revenue for the first nine months, amounting to only 48 billion VND. In contrast, the aquatic sector accounted for over 57% of total revenue, comprising 3,153 billion VND from fish feed sales and over 2,078 billion VND from fish exports. Much of this comes from its subsidiary, IDI (HOSE: IDI), which is headquartered in Dong Thap province.

|

According to Sao Mai Group, the Mekong Delta is renowned for its rice and fish production, with tra fish being a precious gift from nature. Therefore, in 2007, the Group commenced the construction of the 30-hectare Sao Mai Industrial Park in Lap Vo district, Dong Thap province (also the headquarters of IDI). Currently, ASM owns two frozen tra fish processing factories with a capacity of 900 tons of raw materials per day and four cold storage warehouses with a total capacity of 40,000 tons… |

On the other hand, DNA experienced the most significant decline in net profit, falling by 43% to nearly 30 billion VND. This was due to the completion and finalization of numerous electricity and water improvement projects, as well as the replacement of meters to meet the demands and standards of electricity and water usage, which resulted in lower profits.

ACL witnessed a 30% drop in profit to just over 3 billion VND. Additionally, two companies turned losses, with CAG incurring a loss of nearly 1 billion VND and AGM reporting a loss of over 13 billion VND.

|

Q3/2024 Financial Performance of Companies Headquartered in An Giang (in billion VND)

Source: VietstockFinance

|

Among the companies that have not yet published their financial statements, Loc Troi, a leading agricultural group, stands out for requesting an extension to publish its Q3/2024 financial statements due to force majeure. This delay also applies to its Q2/2024 and semi-annual 2024 audited financial statements. Consequently, more than 100 million LTG shares have been placed under restricted trading by HNX since October 24, 2024, allowing trading only on Fridays.

As of November 25, LTG’s share price stood at 7,800 VND per share, a 70% decrease compared to the beginning of the year.

Loc Troi (LTG): Financial Risks Rise Alongside Rice Industry Ambitions Post-Loc Nhan M&A

Similarly, Viet An (UPCoM: AVF) has been subject to restricted trading due to delays in submitting its 2021, 2022, 2023, and 2024 semi-annual financial statements and the failure to hold the annual general meeting of shareholders for the past two financial years. Its share price has remained stagnant compared to the beginning of the year, closing at 400 VND per share on November 25.

Ntaco (UPCoM: ATA) shares have also been restricted from trading due to the auditor’s disclaimer of opinion and negative equity in the 2023 financial statements. As of November 25, ATA’s share price was 500 VND per share, a 55% drop from the beginning of the year.

Over 1,000 new businesses entered the market in the first ten months

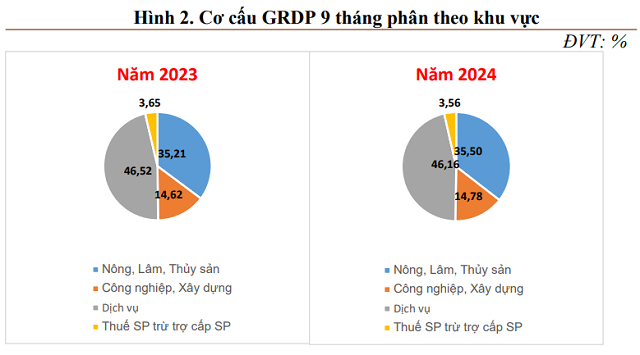

According to the An Giang Statistics Office, the province’s GRDP for the first nine months of 2024 grew by 6.5% year-on-year (compared to a 6.4% increase in the same period in 2023). The economic structure showed that the service sector led with a 46.16% contribution, followed by agriculture, forestry, and fisheries at 35.5%.

|

In 2023, An Giang’s GRDP growth rate ranked fourth in the Mekong Delta region and 21st in the country. |

Source: An Giang Statistics Office

|

According to the Provincial People’s Committee, An Giang’s industrial production index for the first ten months of 2024 is estimated to have increased by over 10% compared to the same period last year. Wholesale and retail trade revenue reached nearly 192 trillion VND, a rise of over 16%. Total import and export turnover was nearly 1.22 billion USD, up 6.5%. Tourism revenue stood at 9.9 trillion VND, surpassing the annual plan by 60%.

In the first ten months of the year, 1,061 new businesses entered the market, an increase of over 8% compared to the same period last year. This includes 818 newly registered businesses, a rise of over 7%, with a total registered capital of 5,712 billion VND, an increase of over 11%. Additionally, 243 businesses resumed operations, a gain of 28 from the previous year.

To date, the province has attracted 36 foreign direct investment (FDI) projects, including 9 projects managed by the Provincial Economic Zone Authority. The total registered investment capital is 261 million USD, with a realized capital of 178 million USD (accounting for over 68% of the total registered investment capital).

According to the Department of Transport, An Giang is focusing on investing in and upgrading its transportation system for the period of 2021-2025. The province has approved a total investment budget of over 24,300 billion VND. This includes the upgrade of 9 provincial roads with a total length of 190 km and the construction of 3 new roads (the Long Xuyen bypass, the N1 road, and the expressway belonging to the first phase of the Chau Doc – Can Tho – Soc Trang project), totaling nearly 100 km…

Thanh Tu

Who Qualifies for the 3.2% Interest Rate Home Loan in Ho Chi Minh City?

On November 28, at a press conference on socio-economic issues, Mr. Phan Huu Vinh, Head of the Appraisal Division of the Housing Development Fund in Ho Chi Minh City, provided information related to borrowers, loan conditions, interest rates, and other relevant details for individuals seeking to establish housing in the area.

“Unlocking Opportunities: Ho Chi Minh City and Bulgaria Explore Avenues for Collaboration”

President of the Republic of Bulgaria, Rumen Radev, emphasized that Vietnam is a significant partner for Bulgaria in Asia and praised the role and position of Ho Chi Minh City. With their shared similarities, the two countries have unlocked opportunities for collaboration in transportation, maritime affairs, logistics, and port infrastructure, among other areas.

The Great Chinese Retreat: Unraveling the Mystery Behind China’s Drastic Cutback on Vietnam’s Billion-Dollar Export

There are numerous factors contributing to the significant decline in the production volume of this particular item over the past month.