Recently, NTP Fund Management was fined VND 92.5 million for failing to disclose information as required by regulations.

Specifically, the company did not submit to the SSC the following documents: Investment Activity Report for 2022, Management Report on Fund Management Activities for 2022, and Financial Statements for 2022 of the Tan Viet Equity Prospect Fund (now known as the NTP Equity Prospect Fund).

The company also disclosed information beyond the deadline for the Investment Activity Report for December 2022 of the NTP Equity Prospect Fund.

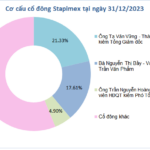

NTP Fund Management was formerly known as An Phat Investment Fund Management Joint Stock Company, established in late 2014, operating in the field of fund management. The company’s head office is located on the 5th floor, 14-16 Ham Long, Phan Chu Trinh ward, Hoan Kiem district, Hanoi. The charter capital is VND 50 billion, contributed by 3 individuals, including Mr. Nguyen Quoc Toan (65%), Mr. Bach Quoc Vinh (30%), and Mr. Ta Van Manh (5%).

Mr. Toan and Mr. Vinh are two of the four members of the Board of Directors of NTP Fund Management, along with Chairman Le Ngoc Duc (born in 1976) and Member of the Board of Directors and General Director Nguyen Trung Hieu (born in 1983).

Chairman Le Ngoc Duc is also known as the Vice Chairman of the Board of Directors of Thanh Cong Group Joint Stock Company, Chairman of the Board of Directors of Hyundai Thanh Cong Commercial Joint Stock Company (the official joint venture between Thanh Cong Group and Hyundai Motor), and Chairman of the Board of Directors of Thanh Cong Technical Service Joint Stock Company…

Chairman Le Ngoc Duc and General Director Nguyen Trung Hieu

|

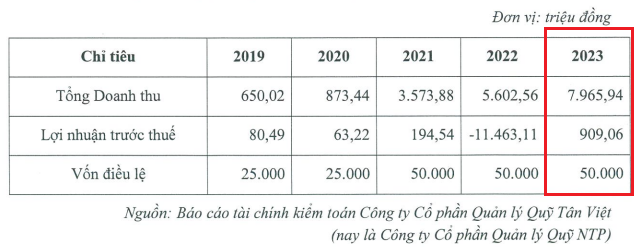

In terms of business performance, from 2019 to 2023, NTP Fund Management’s revenue grew continuously, increasing more than 12 times from VND 650 million to nearly VND 8 billion. However, profits were volatile, even incurring a pre-tax loss of VND 11.5 billion in 2022, and returning to a profit of VND 909 million in 2023 – the highest in the past 5 years.

Performance of NTP Fund Management in the past 5 years

|

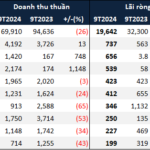

Recently, NTP Fund Management published its Q3/2024 financial statements, reporting a 67% decrease in revenue compared to the same period, amounting to only VND 436 million. This was the main factor leading to a net loss of nearly VND 1.4 billion, higher than the loss of VND 676 million in the same period last year. The company attributed this to a focus on investing in enhancing the quality and capacity of its business operations, resulting in higher costs relative to revenue.

For the first nine months of the year, the company recorded nearly VND 894 million in revenue, a 53% decrease compared to the same period last year, and a net loss of over VND 5 billion. As of September 30, 2024, NTP Fund Management’s accumulated loss increased to over VND 14.8 billion.

The Long and Winding Road to Recovery: Real Estate’s Nine-Month Journey Back to the Starting Line

As of Q3, several residential real estate firms have exceeded their annual targets. However, many are still lagging behind. A significant number of companies reported declining profits, causing the industry’s overall performance to regress compared to the same period last year.

“BIG Set to Smash Year-End Revenue Targets, Thanks to Durian; 5.2% Dividend Payout Imminent”

The Hanoi Stock Exchange (HNX) has announced the record date for the cash dividend of Big Invest Group Joint Stock Company (BIG) listed on UPCoM. As of December 4, 2024, shareholders are entitled to a generous 5.2% dividend yield. The company’s leadership has also revealed impressive revenue growth projections for 2024, largely driven by the China-focused durian import-export business, especially during the pre-Lunar New Year peak season.